Global markets started the week on a positive note, drawing momentum from the robust close last week in the US and buoyed further by slightly better than expected manufacturing data out of China. In Tokyo, stocks received additional support from comments by BoJ Executive Director Takashi Kato, who indicated that the central bank has no immediate plans to unload its holdings of ETFs.

Currency markets, however, are showing less activity as traders hold their positions in anticipation of significant events scheduled for later in the week. Japanese Yen, Australian Dollar, and Canadian Dollar are currently weaker, while Swiss Franc, Euro, and New Zealand Dollar are on the stronger side. Dollar and British Pound are showing mixed performance. The focus of global markets are on the upcoming meetings of ECB and BoC, which may result in interest rate cuts. Additionally, the release of high-profile economic data such as US ISM indexes and Non-Farm Payrolls will be closely watched.

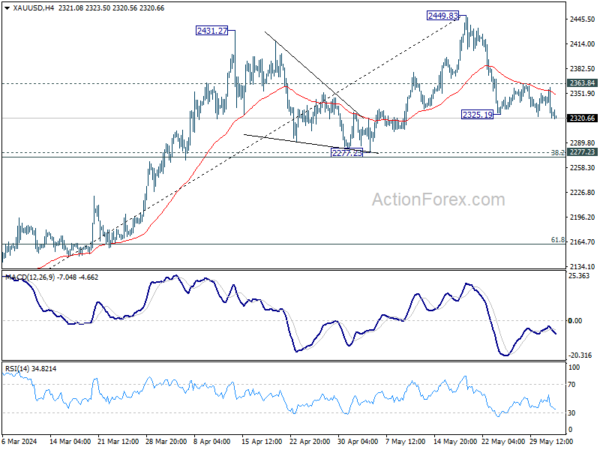

Technically, Gold’s breach of 2325.19 minor support suggests that corrective fall from 2449.83 is resuming for 2277.34 cluster support holds (38.2% retracement of 1984.05 to 2449.83 at 2271.90). Strong support could be seen there to bring rebound. Brea of 2363.84 resistance will argue that larger rally is ready to resume. However, sustained break of 2277.23 will argue that larger scale correction is already underway.

In Asia, at the time of writing, Nikkei is up 1.14%. Hong Kong HSI is up 2.44%. China Shanghai SSE is down -0.43%. Singapore Strait Times is up 0.28%. Japan 10-year JGB yield is down -0.0006 at 1.074.

Japan’s PMI manufacturing, finalized at 50.4, above neutral mark for first time in a year

Japan’s PMI Manufacturing index was finalized at 50.4 in May, up from 49.6 in April, crossing the 50 neutral mark for the first time in a year. S&P Global noted that both output and new orders remained broadly stable, while employment and input stocks saw expansion.

Pollyanna De Lima at S&P Global Market Intelligence highlighted the “encouraging trends” in the manufacturing industry, noting that new orders and output were stable, and businesses were optimistic about the year ahead. She mentioned that input stocks increased as materials ordered in recent months arrived, which bodes well for production and suggests a gradual near-term recovery.

Factory employment also rose but continued to be affected by retirements and difficulties in finding suitable replacements. Another challenge faced by manufacturers was the intensification of cost pressures due to yen depreciation, which strained the prices of imported items. This, along with rising wage costs, led to the sharpest increase in output charges in a year. De Lima pointed out that this is concerning given the subdued domestic and external demand.

China’s Caixin PMI manufacturing rises to 51.7, production picks up

China’s Caixin PMI Manufacturing index edged up from 51.4 to 51.7 in May, surpassing expectations of 51.5. Caixin reported that production expanded at its most pronounced pace since June 2022, with the fastest growth in purchasing activity in three years. Meanwhile, input price inflation reached a seven-month high.

Wang Zhe, Senior Economist at Caixin Insight Group, highlighted that the manufacturing sector continued to improve, with gains in supply, domestic demand, and exports. Logistics and transportation remained efficient, and businesses increased their purchase quantities and inventories, reflecting a positive outlook.

Despite these positive developments, Wang noted persistent challenges, particularly low price levels on the sales side. Additionally, employment continued to shrink as businesses remained cautious about hiring.

