Mishaps such as crediting funds to the wrong person or a wrong account at large institutions like banks are some of the most significant risks of running a financial services firm.

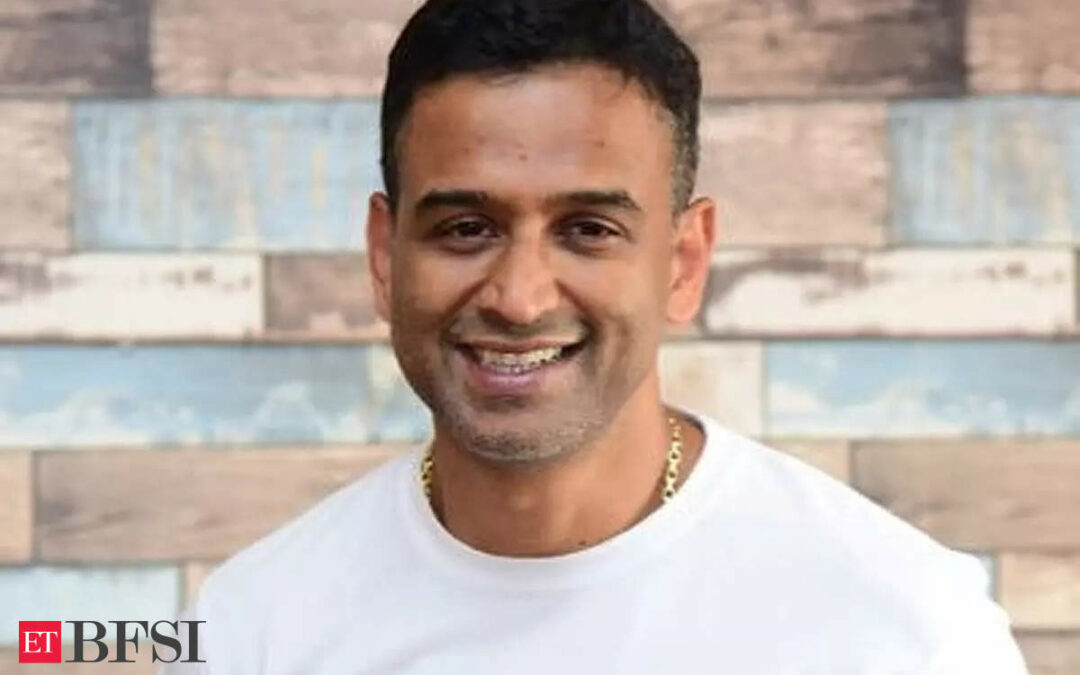

“This risk is like a hanging sword for these businesses…,” Zerodha founder Nithin Kamath said in a tweet.

His comments came against the backdrop of a major mishap at UCO Bank earlier this month, wherein the state-owned lender erroneously transferred a total of Rs 820 crore through mobile-based Immediate Payment Service (IMPS) to some customers due to a technical glitch.

“Whether you are a broker, a bank, or any entity that directly settles with end customers, once securities or funds are sent to the wrong person, it’s hard to get them back,” Kamath said.

Kamath believes all financial services firms are like insurance businesses, as they collect a small fee on services and land up avoiding catastrophic events that can wipe out the entire networth and leave them bankrupt.

It is, therefore, essential to be profitable when running a financial services firm, so that the networth increases proportionally as the business grows.

UCO Bank has managed to recover about 75% or approximately Rs 649 crore, and is actively working to retrieve the remaining Rs 171 crore.

But this event has been yet another eye-opener and stresses on the need to have a robust ecosystem that can help avert such mishaps.

The finance ministry has asked state-owned banks to review systems and processes related to their digital operations. The banks have been advised to check the robustness of cybersecurity and take necessary measures to strengthen the same