A house is a house, and it cannot be an asset. It is meant for living and is different from shares and other assets, said Sanjay Malhotra, Revenue Secretary, Ministry of Finance on the revocation of indexation benefit from the real estate assets.

In the 2024 Budget, Finance Minister Nirmala Sitharaman announced the removal of the indexation benefit for property sales.

Previously, long-term capital gains (LTCG) from property sales were taxed at 10% with the indexation benefit. The new Budget documents indicate that the tax rate for LTCG on property sales will increase to 12.5% without the indexation benefit.

Answering queries over the new arrangement without indexation benefits for the real estate market, the Revenue Secretary said, “Whether indexation is there or not, the point is if you reinvest it, the benefits of rollover will be there.”

“If you sell a house, and get proceeds out of it, now you should re-invest it into another house. The benefits of rollover will be there,” he said.

Revenue Secretary added that the rollover benefits will continue on capital gains of up to Rs 10 crore under the new structure.

Reveals study of FY2022-23:

Revealing the study of FY2022-23 for the ‘first time’, he said, “In FY2022-23, 10.5 lakh returns have capital gains only from land and building, which has indexation benefits. But the effective tax rate was almost 12%.”

“Effective LTCG tax rate was 11.54% on real estate in 2022-23, which is less than tax on salaries,” he added.

On the question of if this 12.5% tax will be increased, he said, “No one knows what future holds for us, but in my sense, for the medium term, this rate are going to remain stable.

He further said, “If you book a profit of a certain amount by selling a real estate property, and you keep it into your pocket then why it should not be treated similar to what you earn from shares on same capital?”

On the question on whether the government has plans to keep the 12.5% rate stable or increase in ner future, the Secretary said, “No one knows what future holds for us, but in my sense, for the medium term, this rate are going to remain stable.”

Speaking further on the capital gains he informed that the changes were driven by simplicity, fairness, and equity, ensuring that those more capable bear a burden than the lesser.

Also Read:Revenue Secretary shares 3 reasons for changes in Capital Gains tax in Budget 2024

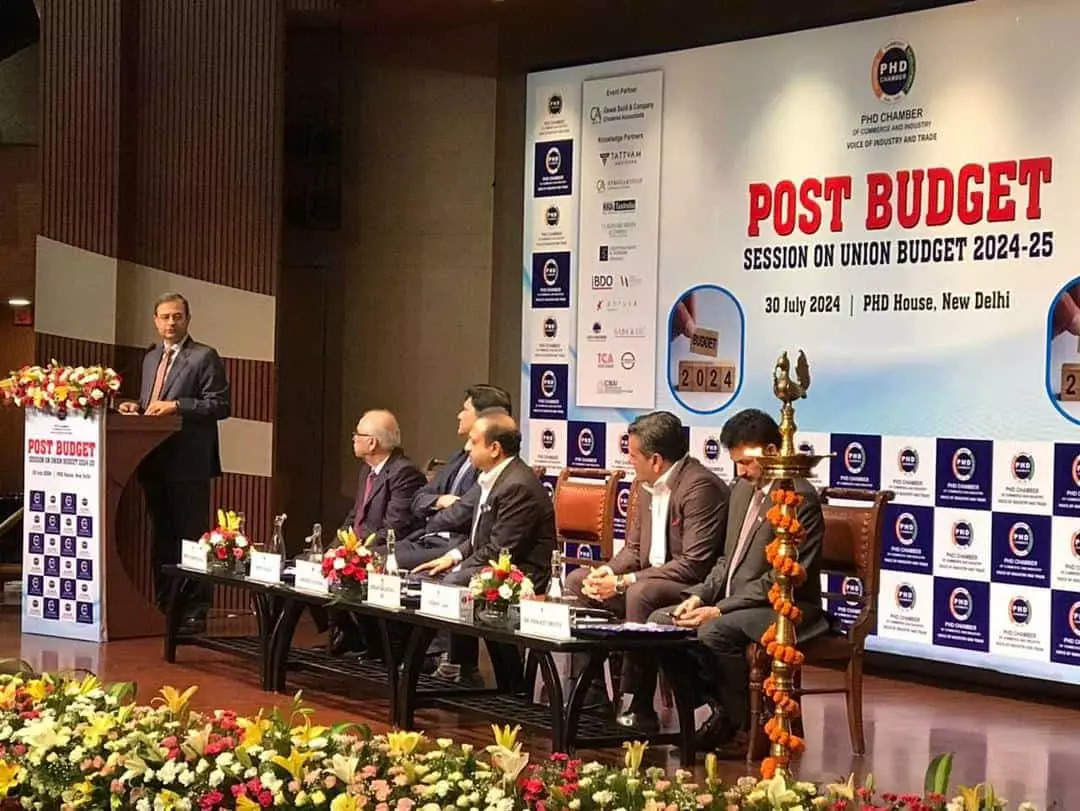

The Revenue Secretary was speaking at PHDCCI’s Post Budget Session on Implications Of Union Budget 2024 in New Delhi.