The Reserve Bank of India on Friday announced the outcomes of the Monetary Policy Committee (MPC) meeting held on February 5-6, reducing the repo rate by 25 basis points to 6.25 per cent led by a unanimous decision of the committee, keeping the policy stance neutral. The standing deposit facility (SDF) rate and marginal standing facility (MSF) rate stand adjusted to 6 per cent and 6.5 per cent respectively, with immediate effect.

This marks the first rate cut since May 2020 when the Indian economy was grappling with the global pandemic. The repo rate had remained unchanged from February 2023 until this latest policy decision.

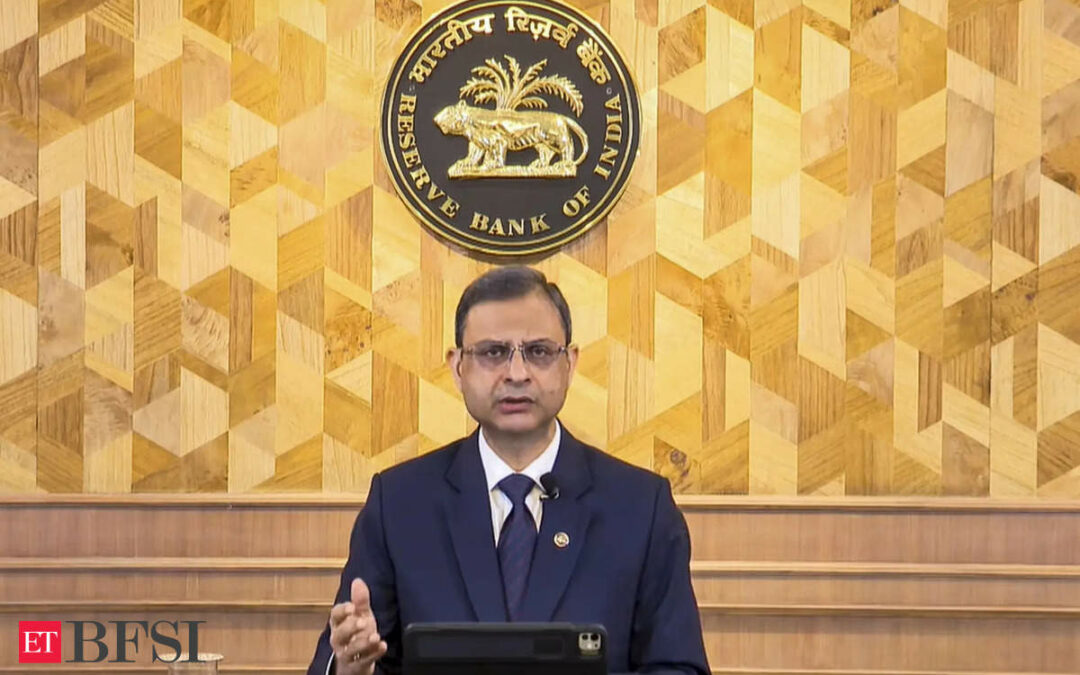

Sanjay Malhotra, who took charge as the RBI Governor in December 2024, succeeding Shaktikanta Das, implemented a rate cut in his very first MPC meeting.

Excessive volatility in global financial markets and continued uncertainties about global trade policies coupled with adverse weather events pose risks to the growth and inflation outlook. This calls for the MPC to remain watchful. Accordingly, it decided to continue with a neutral stance. This will provide MPC the flexibility to respond to the evolving macroeconomic environment.RBI Governor Sanjay Malhotra

The RBI estimates real GDP growth for FY26 at 6.7 per cent, with quarterly projections at 6.7 per cent (Q1), 7.0 per cent (Q2), and 6.5 per cent (Q3 and Q4). Inflation, measured by the Consumer Price Index (CPI), is expected to be 4.8 per cent for FY25 and 4.2 per cent for FY26, with quarterly projections ranging between 3.8 per cent and 4.5 per cent.Here are the key highlights from Governor Malhotra’s Speech:

Encouraging Liquidity in the Call Money Market

“Some banks have been reluctant to on-lend in the uncollateralised call money market and are instead passively parking funds with the RBI,” said Malhotra. The central bank has urged banks to actively trade in the call money market to enhance liquidity and improve signal extraction from the weighted average call money rate (WACR).

Introduction of forward contracts in Government Securities

The RBI is introducing forward contracts in government securities to enable long-term investors, such as insurance funds, to manage interest rate risks across cycles. These contracts will also facilitate better pricing of derivatives using bonds as underlying instruments. Final directions on this initiative will be issued soon.

Expanding Market Participation through SEBI-Registered Brokers

The RBI Governor announced that SEBI-registered non-bank brokers will now be allowed direct access to the Negotiated Dealing System, Order Matching (NDS-OM) platform, expanding market participation. The RBI will issue separate regulations detailing the access conditions.

Review of Trading and Settlement Timings

A working group will be set up to review trading and settlement timings across financial markets regulated by the RBI. This aims to synchronize market operations, optimize liquidity management, and enhance price discovery. The group’s report is expected by April 30, 2025.

Enhancing Cybersecurity with Dedicated Banking Domain

To address rising fraud in digital payments, the RBI is introducing a dedicated Internet domain, ‘bank.in’, for Indian banks. This initiative, managed by the Institute for Development and Research in Banking Technology (IDRBT), aims to enhance cybersecurity and prevent phishing attacks. Registrations will commence in April 2025, and a similar domain, ‘fin.in’, will be introduced for non-bank financial entities.

Strengthening Security for International Digital Transactions

Additional Factor of Authentication (AFA) for domestic digital transactions has improved security and boosted consumer confidence. The RBI now plans to extend AFA to international online transactions made using India-issued cards, subject to overseas merchant compatibility. A draft circular will be issued for stakeholder feedback shortly.