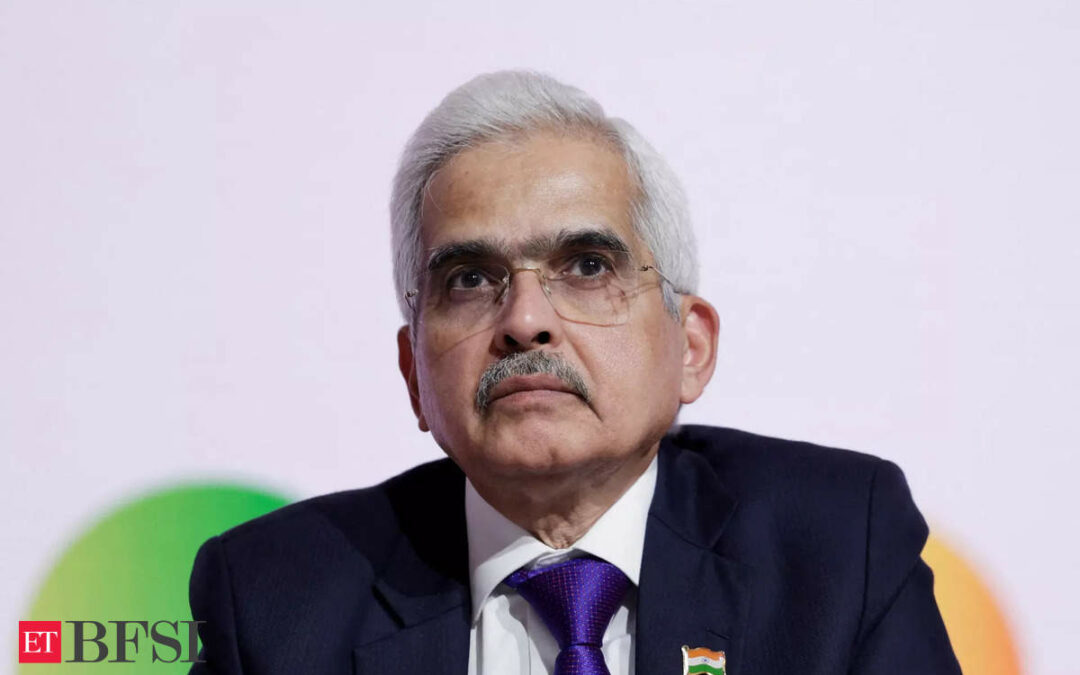

Concentrated borrowing linkages between non-bank financiers and mainstream lenders may pose contagion risks, Reserve Bank of India (RBI) governor Shaktikanta Das said, pointing to potential sectoral fault lines a week after a concerned regulator sought to restrain the recent runaway growth in unsecured advances and safeguard the broader financial system.

“NBFCs (non-banking financial companies) are large net borrowers of funds from the financial system, with their exposure from the banks being the highest,” Das told delegates at an industry conference on Wednesday. “Banks are also one of the key subscribers to the debentures and commercial papers issued by NBFCs. Needless to state that such concentrated linkages may create a contagion risk.”

He noted that NBFCs maintain borrowing relationships with multiple banks simultaneously. Hence, banks must constantly evaluate their own exposure to NBFCs and the exposure of individual NBFCs to multiple banks, Das said.

NBFCs, on the other hand, must focus on expanding their funding sources and bring down disproportionate reliance on bank funding, he said.

Sustainable credit

Non-bank lenders have played a crucial role in helping millions of Indians step on to the consumption ladder for the first time, extending funds to help them buy modern gadgets, dream vacations, entry-level cars and even budget homes.

On November 16, RBI announced increases in bank capital requirements for consumer loans and mandated lenders to set limits on various retail segment loans, signalling the central bank’s vigilance on the unbridled growth in these types of advances.

Das on Wednesday reinforced the message by telling banks and NBFCs to ensure credit growth at all levels remains sustainable and to avoid exuberance in any form. “Expansion of the credit portfolio itself and pricing of the same should be in sync with the risks envisaged,” he said.

With the economy rapidly reopening after the easing of Covid-induced business and mobility curbs, bank credit growth accelerated since April last year even as deposit mobilisation trailed the pace of credit expansion.

Emphasising the need for prudence, Das urged banks and NBFCs to further strengthen their asset liability management, particularly on the liability – or deposit – side to avoid financial stress. “In certain cases, we have observed increased reliance on high-cost short-term bulk deposits, while the tenure of the loans, both in retail and corporate loans, is getting elongated,” he said.

Eye on misuse

Directly calling upon some NBFC microfinance institutions (MFI) to avoid “usurious” lending, the RBI governor told such financiers to keep in mind the affordability and repayment capacity of borrowers in this segment.

“Although the interest rates are deregulated, certain NBFCs-MFIs appear to be enjoying relatively higher net interest margins. It is indeed for microfinance lenders to ensure the flexibility provided to them in setting interest rates is used judiciously,” he said.

MFIs, which play a key role in financial inclusion, cater primarily to marginalised and low-income groups.

While collaboration between banks and fintechs had brought down operational costs, an area that merits attention pertains to model-based lending through analytics, Das said. Banks and NBFCs need to exercise caution in relying only on pre-set algorithms, he said, calling for models to be robust, tested and re-tested periodically.

“It is necessary to be watchful of any undue risk build-up in the system due to information gaps in these models, which may cause dilution of underwriting standards,” he said.