The Reserve Bank of India (RBI) has raised concerns about the rapid growth of home equity loans and top-up loans on collateralised products, like gold loans, in some lending entities, asking them to tighten their monitoring of fund usage.

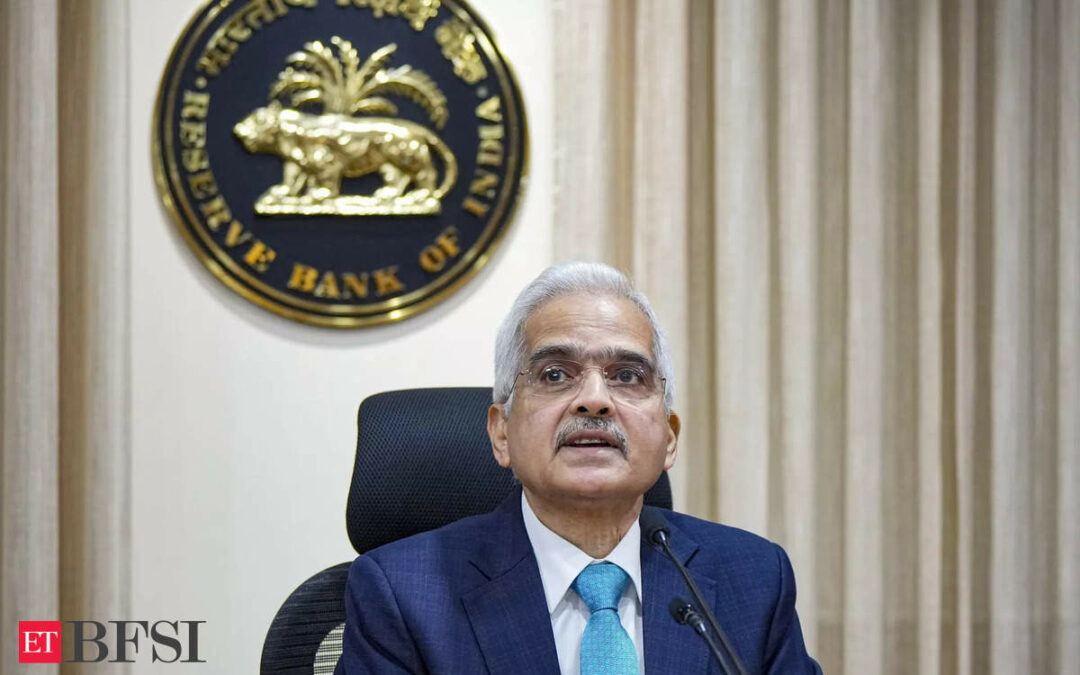

RBI Governor Shaktikanta Das (in picture) Thursday expressed concerns that regulatory standards related to loan-to-value (LTV) ratios, risk weights, and end-use monitoring are being ignored by some lenders, potentially diverting funds into unproductive or speculative activities.

“The issue that is attracting our attention is home equity loans, or top-up housing loans as they are called in India, which have been growing at a brisk pace,” Das said during the bi-monthly policy announcement.

He added that banks and NBFCs have also been offering top-up loans on other collateralised exposures such as gold loans. “Such practices may lead to loaned funds being deployed in unproductive segments or for speculative purposes,” he said.

Governor Das said that in certain entities, regulatory requirements on top-up loans are not being followed, though he clarified that it is not asystem-wide issue. “On a supervisory level, we are dealing with such entities,” Das said. “We have issued an advisory to banks, asking them to proactively monitor the end use of these loans and ensure compliance down the line.”

“Where we have identified lapses, we are addressing them separately with the entities,” he said.

Top-up loans, typically intended for home improvements, could be increasingly used for refinancing existing loans, weddings, vacations, and other non-essential expenses, lea ding the RBI to issue warnings about overleveraging and potential misuse of these funds. Das expressed concerns that such practices could lead to funds being deployed in unproductive segments or for speculative purposes, urging banks and NBFCs to review their practices and take corrective action.

“Such loans not only raise concerns on overleveraging but also suspicions on the quality of such borrowers, as they may use such top-up loans to service existing loans,” said Anil Gupta, senior vice president & sector head at ICRA Ratings.

Gupta added that the RBI’s caution to lenders on calibrating underwriting norms and closely monitoring the end-use of funds is timely.

“It could have implications for banks in each of these areas/segments on the assets and liabilities that they are sourcing,” said Suresh Ganapathy managing director, head of financial services research, Macquarie Capital.

Worries Over Growth of Top-up Home Loans

“While banks don’t disclose exact proportion of home equity/LAP loans, we believe for most banks LAP loans will be roughly about 15-20% of the overall home loan pie.” The regulator flagged heightened risks in the unsecured segment asking lenders to exercise caution while extending personal loans for consumption purposes. Das said that lenders should also look at post disbursal monitoring of such loans. The RBI has previously responded to stress in the unsecured loan segment by increasing risk weights on unsecured consumer credit and bank credit to NBFCs on November 16, 2023.

This preemptive measure moderated consumer loan growth from 23.3% in November 2023 to 13.9% in June 2024, while bank credit to NBFCs declined from 18.5% to 8.2% over the same period. Growth in unsecured personal loans, including credit card debt, remained high at 23.3% in June 2024, though down from 34.2% in November 2023.

“The sectors in which pre-emptive regulatory measures were announced by the regulator in November last year have shown moderation in credit growth,” Das said. “However, certain segments of personal loans continue to witness high growth. Excess leverage through retail loans mostly for consumption purposes needs careful monitoring from a macro-prudential point of view. It calls for careful assessment and calibration of underwriting standards as well as post sanction monitoring of such loans.”

“As the regulator of certain segments of the financial sector it is our responsibility to point out the potential areas where risks may come up,” he said. “It is our responsibility to suggest to banks, NBFCs and other financial institutions to be extra careful and to keep extra vigil on certain aspects which is not a problem at the moment. But, if left unattended can become a problem at a later stage.”