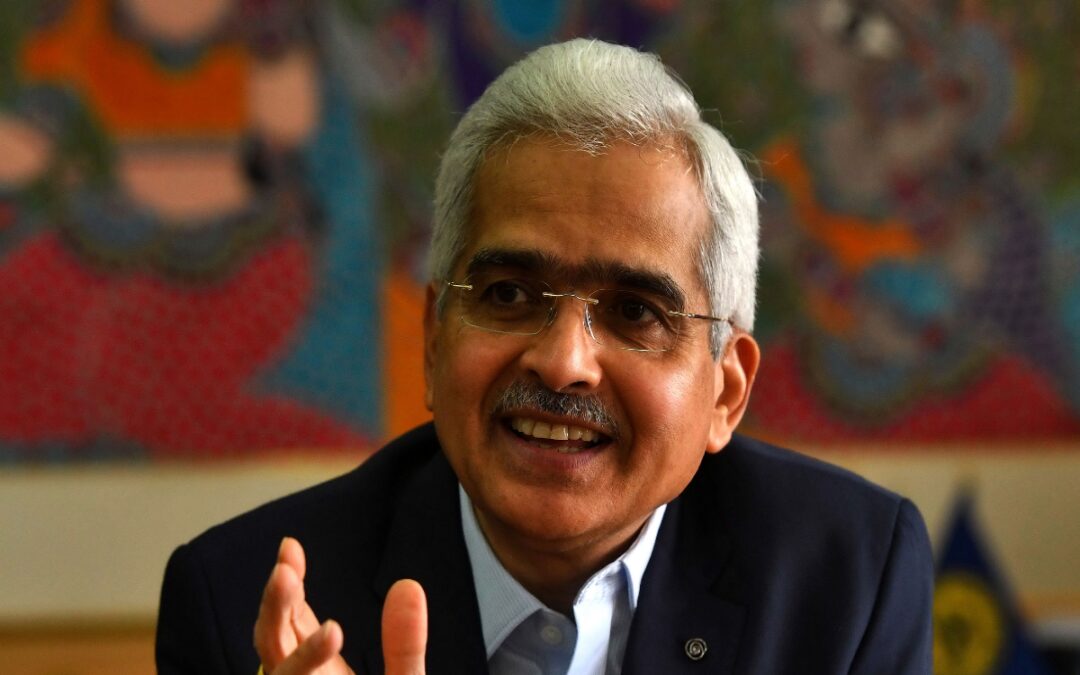

Speaking at the G20 TechSprint Finale on Monday, the Reserve Bank of India (RBI) Governor Shaktikanta Das highlighted the need for bringing in solutions to tackle the key challenges to existing cross border payments including high cost, low speed, limited access and insufficient transparency.

To this, the governor of India’s central bank suggested that Central Bank Digital Currency (CBDC) can play an important role in making cross-border payments cheaper, faster and more secure.

“Faster, cheaper, more transparent, and more inclusive cross-border payment services would deliver widespread benefits to people and economies worldwide. It would also support economic growth, international trade and financial inclusion,” Das said at TechSprint Finale in Mumbai.

India is among the very few countries to have launched the CBDC in pilot mode for both wholesale and retail segments. Launched in December 2022, this tech innovation was one of highlighted problems at the G20 TechSprint, a global long-form hackathon series that the BIS Innovation Hub co-hosted with RBI, as part of the G20 Presidency

Das suggested that to enhance CBDC in efficient cross-border payments, solutions and technologies were needed for these platforms to enable smooth operations between countries and their banking systems at large, thereby reducing costs and ensuring consistency in standards across multiple jurisdictions.

“I strongly believe, cross-border payments can be made more efficient through adoption of CBDCs and this is an area which should receive close attention. As all of us are starting on a clean slate on the CBDC front,” said Das.

The adoption of right technology platform, which is inter-operable, would be a great benefit to the future of cross-border payments ecosystem, he added.

The winner of the ‘Governor of the Year’ award, Shaktikanta Das, also pointed out that India is expanding the CBDC pilot to more banks, more cities, more people and more use cases.

“The empirical data that we are generating would go a long way in shaping the policies and future course of action,” he said.

Meanwhile, he also believes that the instant settlement feature that CBDCs bring to the table are a key to ensure cross-border payments are cheaper, faster and more secure.

Taking a step further in terms of technology and innovation, the State Bank of India and Yes Bank have implemented Unified Payments Interface (UPI) interoperability in CBDC.

This feature, with respective apps of the said banks, helps CBDC users to effortlessly scan any merchant UPI QR code, facilitating swift and secure transactions.

While launching the digital currency in India, RBI had identified eight banks for phase-wise participation in the pilot project. The first phase included four banks, namely the State Bank of India, the ICICI Bank, the Yes Bank and the IDFC First Bank.

Subsequently, another four banks, that is the Bank of Baroda, the Union Bank of India, the HDFC Bank and the Kotak Mahindra Bank were chosen to participate in the pilot.