Reserve Bank of India (RBI) today projected that retail inflation would average 5.4 per cent in this fiscal and come down below 5 percent only in the next fiscal even as it warned of more persistent food prices.

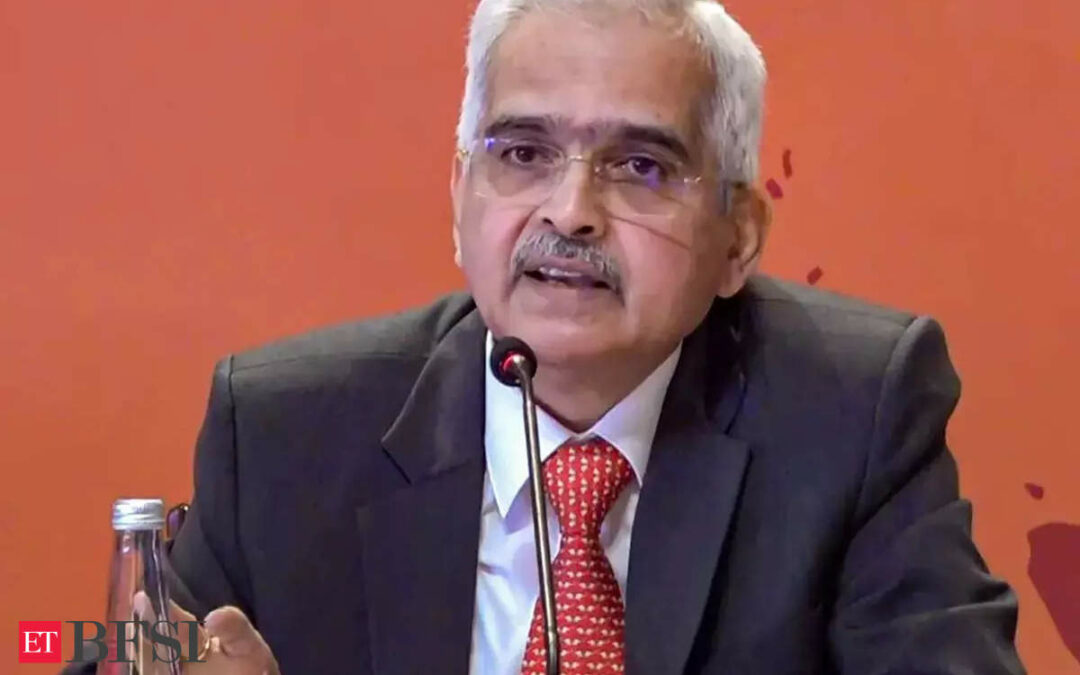

“CPI inflation is projected at 5.4 per cent for 2023-24, with Q2 at 6.4 per cent, Q3 at 5.6 per cent and Q4 at 5.2 per cent. The risks are evenly balanced. CPI inflation for Q1:2024-25 is projected at 5.2 per cent,” RBI governor Shaktikanta Das said in his statement.

High food prices

The overall inflation outlook is clouded by uncertainties from the fall in kharif sowing for key crops like pulses and oilseeds, low reservoir levels, and volatile global food and energy prices. The recurring incidence of large and overlapping food price shocks can impart generalisation and persistence to headline inflation.

While near-term inflation is expected to soften on the back of vegetable price correction, especially in tomatoes, and the reduction in LPG prices, the future

trajectory will be conditioned by a number of factors, he said.

For 2024-25, assuming a normal monsoon, and no further exogenous or policy shocks, structural model estimates indicate that inflation will average 4.5 per cent, in a range of 3.8-5.2 per cent, the Monetary Policy Statement said.

The key factors

For kharif crops, the area sown under pulses is below the level a year ago. Kharif onion production needs to be watched closely. Demand-supply mismatches in spices are likely to keep these prices at elevated levels. The inflation trajectory will also be shaped by El Niño conditions and global food and energy prices. Together with global financial market volatility, these factors pose risks to the outlook.

upside risks emanate from more persistent food price increases due to weather-related disturbances, which could then feed into inflation expectations; further hardening of global commodity prices amidst an escalation of geopolitical tensions; and a larger pass-through of input cost pressures to output prices. The downside risks could emanate from an early resolution of geopolitical tensions, a steep correction in global crude and commodity prices in the event of a sharp slowdown in global growth, and further improvement in supply conditions,” it said.

On the positive side, core inflation softened to 4.9 per cent during July-August 2023. 13 It has eased by around 140 basis points from its recent peak in January 2023.

Further disinflation of the core component is critical for price stability, Das said. “As evident from our survey, there is further progress on anchoring of inflation expectations which entered single digit zone for the first time since the COVID-19 pandemic,” Das said.