A latest report by Morgan Stanley highlighted that it expects RBI to stand out among its other central bank peers in Asia, with no rate cuts, on the back of strong growth and moderating inflation.

Unlike most central banks in Asia, we don’t expect the RBI to cut rates. Growth is strong and inflation, while moderating, is still above target. Moreover, we think the RBI will see the need to keep real rates somewhat high to ward off potential financial stability risks, said the report.

Three primary reasons why the RBI does not need to cut rates is that the growth is strong and capex is leading the way, getting to 4% inflation target will be difficult and keeping real rates high to ward off potential financial stability risks.

Real GDP growth momentum has been strong, averaging 8.2 per cent for the past four quarters. In four of the past five quarters, real GDP growth has surprised to the upside relative to consensus expectations.

Upasana Chachra, Chief India Economist, Morgan Stanley expects GDP growth to remain strong at 6.8 per cent in FY25 (fiscal year ending March 2025) and hold up at 6.5 per cent in FY26. RBI has also revised its growth forecast from 7 per cent to 7.2 per cent for FY25.

ALSO READ: RBI remain in wait & watch mode, rate-cut expected in October: Economists

The headline growth numbers are strong but what is more important is what underpins the GDP growth. In this regard, this is a very different cycle from the decade preceding Covid and very much like the 2003-07 cycle in what there is investment-driven growth, highlighted the report.

Investment to GDP has already risen from the trough of 28 per cent to 34 per cent in FY24 and a further rise to 36 per cent is expected over the coming years. Growth is broadening out too from public to private capex and from urban to rural consumption.

Durable disinflation to be key consideration for RBI

At the June monetary policy meeting, RBI continued to reiterate “its commitment to aligning inflation to the 4 per cent target on a durable basis”. In the post-meeting press conference, Governor Das also stated the following: “once we are confident that it will stay at 4% and it will not rise, then we will think about what the further monetary policy action will be”.

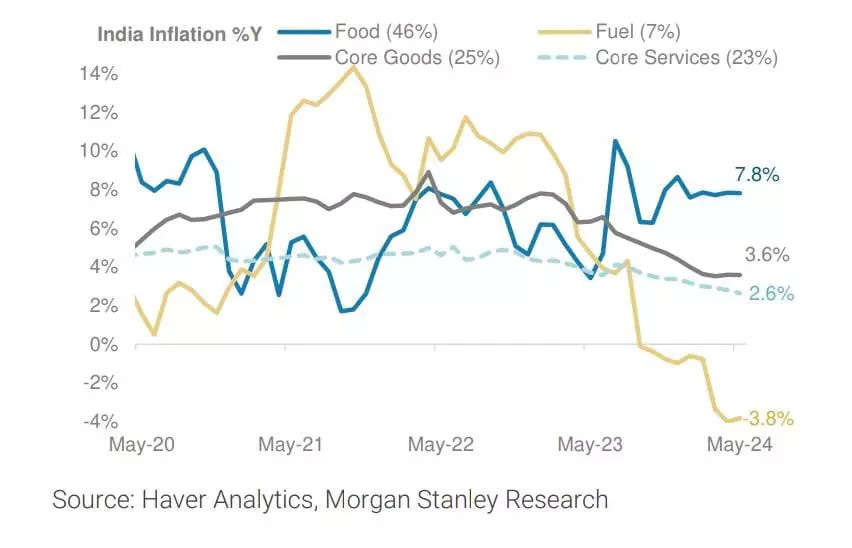

Headline CPI inflation has been on a gradual downtrend but remains above 4 per cent. Headline inflation is expected to edge lower to 3.4 per cent in Q3’24 amid more favorable base effects, but it will then pick up to 4.5 per cent in Q4’24 and average 4.6 per cent in 2025, the report highlighted.

The RBI’s quarterly inflation projections also follow a similar path and with this inflation backdrop, the Governor acknowledged that “the last mile of our journey towards 4 per cent is pretty sticky”.

Food inflation has remained elevated, averaging close to 8 per cent year-to-date. It is expected that a normal south-west monsoon this year should help bring food inflation lower.

Moreover, RBI has further highlighted the need to be watchful of “spillovers from food prices pressures to core inflation and inflation expectations for the final decent of inflation to target and its anchoring”.

Banking system stretched

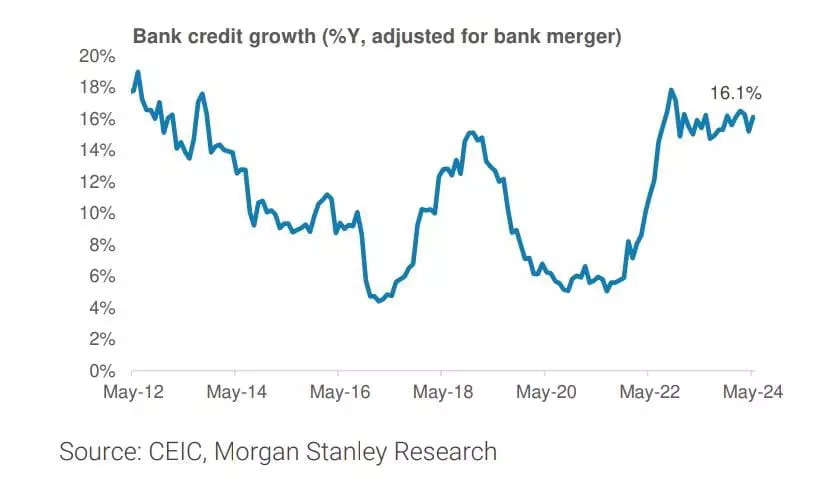

Reflecting the strength in domestic demand, bank credit growth has remained strong at 16 per cent, running well above Q1’24 nominal GDP growth of 9.9 per cent. This has meant that the pace of leveraging has picked up.

Bank credit to GDP has risen by approximately 5 pp from a trough of 48.8 per cent in June-22 to 53.6 per cent currently. While the levels of credit to GDP are not a concern, it is believed that the RBI will not want to encourage an acceleration of credit growth and the pace of leveraging by cutting rates, the Morgan Stanley report highlighted.

Credit growth has also outpaced deposit growth of 12.2 per cent, and as a result the banking system credit to deposit ratio is becoming stretched at 78.2 per cent. The incremental (i.e. 12-month trailing) credit-deposit ratio is at 100 per cent.

The report further revealed that a rate cut would mean the central bank is encouraging banks to cut lending and deposit rates which will run counter to the efforts to narrow the gap between credit growth and deposit growth.

When could RBI cut rates?

Two possible conditions could prompt the start of rate cuts. First, headline inflation will have to moderate to 4 per cent or below on a sustained basis. There is a chance that better-than-expected weather conditions will help slow food inflation meaningfully over the next few months, the report stated.

Second, if GDP growth slows unexpectedly in a significant way either due to domestic or global factors and brings with it a moderation in credit growth, then there could be rate cuts, the report added.

Capex-driven growth brings with it strong productivity growth dynamics. Hence, growth can remain strong without triggering macro stability concerns in the form of an overshoot on inflation.