~Samriddhi Singh Mahar

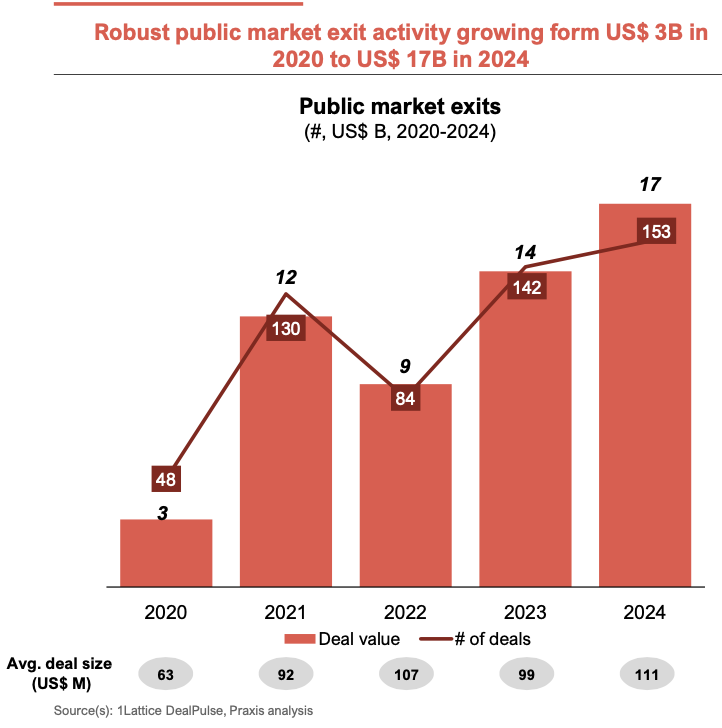

Exit activity soared to a record high in 2024, reaching USD 28 billion across 263 deals, with public market exits accounting for 60% of the total.

Strong regulations and a robust domestic capital market drove this surge, with PE/VC-backed public market exits hitting a record USD 17 billion, as per the latest edition of India Investments Pulse.

As per the report, the average deal size of PE/VC backed exits increased from USD 89 million in 2023 to USD 106 million in 2024.

Further, BFSI saw the maximum number of exits, with a total exit value of nearly USD 5.88 billion.

They were followed by healthcare services and life sciences at USD 4.92 billion and IT services at USD 3.68 billion, respectively.

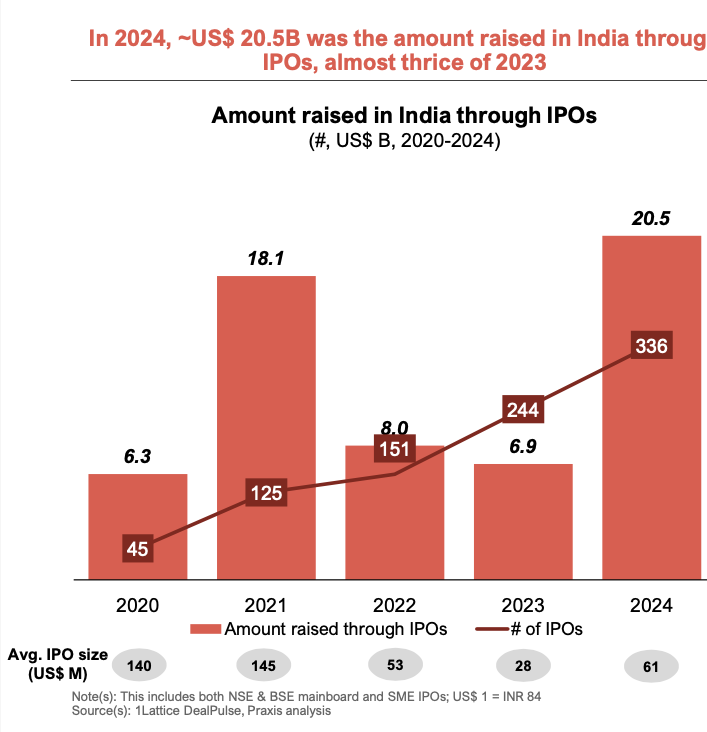

IPO Surge

India’s IPO market soared in 2024, raising USD 20.5 billion. This is nearly three times the 2023 total of USD 6.9 billion.

IPO debuts surged to 146, up from 45 the previous year, while the average IPO size rebounded to USD 61 million, up from USD 28 million in 2023.

