Summary

In the month of July retailers saw a sales increase of $6.8 billion, or 25% of the total gain from the prior two years in a single month. While most of that was an autos bounce after an ugly June, gains were broadly based and thus at odds with reports of a more cautious consumer.

They Might Be Choosy, But Consumers Are Still Spending

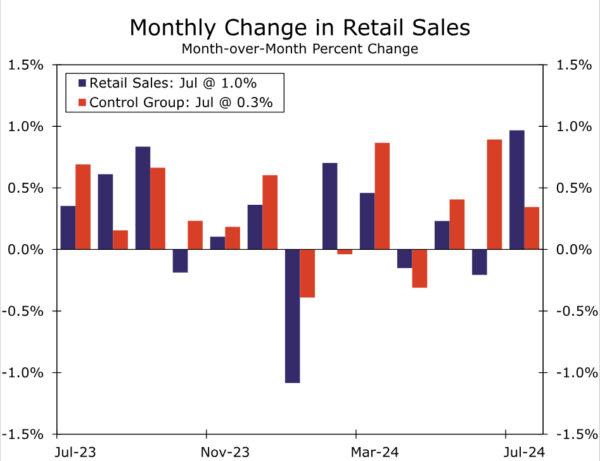

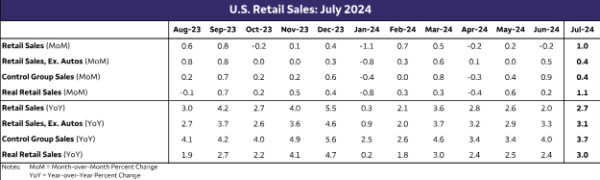

Retailers increased sales more than twice as fast as the consensus had estimated in July. That is true whether describing headline retail sales (+1.0% vs. 0.4% expectation) or the measure that excludes autos and gas (+0.4% vs. 0.2% expectation). Perhaps the most remarkable development though is that control group sales, a favored tool for predicting PCE spending in the GDP report, increased 0.3% in July. Coming on the heels of a 0.9% gain in the prior month, the upshot is more solid goods spending than most forecasters, ourselves included, had expected.

Less than two weeks ago, broad-based weakness in the July jobs report sent global financial markets into a tailspin and re-ignited fears of U.S. recession. In our August forecast update, we described how despite it being somewhat counter-intuitive, recent consumer spending numbers have come in stronger even as labor market indicators have come in weaker. Today’s retail sales report is the latest development on this theme. That spending momentum in July positions spending for a solid third quarter.

Prior to this release we had already been expecting a decent outturn for Q3 spending and forecast total real PCE was set to rise at a 2.3% annualized clip in Q3, essentially matching the Q2 pace. Sales leaped $7 billion in July, which equates to about a quarter of the gain we’ve seen over the past two years for retail in a single month. To say July sales popped is somewhat of an understatement, and it easily sets us up for stronger growth in Q3 than we had been anticipating previously even with some potential payback in August.

Source: U.S. Department of Commerce and Wells Fargo Economics

As was widely expected, the place where sales picked up the most was the largest category: auto dealers. A slump in June set up July for a solid gain of 3.6%. This is made somewhat more impressive by the fact that the CPI report showed auto prices are actually down over the past year. Some old familiar friends have returned to auto dealerships to help move inventory including more attractive financing terms, manufacturer rebates and dealer incentives.

Elsewhere, stores reported broad-based gains across most store types. The only categories that were down were clothing, sporting goods and miscellaneous. If one were to judge only from consumer company earning announcements, little of this makes sense.

The CEO of a major retailer in the building materials and garden equipment space earlier this week noted a “deferral mindset” among their shoppers. While a leading general merchandise retailer today described shoppers at their stores as being “discerning, choiceful, value-seeking.”

Labor market data have grown in importance as the Fed has shifted its focus back to the jobs market, and by extension the health of the consumer matters. Even though inflation and employment are the sole mandates, the Fed cannot afford to look past consumer behavior.

Source: U.S. Department of Commerce and Wells Fargo Economics

We’ve long held the view that continued consumer resilience depends on income growth as savings are no longer in excess and access to affordable credit has dwindled. With retail sales having held up through July, it somewhat walks back the urgency for an aggressive Fed pivot. Yet retail sales are limited in their growth signal as they mostly cover goods consumption and are subject to large monthly revisions. The more comprehensive personal income and spending report out later this month will be key to gauging consumer resilience, but the July retail report was a positive economic development. It’s the latest reminder that its tough to bet against the US consumer.