In the aftermath of RBA’s decision to maintain interest rates unchanged and the absence of explicit hawkish signals, Australian Dollar weakens mildly. Despite notable upgrades in inflation forecasts, the central bank opted for a cautious approach, refraining from signaling imminent rate hikes and maintaining a stance of “not ruling anything in or out.” Recent stronger-than-expected inflation data did not push RBA closer to resume monetary tightening, at least for the time being.

Meanwhile, Japanese Yen displayed continued weakness, retracing last week’s strong gains. Japan’s top currency diplomat, Masato Kanda, chose not to comment US Treasury Secretary Janet Yellen’s recent assertion that currency intervention is permissible only in exceptional circumstances. Kanda’s posture led markets to believe that last week’s alleged intervention may have been unilateral rather than coordinated.

Overall in the currency markets, Dollar is the strongest one for today at this point, followed by Euro and Kiwi. Canadian Dollar and Swiss Franc are on the softer side while Sterling is mixed.

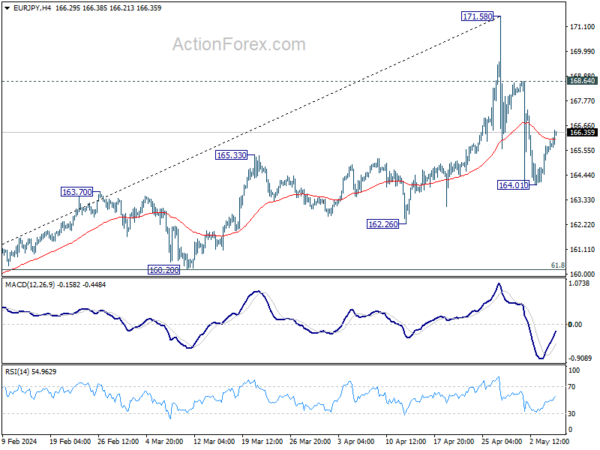

Technically, EUR/JPY’s break of 55 4H EMA suggests that fall from 171.68 could have completed at 164.01 already. Rise from there is seen as the second leg of the corrective pattern from 171.68 and could extend towards 168.64 resistance. Attention is now on whether USD/JPY and GBP/JPY would break through their respective 55 4H EMA to align and solidify this outlook.

In Asia, at the time of writing, Nikkei is up 1.29%. Hong Kong HSI is down -0.74%. China Shanghai SSE is up 0.01%. Singapore Strait Times is up 0.08%. Japan 10-year JGB yield is down -0.0311 at 0.875. Overnight, DOW rose 0.46%. S&P 500 rose 1.03%. NASDAQ rose 1.19%. 10-year yield fell -0.0110 to 4.489.

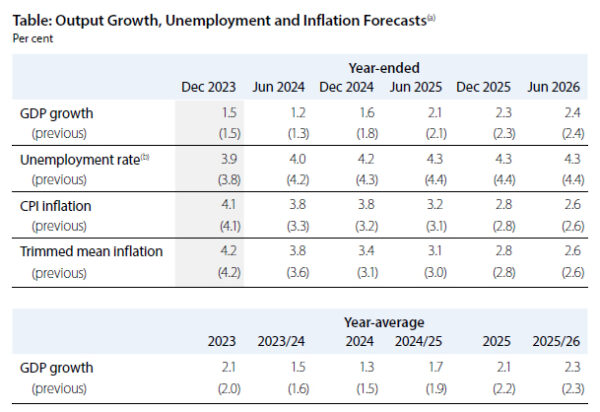

RBA stands pat, upgrades inflation forecasts, not ruling anything in or out

RBA left cash rate target unchanged at 4.35% as widely expected. The central bank maintained that it’s “not ruling anything in or out” regarding the next move in monetary policy because of uncertainty surround inflation outlook.

In the new economic forecasts, both headline and core inflation forecasts for 2024 are upgraded substantially. Meanwhile, growth forecasts were downgraded slightly for both 2024 and 2025.

Year-average GDP growth:

- For 2024 downgraded from 1.5% to 1.3%

- For 2025 downgraded from 2.2% to 2.1%.

Year-ended CPI inflation:

- For Dec 2024 upgraded from 3.2% to 3.8%.

- For Dec 2025 unchanged at 2.8%.

- For June 2026 at 2.6% (new).

Year-ended trimmed mean inflation:

- For Dec 2024 upgraded from 3.1% to 3.4%.

