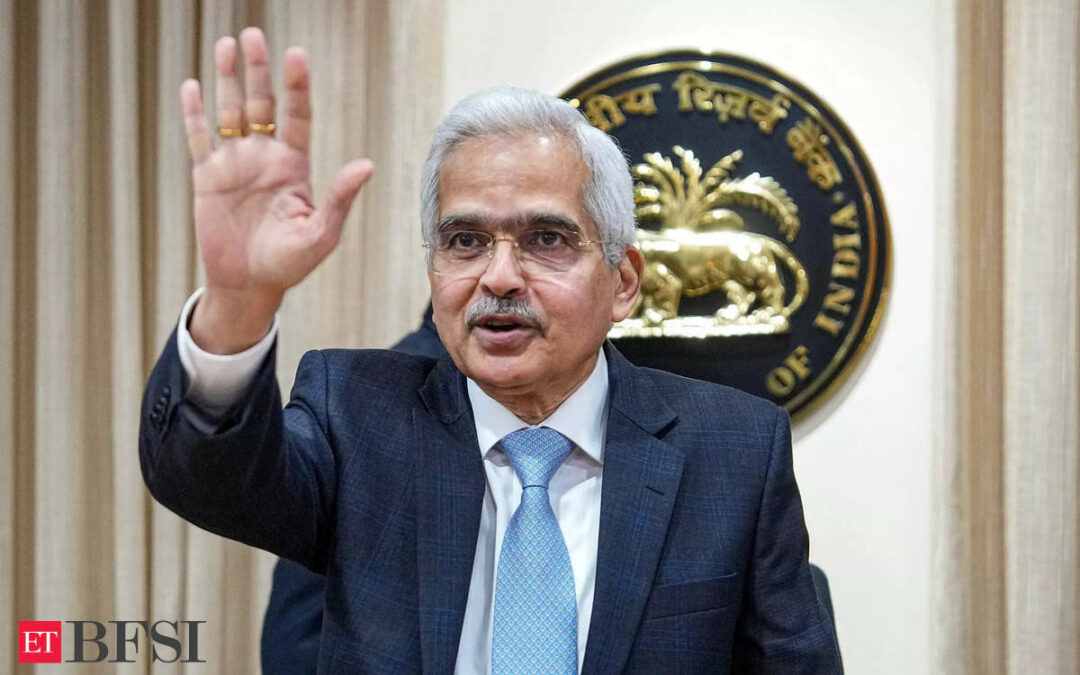

Even as the Reserve Bank of India’s rate-setting panel voted to keep the rates unchanged in its December meeting, Governor Shaktikanta Das held reservations about inflation, which has receded from highs, but remains volatile.

“The overall inflation outlook is expected to be clouded by volatile and uncertain food prices and intermittent weather shocks. In the immediate months of November and December, a resurgence of vegetable price inflation is likely to push up food and headline inflation,” Das said.

In its meeting held between December 6-8, the MPC left benchmark lending rates unchanged at 6.50 per cent for the fifth consecutive meeting. The RBI had raised the repo rate by a total 250 bps since May 2022 in efforts to cool surging inflation.

Retail inflation in India rose at the quickest pace in three months in November, primarily driven by a spike in food prices. The Consumer Price Index (CPI) reached 5.55 per cent, up from 4.87 per cent, 5.02 per cent in October and September respectively.

Food inflation, constituting nearly half of the overall consumer basket, soared to 8.70 per cent, compared to 6.61 per cent in October. Cereal, vegetables, pulses, spices and fruit prices increased by 10.27 per cent, 17.7 per cent, 20.23 per cent, 21.55 per cent and 10.95 per cent, respectively, according to official data from the Ministry of Statistics and Programme Implementation.

While noting that India’s GDP growth is likely to remain resilient, Das said “we are still quite a distance away from our goal of reaching 4 per cent CPI on a durable basis.”

Further stressing focus on cooling prices, Das said that the projected inflation for Q3FY25 at 4.7 per cent is “perilously close” to 5 per cent. “In these circumstances, monetary policy has to be actively disinflationary,” Das said.

Meanwhile, external member of the Monetary Policy Committee Jayanth Varma said that a stance is not needed at all at this stage. “If at all there is a stance, it should be neutral,” Varma said. Additionally, he noted that after many ‘difficult quarters’, India’s economic environment is turning more benign in terms of inflation and growth.

“The challenge for monetary policy is to facilitate this benign outcome where inflation trends down and growth remains robust,” Varma said.

Shashanka Bhide flagged the slower growth rate of private consumption even as investment has fuelled growth in demand. “One reason for the slower growth in consumption relates to the ‘base effects’ in H1 given the on-going ‘catch up’ overcoming the pandemic shock. But the uneven sectoral growth patterns also point to other factors influencing output noted earlier with respect to agriculture and external demand,” Bhide said.

Meanwhile, Ashima Goyal called for investment plans to be fast-tracked, with recent assembly elections reducing uncertainty around national elections and policy. Goyal said that consumption, IT and merchandise exports continue to see weakness.