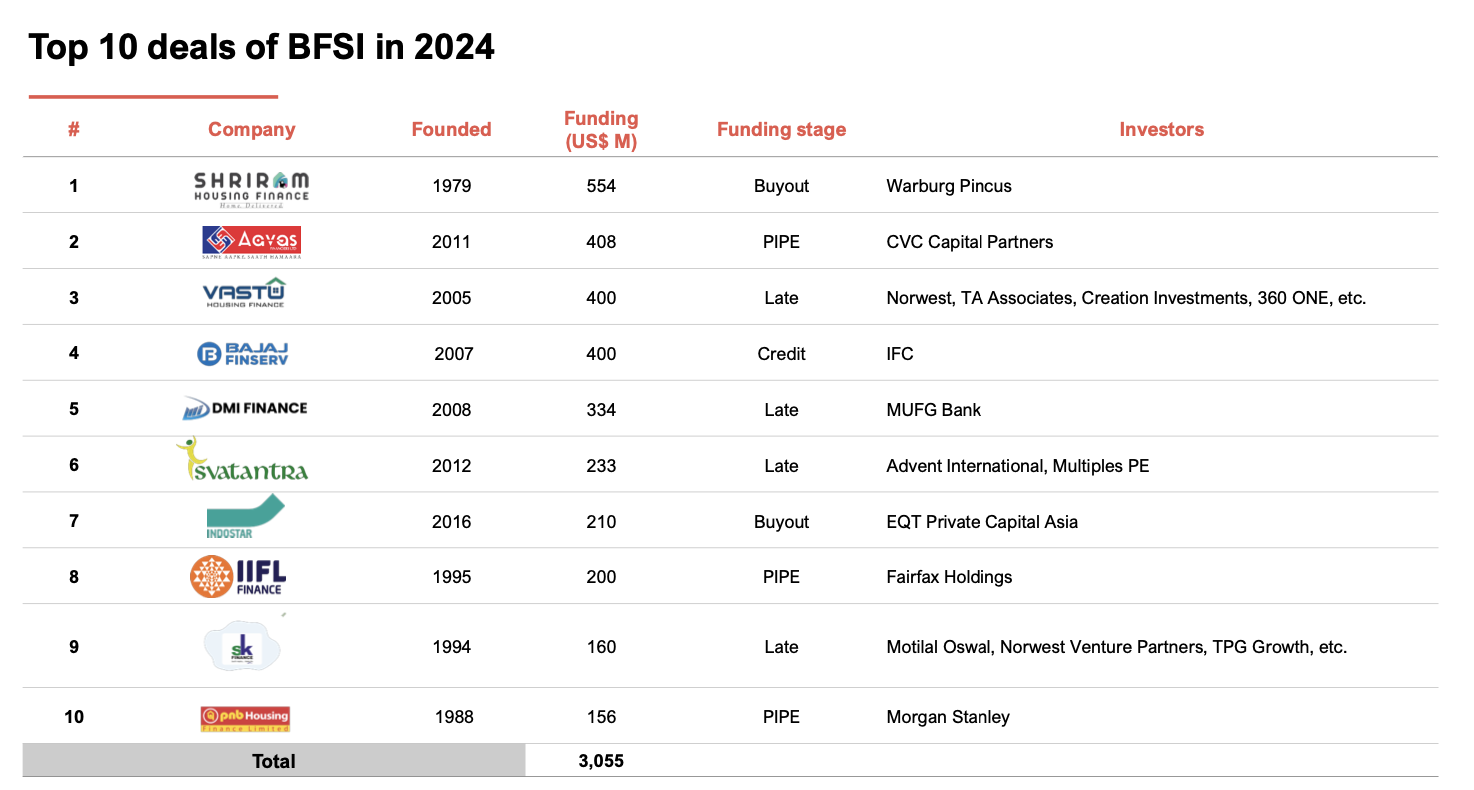

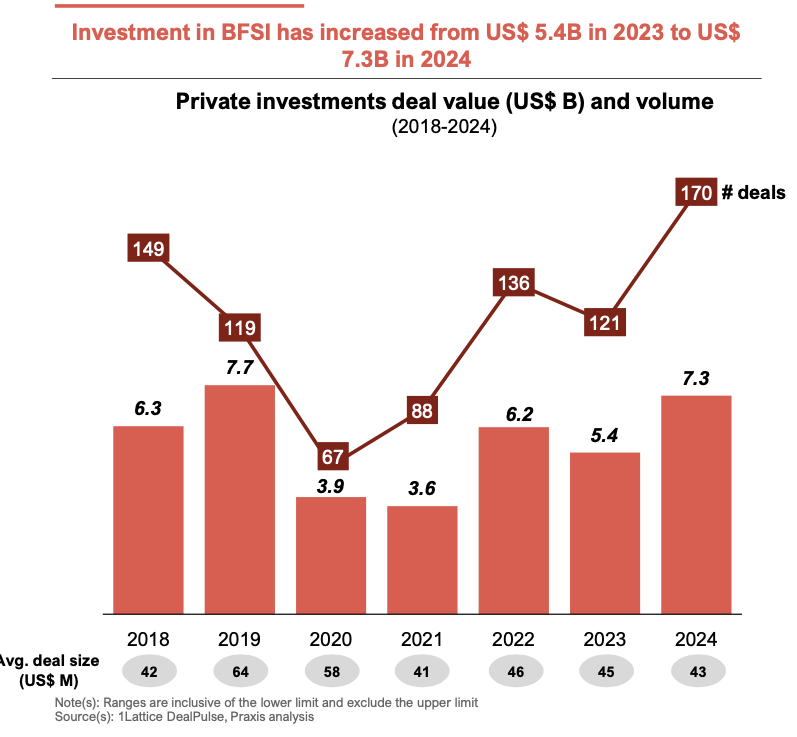

BFSI Deals

In 2024, BFSI investments surged to USD 7.3 billion across 170 deals, up from USD 5.4 billion in 2023. Late-stage deals accounted for 27% of total investments, with 57% exceeding USD 100 million.

Growth was driven by fintech expansion, tech transformation, and strong exit opportunities. BFSI assets remained highly liquid, attracting consistent buyer interest, while NBFC partnerships expanded customer bases. A favourable public market and fintechs moving toward profitability further boosted investor confidence.