Risk aversion is intensifying in early US session after non-farm payroll report significantly missed expectations on all fronts. This follows yesterday’s poor manufacturing data, which has already sparked discussions about a hard landing for the US economy. The weak job data is likely to fuel these concerns further, as stock futures are tumbling sharply, pointing to a notably lower open. In the financial markets, stock futures tumble sharply and are pointing to a sharply lower open. Meanwhile, 10-year yield is extending this week’s steep decline and is set to challenge 3.8% mark.

Dollar’s reaction to these developments has been complex. It continues to decline against safe-haven currencies such as Yen and the Swiss Franc. However, it remains steady against commodity currencies due to the offsetting impact of diving Treasury yields and prevailing risk-off sentiment. The greenback is holding onto most of its gains against Sterling for the week but is showing weakness against the euro, which is also surging against the Pound.

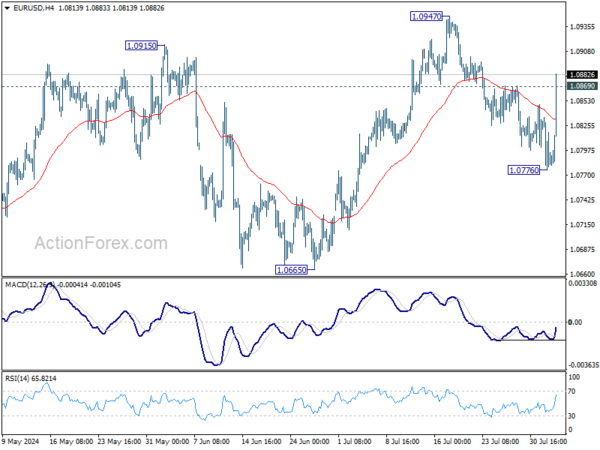

Technically, EUR/USD’s break of 1.0869 resistance suggests that pull back from 1.0947 has completed at 1.0776 already. Rise from 1.0601 (Apr low) is likely ready to resume through 1.0947. While this development won’t make Euro a better candidate to go long than Yen and Swiss Franc, it at least won’t be the best one to sell.

In Europe, at the time of writing, FTSE is down -0.54%. DAX is down -2.16%. CAC is down -1.30%. UK 10-year yield is down -0.074 at 3.818. Germany 10-year yield is down -0.076 at 2.174. Earlier in Asia, Nikkei fell -5.81%. Hong Kong HSI fell -2.08%. China Shanghai SSE fell -0.92%. Singapore Strait Times fell -1.12%. Japan 10-year JGB yield fell -0.0759 to 0.959.

US non-farm payrolls grow 114k in Jul, unemployment rate rises to 4.3%

US non-farm payroll employment grew only 114k in July, well below expectation of 176k. That’s all well below average monthly gain of 215k over the prior 12 months.

Unemployment rate jumped from 4.1% to 4.3%, above expectation of 4.1%. Participation rate ticked up by 0.1% to 62.7%.

Average hourly earnings rose 0.2% mom, below expectation of 0.3% mom. Annual wages growth slowed from 3.8% yoy to 3.6% yoy, below expectation of 3.7% yoy.

Swiss CPI at -0.2% mom, 1.3% yoy in Jul, matches expectations

Swiss CPI fell -0.2% mom in July, matched expectations. Core CPI (excluding fresh and seasonal products, energy and fuel) fell -0.3% mom. Domestic product prices rose 0.2% mom. Imported products prices fell -1.3% mom.

For the 12-month period, CPI was unchanged at 1.3% yoy, matched expectations. Core CPI was unchanged at 2.0% yoy. Domestic product prices growth was unchanged at 2.0% yoy. Import product prices growth deepened from -0.8% yoy to -1.0% yoy.

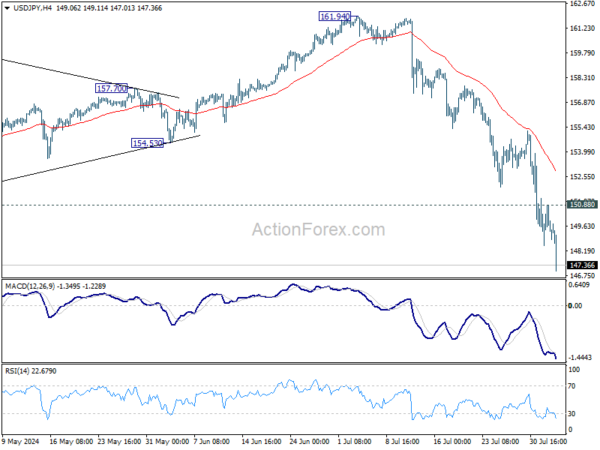

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 148.42; (P) 151.16; (R1) 152.72; More…

USD/JPY’s steep decline from 161.94 reaccelerates to as low as 147.01 so far. There is no sign of bottoming yet and intraday bias stays on the downside. Next target is 140.25 fibonacci level. On the upside, above 150.88 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

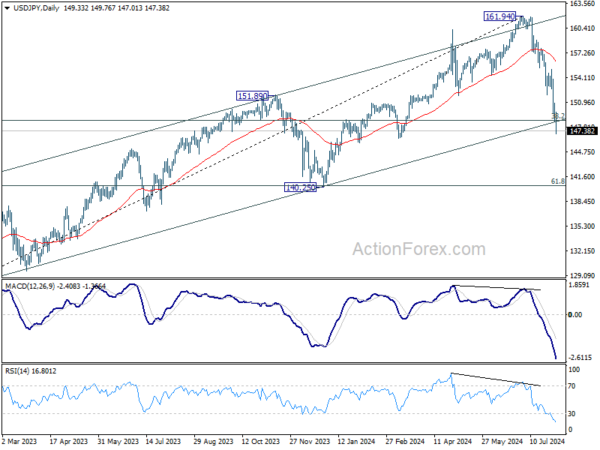

In the bigger picture, fall from 161.94 medium term top is seen as correcting the whole rise from 127.20 (2023 low) at least. With 38.2% retracement of 127.20 to 161.94 at 148.66, taken out, next target is 140.25 cluster support, which is close to 61.8% retracement at 140.47. Risk will now stay on the downside as long as 55 D EMA (now at 156.07) holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Jul | 1.00% | 0.90% | 0.60% | |

| 01:30 | AUD | PPI Q/Q Q2 | 1.00% | 1.00% | 0.90% | |

| 01:30 | AUD | PPI Y/Y Q2 | 4.80% | 4.30% | ||

| 06:30 | CHF | CPI M/M Jul | -0.20% | -0.20% | 0.00% | |

| 06:30 | CHF | CPI Y/Y Jul | 1.30% | 1.30% | 1.30% | |

| 06:45 | EUR | France Industrial Output M/M Jun | 0.80% | 0.90% | -2.10% | -2.20% |

| 07:30 | CHF | Manufacturing PMI Jul | 43.5 | 44.6 | 43.9 | |

| 08:00 | EUR | Italy Industrial Output M/M Jun | 0.50% | -0.20% | 0.50% | |

| 09:00 | EUR | Italy Retail Sales M/M Jun | -0.20% | 0.20% | 0.40% | |

| 12:30 | USD | Nonfarm Payrolls Jul | 114K | 176K | 206K | 179K |

| 12:30 | USD | Unemployment Rate Jul | 4.30% | 4.10% | 4.10% | |

| 12:30 | USD | Average Hourly Earnings M/M Jul | 0.20% | 0.30% | 0.30% | |

| 14:00 | USD | Factory Orders M/M Jun | 0.50% | -0.50% |