In India, corporate houses are not allowed to own banks. Many often ponder why corporates with deep pockets are not allowed to open banks or take influential stakes in lenders.

One of the answers is it may give a rise to ‘connected lending’. This refers to a banking system in which the bank owner provides loans to their own company, affiliated entities, or connected individuals (such as friends and family) at reduced interest rates. Thus, if you own a bank, you have the advantage of borrowing money for a high-risk venture at lower interest rates.

In the last round of bank licensing before it was made on-tap, a slew of corporates had unsuccessfully applied for a banking license.

Interestingly though, a central bank panel back in 2020 had recommended to let industrial houses set up banks. The RBI’s discussion paper advocated for the inclusion of large corporations due to their capability to acquire capital, which could subsequently contribute to funding economic growth.

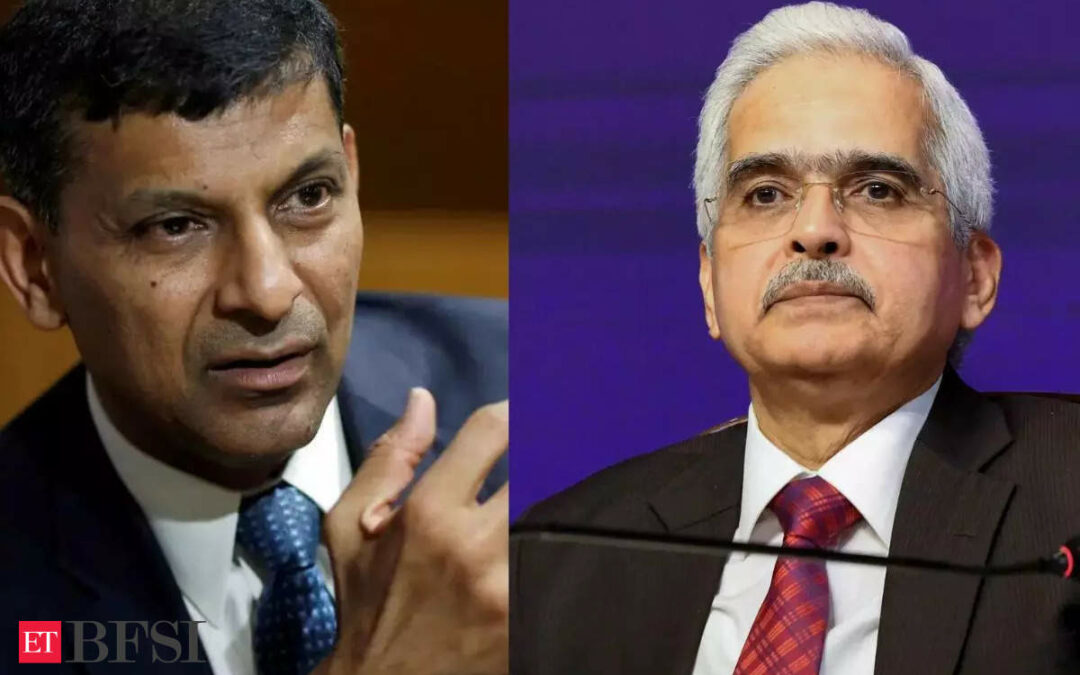

However, the recommendation led to a raft of criticism from former top brass of the central bank, including former RBI Governor Raghuram Rajan and former RBI Deputy Governor who had described this as a “bombshell”. They said, permitting corporate houses into the banking system might heighten the consolidation of political and economic influence within a limited number of business entities.

While announcing the monetary policy decisions today, the current RBI Governor Shaktikanta Das reignited talks about this as the monetary authority plans to come out with ‘unified regulatory framework’ on connected lending, which are of ‘concern’ and involve ‘moral hazards’.”Connected lending or lending to persons who are in a position to control or influence the decision of a lender can be of concern, if the lender does not maintain an arm’s length relationship with such borrowers. Such lending can involve moral hazard issues leading to compromise in pricing and credit management,” the central bank said in a statement.

The central bank flagged that the extant guidelines on the issue are limited in scope and are not applicable uniformly to all regulated entities.

The central bank will thus come out with a unified framework on connected lending for all regulated entities of the RBI. The monetary authority will also issue a draft circular for public comments.

“Connected lending pertains to lending to related parties within the same business group. While on the one hand, the RBI might be seeming to be somewhat more agreeable to allowing business conglomerates to own banking licences, it also feels it is important to, simultaneously, bolster regulations that would disallow conglomerate-owned banks from gaming the system,” said Shivaji Thapliyal, Head of Research and Lead Analyst, Yes Securities.

In 2018, ICICI Bank CEO Chanda Kochhar had resigned due to allegations of favoritism toward Videocon Group for a loan. Separately, Yes Bank’s founder Rana Kapoor purportedly received Rs 600 crore in kickbacks for influencing a lending decision.

While it may seem RBI is only making it difficult for influential people to twist loan conditions in their favor, the seriousness of Das & Co on connected lending is much intense for India as central bank keeps corporate houses away from owning banks.

If one can take the liberty to infer, it can be seen that to block out the large corporate houses from bank ownership is couched in RBI’s statement today. Much like when Rajan and Acharya, back in 2020 after the internal working group’s recommendation, had referred to the report and said “its most important recommendation, couched amidst a number of largely technical regulatory rationalisations, is a bombshell…it proposes to allow Indian corporate houses into banking. ”

In November 2021, the RBI had allowed a rise in promoter stakes from 15% to 26% in banks, aligning with an internal working group’s recommendation. Earlier this year, the RBI had given in-principle and conditional approval to IndusInd International Holdings Ltd, a Hinduja Group entity, to raise its stake in IndusInd Bank to 26%.

So, what is the problem if large corporates own banks?

“The history of such connected lending is invariably disastrous — how can the bank make good loans when it is owned by the borrower,” Rajan and Acharya had argued.

Indian banks have experienced the daunting troubles of high bad loans, which the Narendra Modi-led government has strived and still working on to curtail them down. The widespread NPAs predicament in the banking sector, along with specific institutional failures such as Yes Bank, Lakshmi Vilas Bank and IL&FS, perhaps underscored the regulatory and supervisory shortcomings in the financial domain.

The central bank has been reluctant to allow big business houses to set up banks after amending the Banking Regulation Act because of worries over governance, conflict of interest, misallocation of credit and concentration risks. During Rajan’s time as governor, corporate houses were allowed to seek universal bank licences in 2013 but none were awarded to them.

L&T failed to secure a bank license while several others withdrew their candidature in 2014, when the licenses were opened up last before becoming on-tap.

“Highly indebted and politically connected business houses will have the greatest incentive and ability to push for licences. That will increase the importance of money power yet more in our politics, and make us more likely to succumb to authoritarian cronyism,” Rajan and Acharya had argued.

Narayan Vaghul, a seasoned banker, had also suggested that India has drawn lessons from its pre-bank nationalisation era, and the country would need to avoid repeating past errors by permitting the entry of major corporations into the banking sector.

Industrial houses “cannot be banking”, Vaghul had told reporters.

“There used to be a talk about, even in professional banking circles, that things are not alright in the banks which are owned by the industrial houses…I don’t think this country will have a repetition of that. It will be all professional banking.”