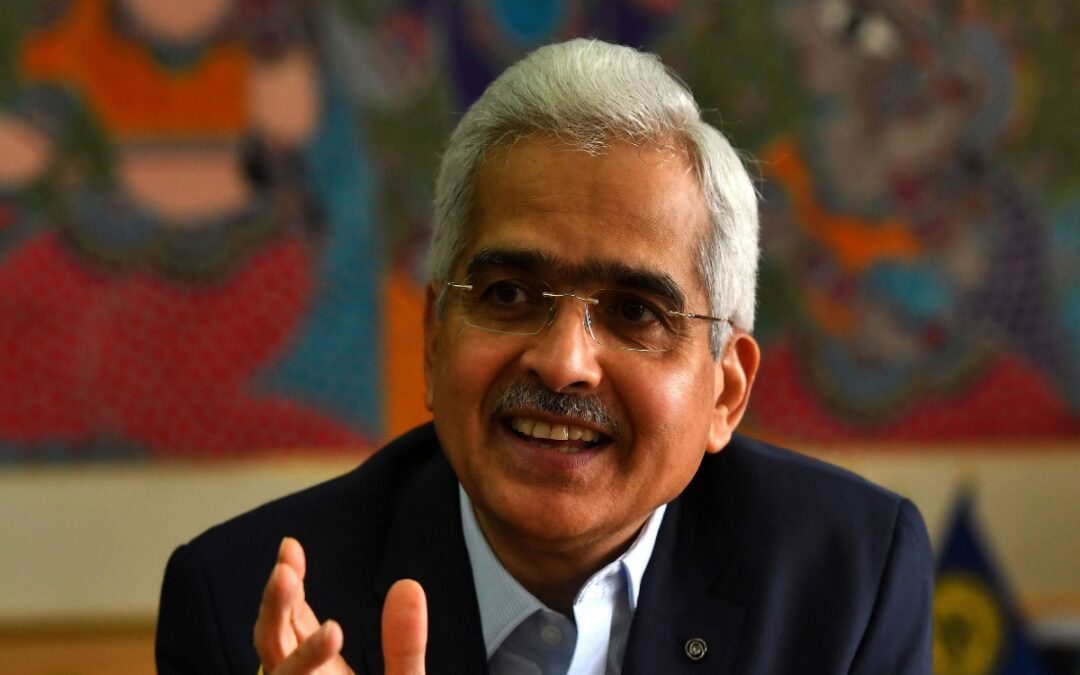

Some people across the world might believe the cryptocurrency “party” has resumed, but such instruments with no underlying value pose huge risks for emerging market economies, Reserve Bank of India (RBI) Governor Shaktikanta Das said Tuesday, just days after the US capitalmarkets regulator approved bitcoin exchange traded funds.

“They (the US Securities and Exchange Commission) are the best judge of what is good for their country, so they have done it. I would not like to comment on what another regulator in another country has done,” Das said at the World Economic Forum at Davos. “So far as India is concerned, we see a lot of risks and it is not necessary for us that what somebody else does, we simply adopt.”

Last week, the US SEC approved ETFs based on bitcoin, a move that sent cryptocurrency prices soaring worldwide.

Das has steadfastly maintained over the years that cryptocurrencies pose a palpable threat to currency and monetary stability and could be the source of the next major global financial crisis.

Food inflation woes

In response to a question on the future of cryptocurrencies in India, Das gave a short reply — “very bad” — before reiterating his concerns.

“I think some people are celebrating it as the party has just begun — it began four-five years ago then it collapsed. Now, again the party has started but there are huge risks, particularly for emerging market economies. It has issues of money laundering, terror financing. There is no underlying (for cryptocurrencies),” Das said.

While saying that India’s world-beating GDP growth is rooted in durable macroeconomic factors, Das acknowledged the central bank’s concern on volatile food inflation. “One area that is always on top of our agenda at the moment is the dynamics of food inflation, which is subject to global supply chain issues and also subject to unexpected weather events,” he said.

Wild swings in food inflation over the past few months have imparted volatility to the headline consumer price index in India, with the price gauge printing 170 basis points above the RBI’s 4% target in December. One basis point is a hundredth of a percentage point.

Das pointed to the impact of heavy rains and floods on vegetable price inflation in the past year, adding that while such factors were not in the RBI’s control, the central bank has to respond to them.

He, however, was satisfied with the trajectory of core inflation, which strips out the volatile components of food and fuel.