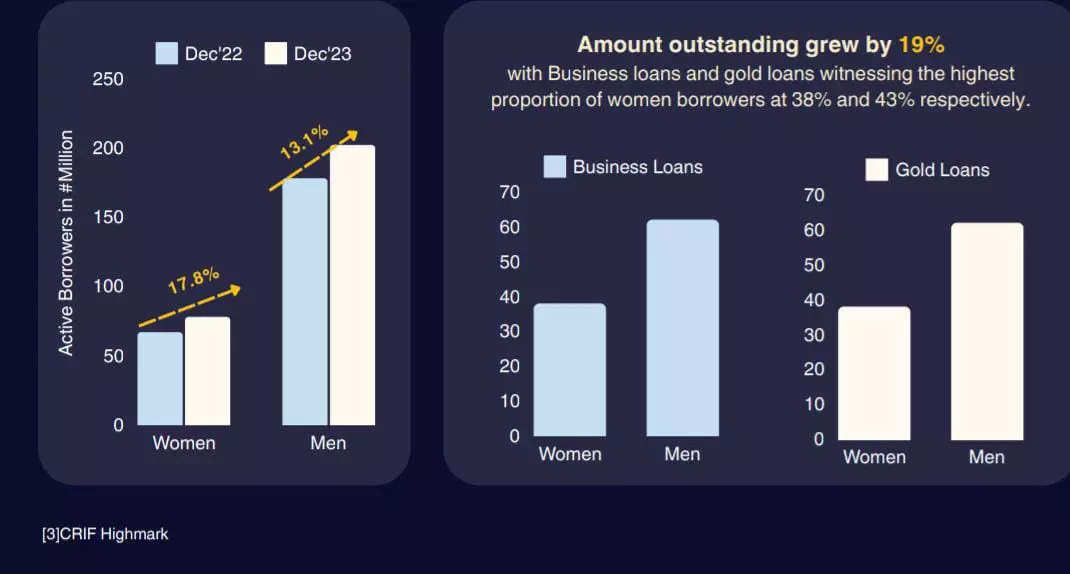

A recent report by IndiaP2P revealed that women are outpacing men in credit uptake year-on-year. CY23 witnessed women borrowers with active loans outpacing men growing from 67 million active borrowers to 78 million. This pace of growth is extremely encouraging and indicative of women’s business and wealth-creation ambitions.

Surveys with borrowers indicate that women are increasingly using digital tools to start and grow their businesses. Selling online via marketplaces, WhatsApp-based order booking, and using social media platforms for video-based promotions are some of the more common examples of digital tools.

The usage of these tools is levelling the playing field for entrepreneurs when it comes to expanding beyond local clientele. This new digital confidence is also contributing to greater credit demand for growth.

Overall, India ranks 122 out of 190 countries in the Gender Inequality Index (GII), a component of UNDP’s Human Development Index (HDI). Faster and more equitable access to credit can generate substantial economic growth and social progress.

As per the report, women in India are more reliable when it comes to lending by banks or NBFCs as they are more diligent in repayments. The number of loans disbursed to women has also grown faster in the past years, reversing years of stagnation. A large part of this growth has come from women borrowing for business and entrepreneurship purposes.

While women are increasingly borrowing more, the average borrowings disbursed to men are higher than women across every loan type, including gold loans.

Another recent report by FinTech company Tide revealed that while access to credit exists for women entrepreneurs, there is also a high degree of informal borrowing.

About 52 per cent of women entrepreneurs have access to financial credit, indicating that 1 in 2 entrepreneurs has access to finance, while 47 per cent said they face challenges, said the report.

The report further highlighted that nearly all, 95 per cent of women say they are unaware of existing government financial schemes or initiatives to leverage for their business. This indicates women are turning to the informal sector for access to credit.

Interestingly, about 80 per cent of women agree that tailored financial programmes can make their entrepreneurial journey easy.