Dollar faced some selling pressure overnight, as dragged down by the sharp decline in the 10-year treasury yield. Despite this, the impact on the greenback was relatively contained, thanks to significant pullbacks in major stock indices, which provided a cushion against more substantial losses. Today’s spotlight turns to Fed Chair Jerome Powell’s semiannual testimony, an event that, despite low expectations for groundbreaking revelations, is highly anticipated for its impact on financial market, particularly in stocks and bonds.

Simultaneously, Canadian Dollar finds itself among the week’s laggards, in tandem with other commodity currencies. The spotlight is now on BoC as it gears up for its latest rate decision. While analysts broadly anticipate the central bank will maintain rates, the focal point will be the tone of BoC’s statement and Governor Tiff Macklem’s press conference, specifically whether a dovish stance will be adopted. Or, BoC would adopt a cautious “wait and see” approach, contingent on forthcoming data, will prevail to set the stage for future rate cuts.

Sterling leads as the week’s top performer, with Euro and Yen trailing behind. Swiss Franc and Dollar are mixed, while New Zealand Dollar, Australian Dollar, and Canadian Dollar lag at the bottom of the performance chart.

Technically, Gold surged to new record high at 2141.53 overnight and stays firm. Current interpretation is that rise from 1984.50 is resuming the rise rise from 18102.6 (which is a five-wave impulsive rise with a failure fifth ended at 2088.24). Further rally is expected as long as 2088.24 resistance turned support holds. Next target is 61.8% projection of 1810.26 to 2088.24 from 1984.05 at 2155.84.

But the ultimate target for this round would be cluster level at around 2260, 100% projection of 1810.26 to 2088.24 from 1984.05 at 2262.03 and 100% projection of 1614.60 to 2062.95 from 1810.26 at 2259.15

In Asia, Nikkei fell -0.02%. Hong Kong HSI is up 1.80%. China Shanghai SSE is down -0.05%. Singapore Strait Times is up 1.17%. Japan 10-year JGB yield rose 0.0080 to 0.716. Overnight, DOW fell -1.04%. S&P 500 fell -1.02% NASDAQ fell -1.65%. 10-year yield fell -0.082 to 4.137.

RBNZ’s Conway: OCR to stay restrictive for some time into the future

RBNZ Chief Economist Paul Conway, speaking at a webinar today, noted that emphasizing the contractionary nature of current interest rates is effectively “tapping the brakes” on the economy to moderate its pace of growth and address inflationary pressures.

Conway expressed optimism about the recent declines in core inflation and business inflation expectations. However, he also highlighted ongoing concerns regarding elevated household inflation expectations, which pose a potential risk to the inflation outlook.

Looking forward, Conway underscored the necessity for OCR to maintain a restrictive level “for some time into the future” to get headline inflation, currently at 4.7%, back into the 1-3% target band.

An interesting consideration Conway raised was the impact of Fed’s policy moves on New Zealand’s monetary policy trajectory. He suggested that if Fed were to initiate rate cuts towards the end of the year, and RBNZ did not follow suit, the resulting appreciation in NZD could alleviate inflationary pressures in New Zealand. This scenario might prompt RBNZ to reassess its rate cut timeline, leading to earlier-than-anticipated adjustments depending on the broader economic implications.

Australia’s GDP up 0.2% qoq in Q4, continuing consistent slowdown

Australia GDP grew 0.2% qoq in Q4, slightly below expectation of 0.3% qoq. On an annual basis, the economy expanded by 1.5% yoy.

The data indicates deceleration in economic momentum as the year progressed, with Katherine Keenan, the head of national accounts at ABS, noting a consistent slowdown across each quarter of 2023.

The main pillars supporting GDP growth were identified as government spending and private business investment. Government final consumption expenditure saw 0.6% qoq increase , while private business investment grew 0.7% qoq.

The significant contribution of net trade, which added 0.6 percentage points to the overall GDP growth, was largely attributed to a -3.4% qoq decrease in import.

BoC to hold rates steady, EUR/CAD and GBP/CAD extending gains

BoC is widely anticipated to maintain benchmark overnight rate at 5.00% today, marking the fifth consecutive meeting without change. While dropping its tightening bias in January, it is deemed premature for BoC to adopt a loosening stance at this point. The central bank might reiterate the ongoing process to bring inflation back to target, indicating that the desired state has not been fully achieved yet. The critical aspect to observe will be how Governor Tiff Macklem articulates the current inflation outlook.

A recent Bloomberg survey highlighted consensus among economists predicting the first rate cut to occur in June. Overnight swaps markets attributing a mere 30% chance for a cut in April and anticipating the initial full 25 basis points reduction in July. Nonetheless, these projections remain flexible, hinging on forthcoming data and economic developments.

Canadian Dollar is trading as the month’s weakest performer so far, particularly struggling against Euro and Sterling. More downside is in favor for the Loonie in the near term as traders continue to reverse their bets on earlier ECB and BoE cut. The persistence of this selling momentum, however, ultimately depends on which central bank initiates rate cuts first and the subsequent rate of policy easing.

Technically, EUR/CAD’s breach of 1.4733 resistance suggests that correction from 1.5041 has already completed with three waves down to 1.4457. Further rally is now in favor as long as 55 D EMA (now at 1.4625) holds. Further rally would be seen to retest 1.5041 resistance first. Firm break there will resume the larger up trend to 61.8% projection of 1.4155 to 1.5041 from 1.4457 at 1.5343 next.

GBP/CAD’s breach of 1.7270 resistance this week suggests that consolidation from there has completed at 1.6919 already. Further rise is in favor as long as 55 D EMA (now at 1.7060) holds. Decisive break of 1.7332 high will resume the larger up trend from 1.4069 and target 100% projection of 1.6355 to 1.7270 from 1.6919 at 1.7834.

