After issuing directives against unhedged exposure in forex derivatives, the Reserve Bank of India is cracking down on unauthorised forex trading platforms

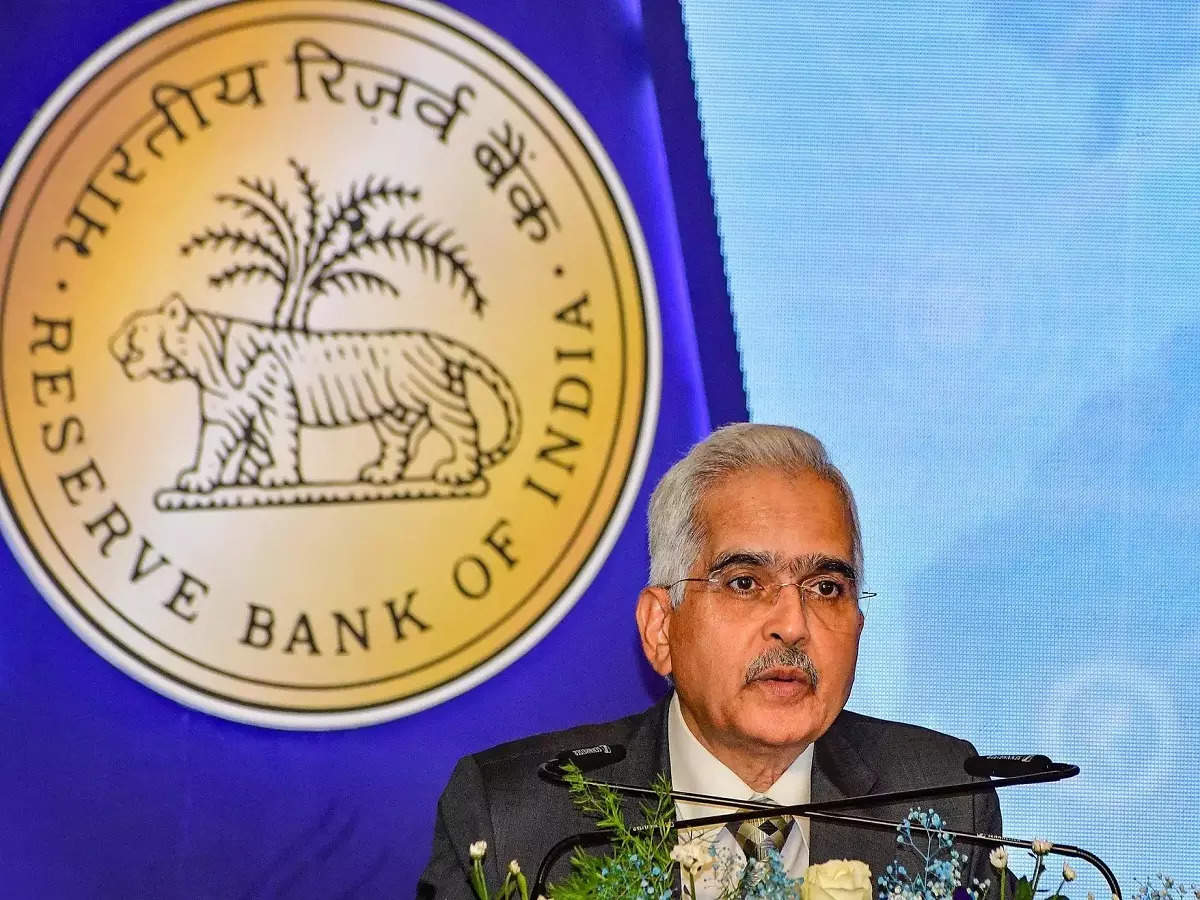

In a recent address at the Fixed Income Money Market and Derivatives Association of India-Primary Dealers Association of India in Barcelona, Reserve Bank of India (RBI) Governor Shaktikanta Das emphasised the need for increased vigilance by banks regarding certain persons or entities utilising banking channels to fund activities on unauthorised forex trading platforms.

Governor Das highlighted the persistent issue of banking channels being exploited for funding unauthorised FX trading platforms and urged banks to exercise enhanced vigilance in monitoring such activities.

To address concerns surrounding unauthorised trading platforms, Das mentioned that the RBI had implemented a framework for the authorisation of electronic trading platforms in 2018. This framework, which ensures compliance with stringent conditions, is currently being updated to align with advancements in technology that have accelerated the electronification of financial markets.

In response to complaints regarding cheating and fraud associated with unauthorised trading platforms, Das disclosed that cautionary advice has been issued against engaging in forex transactions on such platforms.

| Additionally, an ‘Alert List’ featuring entities offering or promoting unauthorised forex trading facilities has been circulated. |

Unauthorised platformsFurthermore, the RBI recently released a list of 75 entities, including alpari.com, Anyfx.com, Binomo, and Ava Trade, which are neither authorised to conduct forex dealings by the RBI nor authorised to operate electronic trading platforms for forex transactions.

Governor Das advocated for equitable treatment of retail customers in the forex market, emphasizing the need for transparency in pricing and finer pricing for smaller deals on the Negotiated Dealing System-Order Matching (NDS-OM).

Expressing concern over the wide pricing divergence between small and large customers in forex markets, Das urged banks to facilitate the use of the FX Retail platform and encouraged greater participation of Indian banks in derivative markets both domestically and offshore.

He emphasised the importance of banks conducting due diligence, assessing risk appetite, and proceeding cautiously while enhancing and expanding the participation of Indian players in rupee derivatives markets, both domestically and internationally.

ETBFSI now has its WhatsApp channel. Join for all the latest updates.