Mumbai: Fresh capital raised via initial public offerings (IPO) this year has surged to the highest in more than a decade, pointing to the long-awaited revival in capital expenditure by India’s private sector that believes a rapidly expanding economy will soon stretch existing capacities.

About half the initial public offerings proceeds of ₹27,435 crore garnered or announced in 2023 are fresh issues, meaning the funds will go into the capital structure of the issuers to either finance capital assets or retire existing debt earlier garnered to build capacities.

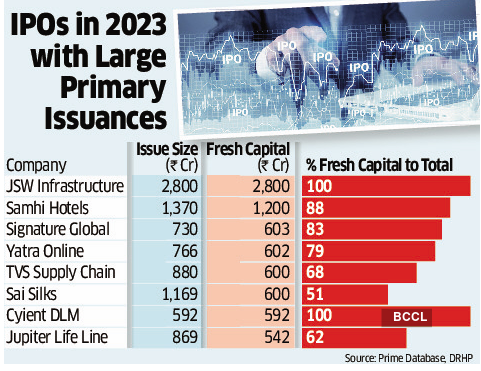

The ₹2,800-crore public issue of JSW Infrastructure, India’s second-largest commercial port operator, consists entirely of primary shares. Likewise, a significant 88% of the ₹1,370-crore public offering of Samhi Hotels comprises fresh issue of shares. Recent initial public offerings, such as those by SignatureGlobal, Yatra Online, and Zaggle Prepaid Ocean Services feature fresh issue components ranging from 70% to 85%.

Bankers said companies are preparing for an economic expansion and putting in capital expenditure to encash the anticipated boom. “Most of the recent public issues are from the manufacturing sector, seeking substantial capital infusion for both capital expenditure and acquisitions,” said Dharmesh Mehta, MD & CEO of DAM Capital.

50% from Manufacturing Sector

“Corporations, buoyed by a bullish outlook are diligently strategising to facilitate their anticipated growth trajectory,” he said.

So far in 2023, about 50% of the IPOs that have successfully raised funds originate from the manufacturing sector, while 35% of the issuers belong to other capital-intensive industries such as hotels, hospitals, logistics and construction.

Interestingly, the banking, financial services, and insurance (BFSI) sector accounted for just two IPOs this year.

“Amid the market euphoria, corporations are actively securing fresh capital to fortify their balance sheets in preparation for future growth,” said Abhijit Tare, CEO-Investment Banking Motilal Oswal Financial Services. “Many mid-level companies are augmenting their capacity to align with the China+1 strategy, while others are gearing up for building capacity in Production-Linked Incentive (PLI) schemes.”

Through the decade to 2022, companies had raised relatively smaller amounts through IPOs to meet their internal financial needs, with most funds channelled toward existing shareholders.

In 2022, a mere 30%, equivalent to Rs 17,659 crore of the total funding of Rs 59,302 crore, originated from primary issuances, with the remaining Rs 41,643 crore raised through the sale of existing holdings by investors, showed data compiled by Prime Database. This marks a decline from the 36% ratio observed in 2021. The ratio was a meagre 13% in 2020.

Projects announced in the first quarter of FY24 were estimated at Rs 5.96 lakh crore – the highest in five years.

In recent years, the government has taken the lead in driving investments, while private capital expenditure that has a cascading impact on economic growth and job creation remained a relative straggler.