Fed Powell’s testimony eyed, 10-year yield takes a preemptive drop

Fed Chairman Jerome Powell is set to begin his two-day semiannual Congressional testimony today, drawing significant attention from the markets as participants seek clarity on the Fed’s monetary policy direction for the year. Key questions include the timing of the first rate cut and the total number expected throughout the year.

Powell is anticipated to reiterate the cautious stance echoed by his colleagues, indicating that Fed is not in a hurry to lower interest rates. The central bank seeks further assurance that inflation is on a consistent downward path to target before considering rate reductions. Regarding the number of rate cuts, Powell may reference the median projection of three cuts this year, emphasizing that any adjustments will be contingent on incoming economic data.

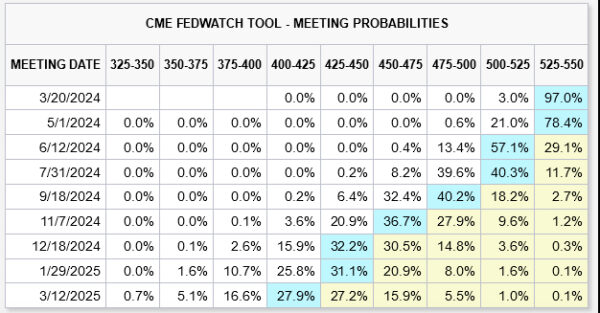

Currently fed fund futures suggest a slightly less than 70% probability of the initial rate cut occurring in June. By year-end, the likelihood exceeds 80% that federal funds rate will adjust to a range of 4.50-4.75%, marking three 25bps reductions from the present 5.25-5.50% level.

A key to watch is the reactions in 10-year yields the break of 55 D EMA (now at 4.188) affirms the case that corrective recovery from 3.785 has completed at 4.354 already. Risk will now stay on the downside as long as this EMA holds. Deeper fall is in favor towards 3.785 low. This development would keep Dollar under some pressure, or at least cap its rally momentum. A daily close above 55 EMA would delay the bearish case. But upside potential for rebound should be limited below 4.354.

On the data front

Germany trade balance, UK PMI construction and Eurozone retail sales will be released in European session. Canada will release labor productivity and Ivey PMI later in the day. Fed will also publish Beige Book economic report.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2672; (P) 1.2704; (R1) 1.2736; More…

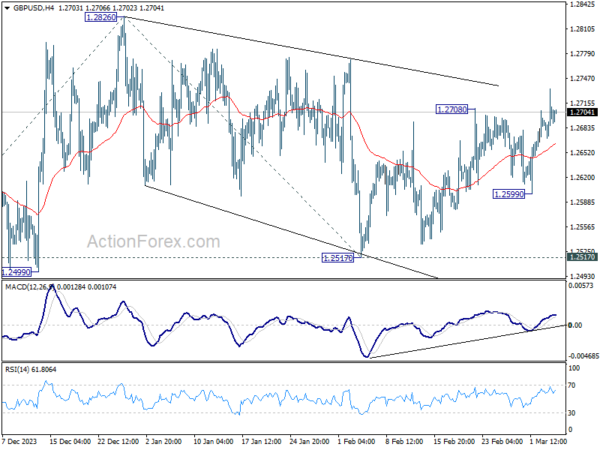

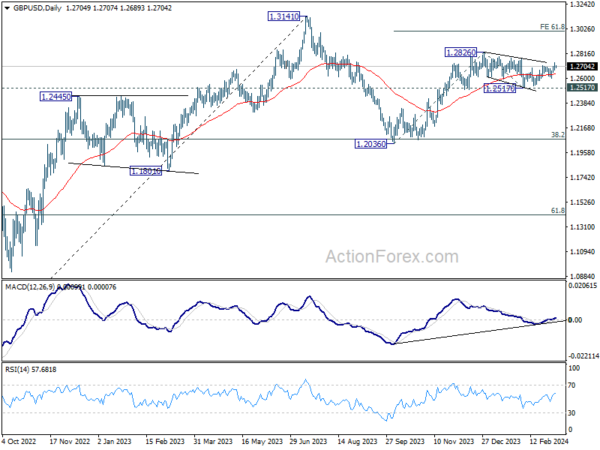

Gold’s rise from 1.2517 resumed by breaking through 1.2708 and intraday bias is back on the upside. Further rally would be seen to 1.2826 resistance first. Firm break there will target 61.8% projection of 1.2036 to 1.2826 from 1.2517 at 1.3005 next. For now, further rise will remain in favor as long as 1.2599 support holds, in case of retreat.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg, which could be still in progress. But upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2517 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | GDP Q/Q Q4 | 0.20% | 0.30% | 0.20% | 0.30% |

| 07:00 | EUR | Germany Trade Balance (EUR) Jan | 21.0B | 22.2B | ||

| 09:30 | GBP | Construction PMI Feb | 49.2 | 48.8 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Jan | 0.10% | -1.10% | ||

| 13:15 | USD | ADP Employment Change Feb | 150K | 107K | ||

| 13:30 | CAD | Labor Productivity Q/Q Q4 | -0.10% | -0.80% | ||

| 14:45 | CAD | BoC Interest Rate Decision | 5.00% | 5.00% | ||

| 15:00 | USD | Fed’s Chair Powell testifies | ||||

| 15:00 | USD | Wholesale Inventories Jan F | -0.10% | -0.10% | ||

| 15:00 | CAD | Ivey PMI Feb | 54.4 | |||

| 15:30 | USD | Crude Oil Inventories | 2.4M | 4.2M | ||

| 19:00 | USD | Fed’s Beige Book |