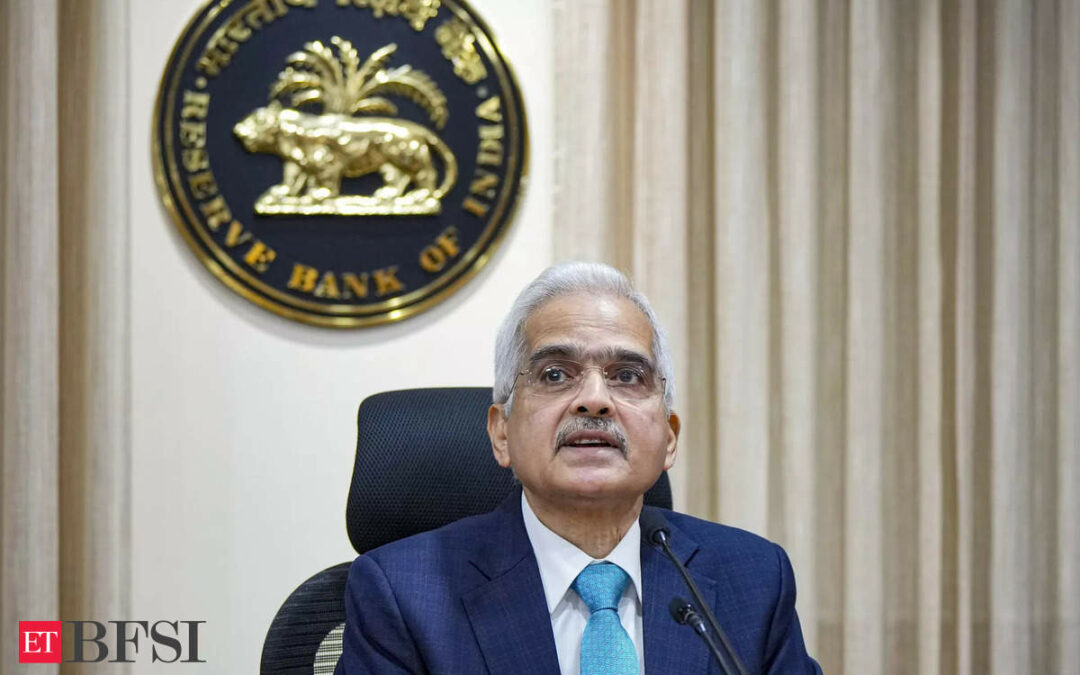

Mumbai, Reserve Bank Governor Shaktikanta Das on Thursday said price stability acts as a bedrock for sustained growth, and the central bank’s endeavour is to bring down retail inflation to 4 per cent on a durable basis. Speaking on ‘Balancing Inflation and Growth: The Cardinal Principle of Monetary Policy’, he said resilient growth has given the Reserve Bank of India (RBI) the space to focus on inflation to ensure its durable descent to the 4 per cent target.

“A stable inflation or price stability is in the best interest of people and the economy. It acts as a bedrock for sustained growth, enhances the purchasing power of people and provides a stable environment for investment,” he said.

He was addressing a high-level policy conference of central banks from the Global South here.

The Governor said when the RBI took a pause on the policy rate in April 2023 after raising it by 250 basis points, it was important to anchor market expectations from running ahead or front running the central bank.

It was, therefore, emphasised that it was a pause and not a pivot. This was to ensure that past rate actions were transmitted fully to the broader economy, he said.

The focus was on anchoring inflation expectations by emphasising our firm commitment to re-align inflation with the target, he said.

“We also categorically said that it is not enough to be within the tolerance band and that our job is not finished until we reach the target of 4 per cent on a durable basis,” the Governor added.

He further said, while the global economy has managed to hold its ground in the highly stormy weather of the last few years, clouds of uncertainties still loom on the horizon.

Policymaking in this environment of heightened uncertainty is akin to driving a car through a foggy path ridden with speed bumps. These are conditions which will test the driver’s patience and skill.

Historical regularities are looking improbable, and policymakers are being put to test. When the history of our times is written, the experiences and learnings of the last few years will, in all probability, be a turning point in the evolution of central banking, Das said.

For the countries of the Global South, maintaining overall stability which includes sustained growth, price stability and financial stability continues to be a daunting challenge, he emphasised.

Central banks need to work towards more robust, realistic and nimble policy frameworks that use monetary, prudential, fiscal and structural policies synergistically to achieve the desired outcomes, the Governor said.