The Reserve Bank of India (RBI) has maintained its forecast for India’s GDP growth projections at 6.5 per cent for FY24 despite global economic slowdown and high inflation.

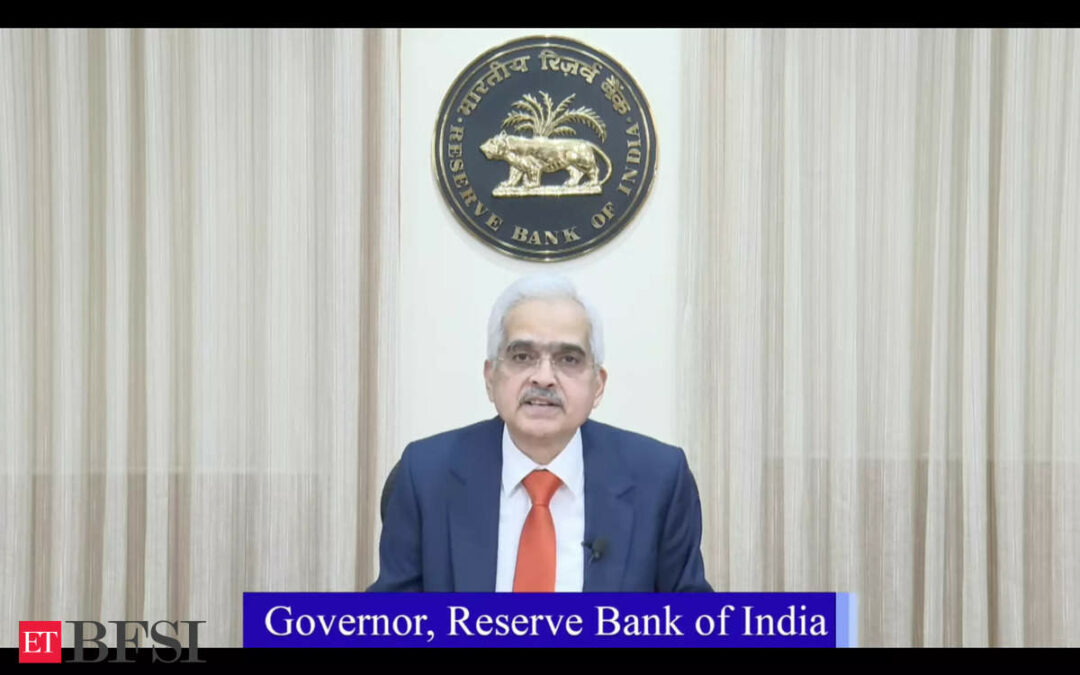

Real GDP growth for 2023-24 is projected at 6.5 per cent with Q2 at 6.5 per cent; Q3 at 6.0 per cent; and Q4 at 5.7 per cent while the growth for Q1:2024-25 is projected at 6.6 per cent, RBI Governor Shaktikanta Das said in his Monetary Policy statement.

“Looking ahead, domestic demand conditions are likely to benefit from sustained buoyancy in services, consumer and business optimism, government’s continued thrust on capex, healthy balance sheets of banks and corporates, and supply chain normalisation,” Das said.

Headwinds from geopolitical tensions and geoeconomic fragmentation, volatility in global financial markets, global economic slowdown, and uneven monsoon, however, pose risks to the outlook, he added.

On growth path

Listing the domestic growth propellers, Das said, the momentum in agricultural activity in Q2:2023-24 has been sustained, although the monsoon has been uneven, with acreage under kharif crops 0.2 per cent above last year’s level.

“Manufacturing sector gained ground in July-August 2023, supported by key sectors such as pharmaceuticals, basic metals, cement, motor vehicles, and food products and beverages. The purchasing managers’ index (PMI) for manufacturing remained robust in September.. Services sector activity is maintaining buoyancy as indicated by healthy expansion in high frequency indicators in August-September,” Das said.

While PMI Services exhibited strong expansion in September, construction activity continues to be strong.

Investment activity maintained its momentum with good support from government capex. Private sector capex is gaining ground as suggested by expansion in production and imports of capital goods and new projects sanctioned by banks.

Capacity utilisation in the manufacturing sector, on a seasonally adjusted basis, continued to trend up, which augurs well for investment activity.

The total flow of resources to the commercial sector from banks and other sources taken together at Rs 10.6 lakh crore during the current financial year so far is higher than that of last year (Rs 10.4 lakh crore). Merchandise exports and non-oil non-gold imports, however, contracted though at a moderated pace in August while services exports expanded at a healthy pace.