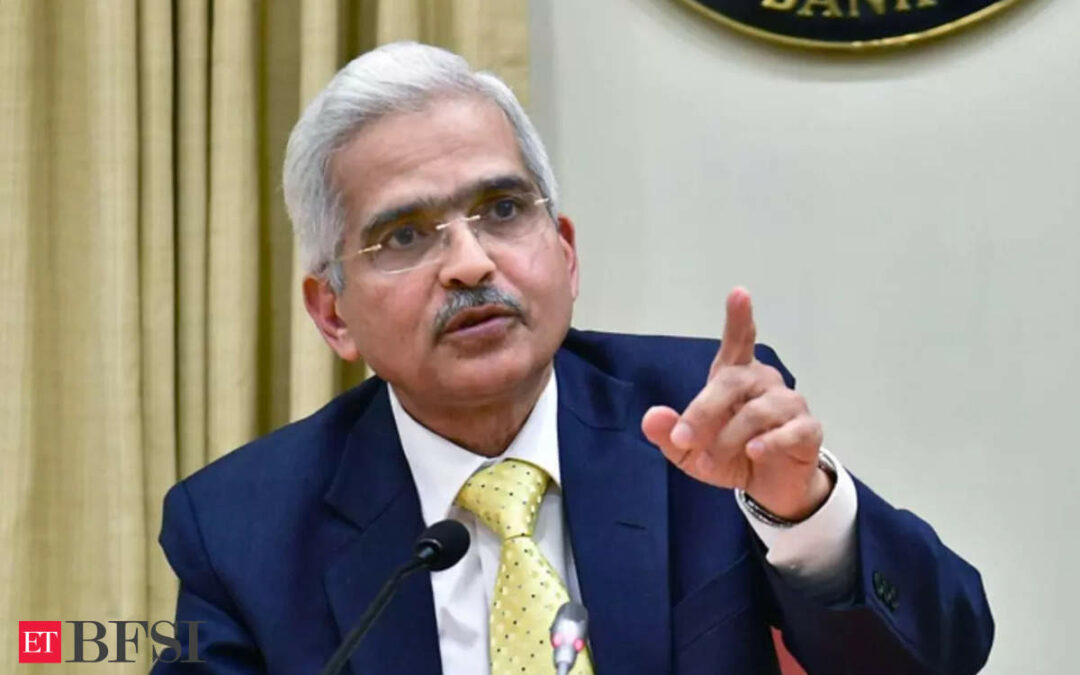

The RBI Governor Shaktikanta Das on Friday announced the inclusion of auto replenishment facility of FASTag, NCMC and UPI Lite wallet balances in the e-mandate facility.

The Central bank governor highlighted that the adoption of e-mandates for recurring payment transactions has been increasing.

“It is proposed to include payments such as replenishment of balances in FASTags, National Common Mobility Card (NCMC), etc which are recurring in nature but without any fixed periodicity in the e-mandate framework,” Governor Das stated.

ALSO READ: RBI to set up Digital Payments Intelligence platform; forms committee

He elaborated that under the e-mandate framework, it is proposed to introduce an automatic replenishment facility for such payments. The automatic replenishment will be triggered when the balance in Fastag or NCMC falls below a threshold amount set by the customer.

The Framework for processing of e-mandate for recurring transactions, issued by RBI on January 10, 2020 currently enables recurring payments with fixed periodicity such as daily, weekly, monthly, etc.

The current e-mandate framework requires a pre-debit notification at least a 24-hours before the actual debit from customer’s account. It is proposed to exempt this requirement for payments made from customer’s account for automatic replenishment of balances in FASTag, NCMC, etc. under the e-mandate framework.

ALSO READ: RBI MPC Meet 2024: Repo rate unchanged at 6.5%, GDP forecast raised to 7.2%

He further proposed the introduction of auto replenishment of UPI Lite wallet, its inclusion under the same e-mandate framework.

“In order to enable the customers to use the UPI Lite seamlessly, and based on the feedback received from various stakeholders, it is proposed to bring UPI Lite within the ambit of the e-mandate framework by introducing an auto-replenishment facility for loading the UPI Lite wallet by the customer, if the balance goes below a threshold amount set by him/her,” Governor Das said.

Since the funds remain with the customer (funds move from his/her account to wallet), the requirement of additional authentication or pre-debit notification is proposed to be dispensed with.

The UPI Lite facility currently allows a customer to load his UPI Lite wallet upto Rs 2000/- and make payments upto Rs 500/- from the wallet.

ALSO READ: RBI June MPC Highlights: Growth Up, Rates Steady, Innovation Ahead

He asserted that this will enable the customers to automatically replenish the balances in FASTags, NCMC, UPI Lite, etc if the balance goes below the threshold limit set by them.

He said that related guidelines for this proposal would be issued shortly.

“The recommendation around increased adoption of recurring payments is a very welcome move. Enabling a friction less payments experience is a critical success factor for greater adoption of mobility solution. Use of recurring payments by managing top ups and balances in mobility related solutions like fastags, NCMC, pre-paid instruments etc. will hasten the adoption of digital payments,” said Ramakrishnan Ramamurthy, Executive Vice President, India- Worldline.

Further speaking on similar lines, Anand Kumar Bajaj, Founder, MD & CEO, PayNearby highlighted that integrating UPI Lite with the e-mandate framework will benefit people in Tier 2-3 towns and rural regions, who frequently rely on small-value payments for daily needs.

“The Reserve Bank of India’s (RBI) focus on promoting small-value digital payments is a positive move towards empowering Digital Bharat. Integrating UPI Lite with the e-mandate framework will benefit people in Tier 2-3 towns and rural regions, who frequently rely on small-value payments for daily needs. This initiative is expected to spur consumption, contributing to the growth of our country’s economy. These efforts are crucial in supporting the less tech-savvy population and helping them become part of the digital economy,” he stated.