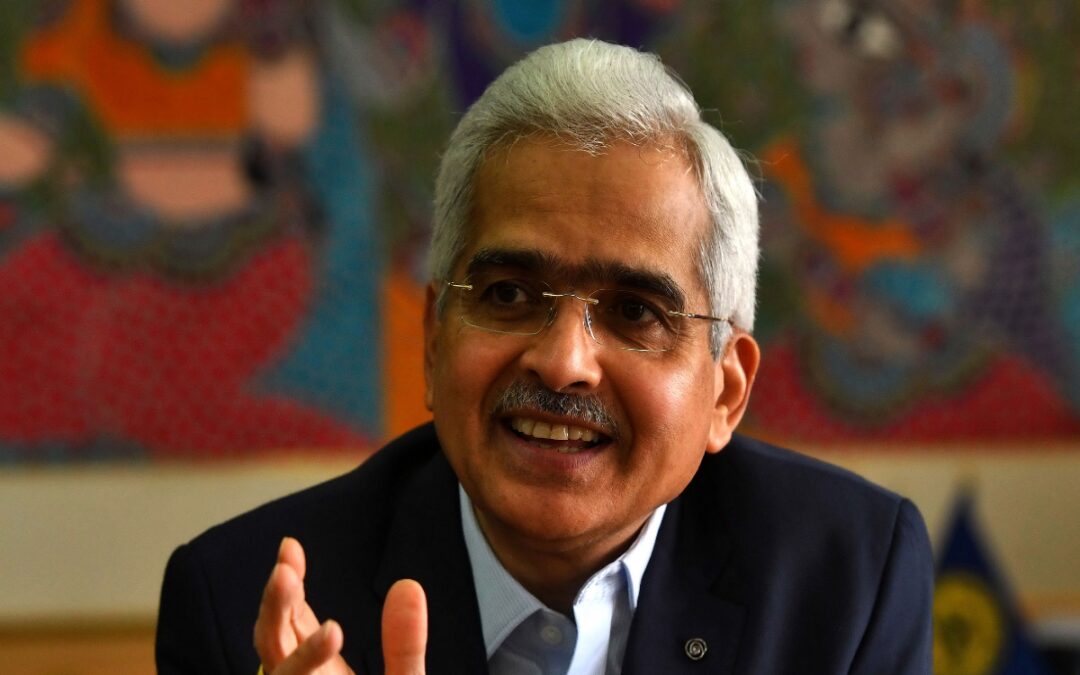

Mumbai, Reserve Bank of India remains watchful and the monetary policy is actively disinflationary and supporting growth, Governor Shaktikanta Das said on Thursday. The government has mandated the RBI to ensure that inflation based on the Consumer Price Index (CPI) remains at 4 per cent with a margin of 2 per cent on either side.

At a symposium in Tokyo, Das also talked about the central bank’s approach to the fintech ecosystem, saying it is customer-centric.

There is focus on good governance, ensuring effective oversight, ethical conduct and risk management, and encouraging self-regulation by the fintechs themselves through a Self-Regulatory Organisation (SRO), he said.

Das said the Monetary Policy Committee (MPC) in its October meeting projected CPI inflation at 5.4 per cent for 2023-24, a moderation from 6.7 per cent in 2022-23.

The CPI inflation fell to a three-month low of 5 per cent in September. The data for October is scheduled to be released on November 13.

Headline inflation, however, remains vulnerable to recurring and overlapping food price shocks, Das said and added that core inflation has moderated by 170 basis points since its recent peak in January 2023.

“In these circumstances, monetary policy remains watchful and actively disinflationary to progressively align inflation to the target, while supporting growth,” the Governor said.

The MPC has left the benchmark lending rate unchanged at 6.5 per cent and its next meeting is scheduled in early December.

According to Das, the Unified Payments Interface (UPI) has played a phenomenal role in the fintech revolution in India.

Its success story has in fact become an international model. Its ability to instantly transfer money between bank accounts through mobile applications has transformed the way people make digital transactions, he noted.

“Further, linking of the UPI with fast payment systems of other countries is also being undertaken. Linkage of fast payment systems of India and Japan may also be explored to leverage the power of fintech and make cross-border payments more efficient and less costly,” he said.

He was delivering the keynote speech at the Symposium on Indian Economy 2023 organised by Institute of Indian Economic Studies at the Tokyo Chamber of Commerce and Industry at Tokyo in Japan.

Regarding the performance of the Indian economy, Das said it is “a matter of satisfaction” that it has sailed through the turbulent waters smoothly during the recent years.

“Driven by its inherent dynamism and supported by a prudent policy mix, growth is getting stronger foothold while inflation is also coming under control. Our economic performance also owes a lot to the very calibrated, focused and targeted monetary and fiscal responses since the pandemic,” the Governor said.

However, he also said that in the current uncertain environment, it is best to avoid any sense of complacency.

“We remain agile and continue to fortify our macroeconomic fundamentals and buffers. Today, the confidence and trust in India’s prospects are at an all-time high,” he said.

To seize the moment, Das said that India looks at Japan as a close partner to usher in a new era of growth and prosperity, for both the countries.

“We will be celebrating the festival of lights, Deepavali, in a few days in India. With Japan as our close partner, I am sure the land of the rising sun will further light up our spirits to take our economies and well-being of our people to greater heights,” the Governor said.

Further, he said the policy focus on strengthening macroeconomic fundamentals and continued structural reforms have made India distinct in terms of growth outcomes.

This was reflected in the rebound in GDP growth after the pandemic from a contraction of 5.8 per cent in 2020-21 to an expansion of 9.1 per cent in 2021-22 and 7.2 per cent in 2022-23.

The GDP grew by 7.8 per cent in the first quarter of 2023-24 and the available high frequency indicators suggest continuation of this momentum, Das said.

For 2023-24, RBI has projected real GDP growth at 6.5 per cent.