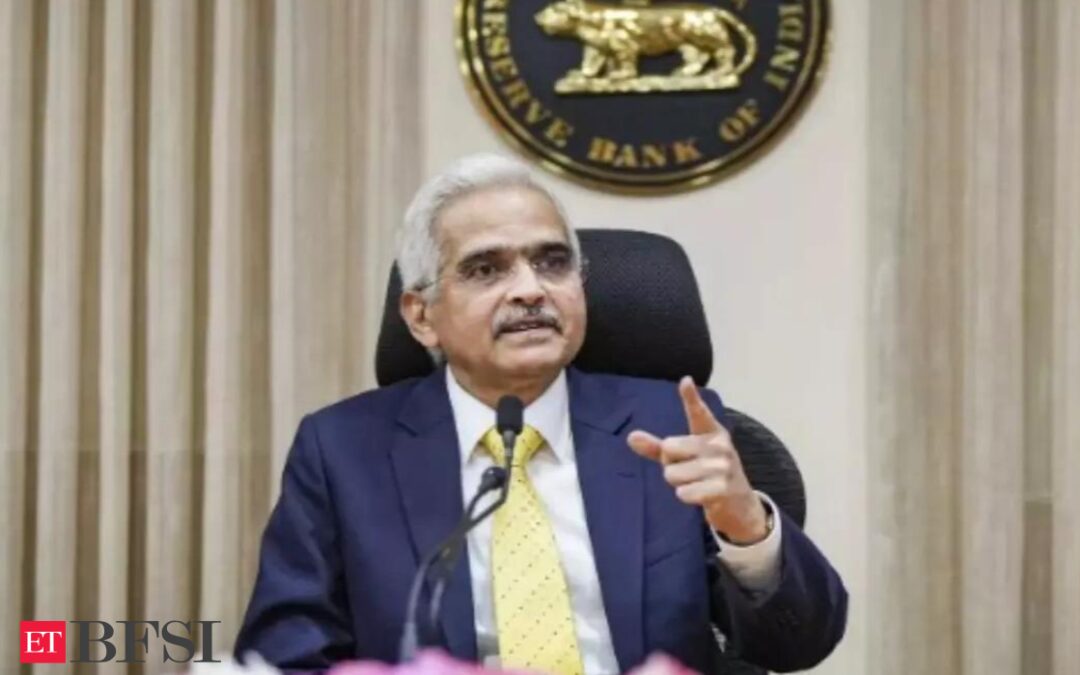

NEW DELHI: The Reserve Bank of India (RBI) governor Shaktikanta Das on Tuesday said that the growth momentum continues to be strong and the second quarter GDP number will surprise everyone on the upside.

“RBI is looking closely at attrition at banks. Attrition seen to be high in certain private sector banks,” the RBI governor said.

“Geopolitical uncertainty is the biggest risk to global growth and India is better placed to deal with potentially risky situations,” he added.

Meanwhile, Reserve Bank data showed that the credit growth to industry decelerated in September while it improved in case of agriculture and services sectors.

Personal loan growth too decelerated to 18.2 per cent year-on-year in September 2023 (19.4 per cent a year ago), due to moderation in credit growth to housing, the central bank said.

The credit to industry grew 6.5 per cent (y-o-y) in September 2023 as compared with 12.6 per cent in the year-ago month.

Among major industries, annual credit growth to ‘basic metal & metal products’, ‘food processing’ and ‘textiles’ accelerated in September 2023 while that to ‘all engineering’, ‘chemicals & chemical products’ and ‘infrastructure’ decelerated.

Growth in advances to agriculture and allied activities improved to 16.8 per cent (y-o-y) in September 2023 from 13.4 per cent a year ago.

The Reserve Bank data showed credit to services sector grew by 21.3 per cent (y-o-y) in September 2023 from 20.2 per cent a year ago with ‘non-banking financial companies (NBFCs)’ and ‘trade’ being the major contributors.

Data on sectoral deployment of bank credit for September 2023 has been collected from 40 select banks, accounting for about 93 per cent of the total non-food credit deployed by all scheduled commercial banks.

(With agency inputs)