India’s robust growth prospects and consumption demand are unhurt despite June’s first sub-7% expansion rate in five quarters that central bank governor Shaktikanta Das Thursday said perhaps reflects the customary – and temporary – drop in government spending through the polls. RBI’s FY25 economic expansion forecast of 7.2% also stays unchanged.

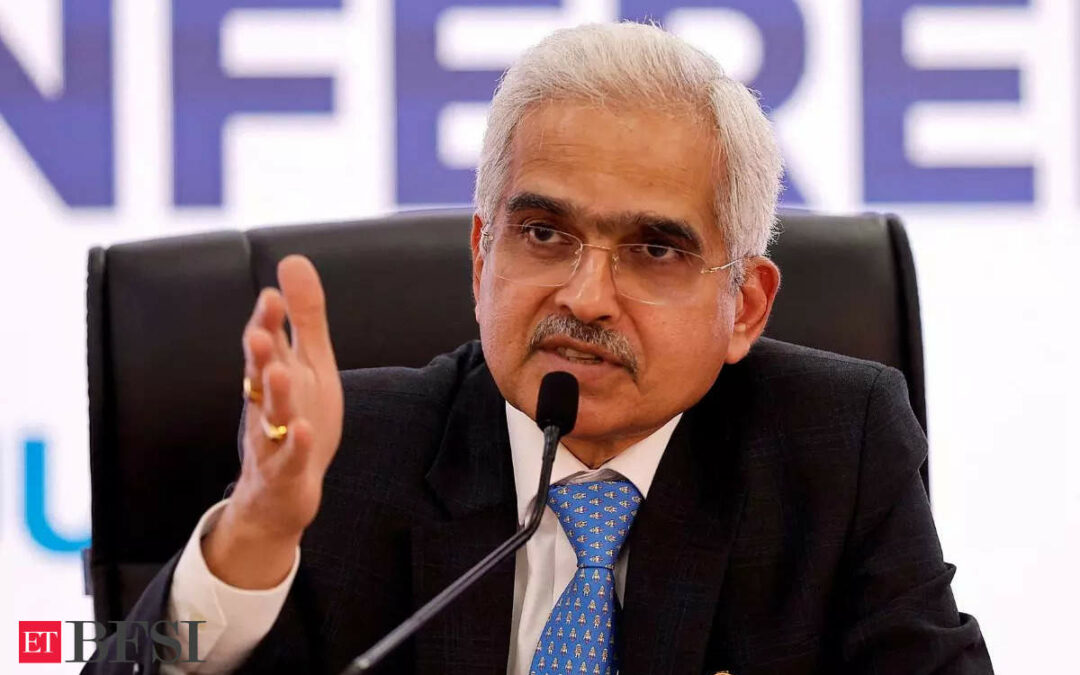

“The headline (GDP) number, however, came lower against the backdrop of muted government expenditure of both the Centre and the states, perhaps due to the Lok Sabha elections. Excluding government consumption expenditure, GDP growth works out to 7.4%,” Das said at a conference organised by the Federation of Indian Chambers of Commerce and Industry (Ficci) and the Indian Banks’ Association (IBA).

The imposition of the model code of conduct, aimed at ensuring free and unbiased polling, typically slows government spending through the period. There are curbs on announcing and allocating funds to large and capital-intensive projects that might be seen to be swaying voters.

Inflationary Pressures

Data published late last month showed that India’s GDP growth in April-June was at 6.7%, lower than the Reserve Bank of India’s (RBI) projection of 7.1% for the first quarter of FY25. The economy expanded at 7.8% in the January-March period.

Das underscored the economy’s foundational strength by pointing to the synchronised expansion in consumption and investment demand – the two key drivers of growth. Furthermore, he said government expenditure, of both the Centre and states, would likely pick up in the remaining quarters of the year, in line with the estimates provided in the budget.

He detailed the performance of the various components of GDP. Private consumption – the “mainstay of aggregate demand” with a share of around 56% in the GDP – had rebounded to 7.4% growth from 4% in the second half of the previous fiscal year, Das said.

This rebound provides evidence of the revival of rural demand, Das said. Meanwhile, investment, the other main driver of growth that makes up around 35% of GDP, grew at 7.5%, he said. “Thus, more than 90% of the GDP expanded at a robust pace and materially above 7%.”

Strong balance sheets of banks and corporates had created congenial conditions to further drive private capital expenditure.

Price stability

On persistent food inflation, which has exerted upward pressure on headline retail inflation over the past year, Das said that there was greater optimism the outlook could turn more favourable over the rest of the year with the progress of the monsoons.

India’s Consumer Price Index inflation was at 3.54% in July, the lowest level in almost five years and below the RBI’s target of 4% for the price gauge. However, food inflation was at 5.4% in July.

Early August, a few days before publication of the inflation data, Das had said that large favourable base effects may push headline inflation lower in July and that food inflation pressures could not be ignored.

“We have to remain watchful of how the forces impacting inflation play out. The balance between inflation and growth is well-poised,” Das said. “We must successfully navigate the last mile of disinflation and preserve the credibility of the flexible inflation targeting framework which is a major structural reform.”

Following a sharp rise in international commodity prices because of the Ukraine war, the RBI raised the repo rate by a total of 250 basis points from May 2022 to February 2023. The central bank has kept the benchmark policy rate unchanged at 6.50% since then, while maintaining a policy stance of withdrawal of accommodation.

Underpinned by reforms

Das said that from an economic perspective, six reforms had buttressed India’s growth story, but more needed to be done.

The reforms include the shift to a market-determined regime for the rupee’s exchange rate, the stoppage of automatic monetisation of budget deficit financing by the RBI and the enactment of the Fiscal Responsibility and Budget Management Act.

“While we have made some progress in these areas, a lot more needs to be done both at the national and sub-national levels. Improvements in ease of doing business, especially at local levels, will boost our competitiveness,” he said.

The RBI governor also listed out the introduction of the flexible inflation targeting framework, the enactment of the Insolvency and Bankruptcy Code and the implementation of the goods and services tax.