- For Dec 2025 unchanged at 2.8%.

- For June 2026 at 2.6% (new)

Japan’s PMI services finalized at 54.3, strong demand and rising costs

Japan’s PMI Services for April finalized at 54.3, slightly up from March’s 54.1. PMI Composite also saw an uptick, reaching 52.3, the highest level since August 2023.

According to Tim Moore, Economics Director at S&P Global Market Intelligence, April showcased “another strong month” for the service sector, driven by increasing business and consumer spending. This momentum resulted in the fastest upturn in business activity since August 2023. Despite challenges such as shortages of candidates hindering recruitment, positivity regarding the longer-term business outlook contributed to solid employment growth.

However, rising wage costs have emerged as a significant concern, leading to the sharpest increase in average cost burdens in eight months. Service providers are responding to elevated cost pressures by seeking higher prices from clients, with the latest survey indicating the fastest pace of price increases since the sales tax hike in April 2014.

Fed’s Barkin: More demand moderation needed

Richmond Fed President Thomas Barkin’s said overnight that the pace of disinflation has possibly stalled. “We’re going to need a little more edge off of demand to get all the way” back to target, he added. Despite these challenges, he expressed optimism regarding the current level of the benchmark policy rate, indicating confidence that it will effectively address inflation.

“I still have the weight going toward inflation,” Barkin said. “It’s a stubborn road back…It doesn’t mean you won’t get it back. It just means it takes a while…to corral price setters into believing they don’t really have a chance” for aggressive increases.

Separately, New York Fed President John Williams affirmed that “eventually we’ll have rate cuts”. But for now, monetary policy is in a “very good place.” He refrained from providing a specific timetable for rate adjustments but noted that the economy is gradually returning to better balance amid a shift to a slower rate of growth. He anticipates GDP growth in the range of 2-2.5% for the year.

Looking ahead

Swiss unemployment rate and foreign currency reserves, Germany factor orders and trade balance, France trade balance, UK PMI construction, and Eurozone retail sales will be released in European session. Later in the day, Canada will release Ivey PMI.

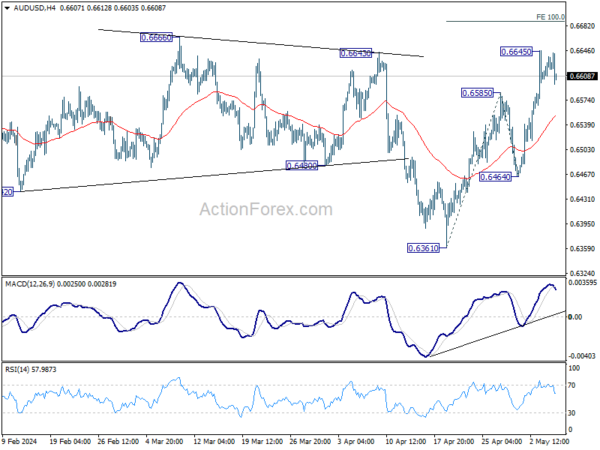

AUD/USD Daily Report

Daily Pivots: (S1) 0.6608; (P) 0.6623; (R1) 0.6642; More…

Intraday bias in AUD/USD is turned neutral with current retreat. Some consolidations could be seen but further rally is expected as long as 0.6464 support holds. As noted before, fall from 0.6870 could have completed with three waves down to 0.6361. Above 0.6645 will target 100% projection of 0.6361 to 0.6585 from 0.6464 at 0.6688 next.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which could still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | Services PMI Apr F | 54.3 | 54.6 | 54.6 | |

| 04:30 | AUD | RBA Interest Rate Decision | 4.35% | 4.35% | 4.35% | |

| 05:30 | AUD | RBA Press Conference | ||||

| 05:45 | CHF | Unemployment Rate M/M Apr | 2.30% | 2.30% | ||

| 06:00 | EUR | Germany Trade Balance (EUR) Mar | 22.4B | 21.4B | ||

| 06:00 | EUR | Germany Factory Orders M/M Mar | 0.40% | 0.20% | ||

| 06:45 | EUR | France Trade Balance (EUR) Mar | -5.0B | -5.2B | ||

| 07:00 | CHF | Foreign Currency Reserves (CHF) Apr | 715B | |||

| 08:30 | GBP | Construction PMI Apr | 51.1 | 50.2 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Mar | 0.60% | -0.50% | ||

| 14:00 | CAD | Ivey PMI Apr | 58.1 | 57.5 |