The Federal Reserve’s latest move to raise its policy rate, marking the 11th increase in 12 meetings, has sparked widespread discussion in economic circles. The overnight interest rate at 5.25%-5.50% now stands at its highest level in 22 years, prompting the European Central Bank to follow suit with its 9th consecutive rate hike, reaching levels not seen since 2001. While these actions were somewhat anticipated, they have inadvertently created a challenging situation for India’s central bank.

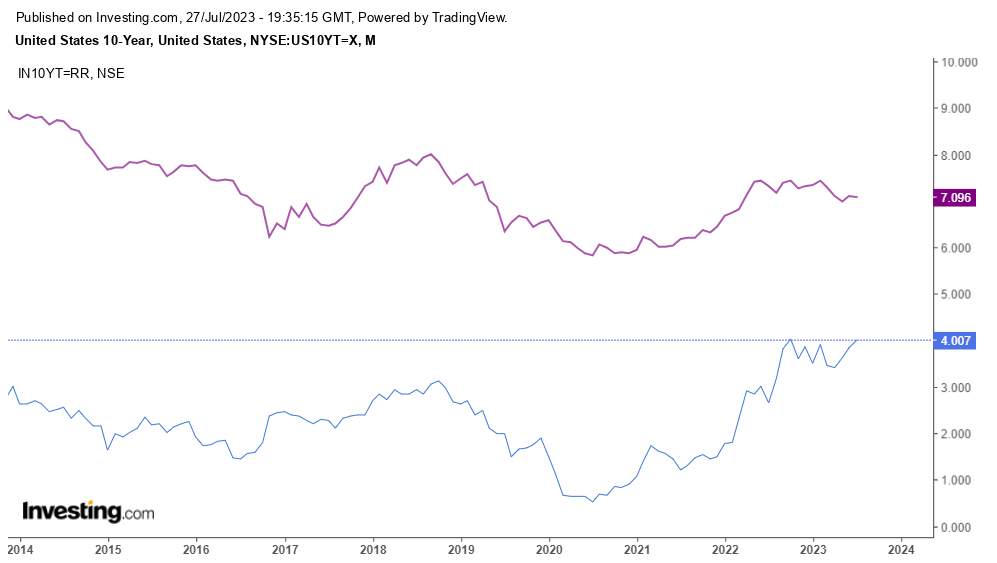

India finds itself at a critical point as its interest rate differential with the US has notably narrowed (see Figures 1 & 2 wherein government bond yields have been used as proxies for interest rates). This tight spot has left the Reserve Bank of India (RBI) facing a tough decision – whether to align with global peers and raise its repo rate or opt for a differing path.

On one hand, following the global trend of raising interest rates might help control inflation and fortify the Indian rupee. However, this move carries various implications for the country’s economic growth. Despite uncertainties in the global economic outlook, India has sustained strong economic momentum since the COVID-19 pandemic, achieving a robust growth rate of 7.2% in FY 2022-23. Elevating interest rates would inevitably heighten credit costs for businesses and consumers, thus potentially dampening India’s growth trajectory.

However, choosing not to raise interest rates in order to support growth may have implications for India’s capital account. As yield spreads between Indian and US government bonds shrink, foreign investors may find the risk-reward ratio unfavourable, leading to capital outflows. Such fund outflows could strain India’s economy and its currency.

Adding to this complexity is the recent economic performance of the United States. Contrary to expectations, the US economy grew at 2.4% in the April-June quarter of 2023. This favourable growth outcome coupled with a persistent core inflation, would invariably compel the Federal Reserve to further increase rates, thus intensifying the dilemma for the RBI, as it strives to balance inflation management with its goal of economic growth.

The higher US interest rates and a stronger US Dollar pose an additional challenge of importing inflation for a developing economy such as India with significant dollar-denominated imports. Although the recent Russia-Ukraine and the resulting sanctions on Russia, have forced India to convert a significant portion of its energy imports into currencies other than the US dollar, it is yet to be seen how reliable and robust those alternative settlement mechanisms are for India’s energy imports.

Amidst these challenges and uncertainties, there are glimmers of hope that might aid RBI’s decision-making process. Notably, the Eurozone’s negative money supply (M1) signals weakening inflationary forces. Moreover, the US Consumer Price Index (CPI) along with the US labour market have exhibited some hopeful signs of cooling off. On the domestic front, India has experienced a decrease in headline inflation and encouraging economic figures in the form of strong automobile sales and higher Industrial Production Index (IIP) numbers.

Moreover, Indian government’s prudent fiscal measures has the potential to significantly aid RBI’s economic management. The government’s ‘Make in India’ slogan has finally caught global attention. In wake of slowing economic growth in China and the current geopolitical tensions, India has a unique opportunity to forge a path of sustained economic growth coupled with benign inflation environment. Only time will tell if India’s FDI numbers are able to compensate for any short-term capital movements due to interest rates and thus propel its economy to a truly enviable growth trajectory.

Figure 1: 2 Year Bond Yields US & India

Figure 2:10 Year Bond Yields US & India

(The author is a Professor of Economics at IIM Kozhikode and Ishit Doshi is an MBA student at IIM Kozhikode)

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of Economic Times)