Global rate cut camp to expand: ECB and BoC to lower rates this week?

Meetings of two major central banks, BoC and ECB—will be closely monitor this week, together with market moving indicators from the US, Swiss, Australia and China.

For BoC, expectations are leaning towards a 25 basis point rate cut to 4.75%, especially after Canadian GDP showed slower than expected growth in Q1 and inflation rates stabilized within the target band of 1-3% for several months. However, not all economists are in agreement, with some predicting the rate cut might be postponed until July.

Whether policy easing starts this week of not, the focal point for BoC will undoubtedly be any forward-looking guidance they provide about the path of monetary policy easing throughout the year. A recent Reuters poll indicated that the majority of economists are anticipating at least three rate cuts this year, with predictions centering on a reduction to 4.00% by year-end. BoC has the possibility to move the Canadian Dollar by shaping expectations the other ways.

On ECB front, a rate cut seems almost certain this week, with expectations pointing to a 25bps reduction in deposit rate to 3.75% and corresponding adjustment in main refinancing rate to 4.25%. Given the recent unexpected uptick in Eurozone inflation, a consecutive rate cut in July appears highly unlikely.

ECB President Christine Lagarde is expected to maintain a data-dependent stance, focusing on a meeting-by-meeting approach in her communications. However, the upcoming economic projections could offer valuable insights into the likelihood of whether one or two additional rate cuts will be delivered later in the year.

Apart from these central bank meetings, several other key economic reports are set to be released, which could also sway market sentiments. These include US ISM indexes and non-farm payrolls, Japan’s cash earnings and household spending, Swiss CPI, Canadian employment figures, Australia’s GDP, and China’s Caixin PMIs and trade balance.

Here are some highlights for the week:

- Monday: Japan PMI manufacturing final; China Caixin PMI manufacturing; Swiss PMI Manufacturing; Eurozone PMI manufacturing final; UK PMI manufacturing final; Canada PMI manufacturing; US ISM Manufacturing, construction spending.

- Tuesday: Japan monetary base; Australia current account; Swiss CPI; Germany unemployment; US factory orders.

- Wednesday; New Zealand terms of trade; Japan average cash earnings; Australia GDP; China Caixin PMI services; France industrial production; Eurozone PMI services final, PPI; UK PMI services final; US ADP employment, ISM services; BoC rate decision,

- Thursday: Australia goods trade balance; Swiss unemployment; Germany factory orders; Italy retail sales; UK PMI construction; Eurozone retail sales; ECB rate decisions; Canada trade balance, Ivey PMI; US jobless claims; trade balance.

- Friday: New Zealand manufacturing sales; Japan household spending; China trade balance; Germany industrial production, trade balance; Swiss foreign currency reserves; Eurozone GDP revision; Canada employment; US non-farm payrolls.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 199.60; (P) 200.06; (R1) 200.88; More….

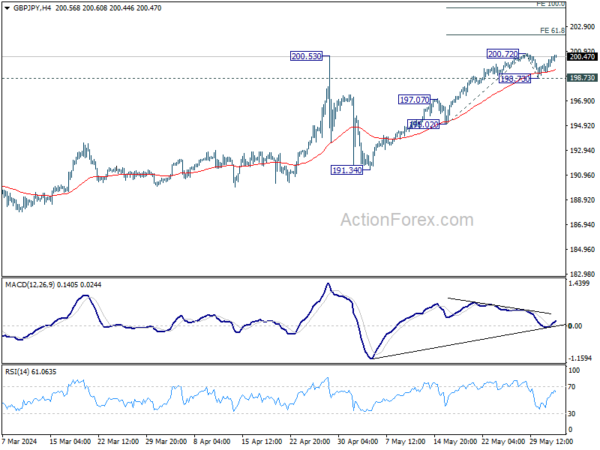

Intraday bias in GBP/JPY remains neutral for the moment. Further rally is expected as long as 198.73 support holds. Firm break of 200.72 will confirm larger up trend resumption. Next target is 61.8% projection of 195.02 to 200.72 from 198.73 at 202.25.

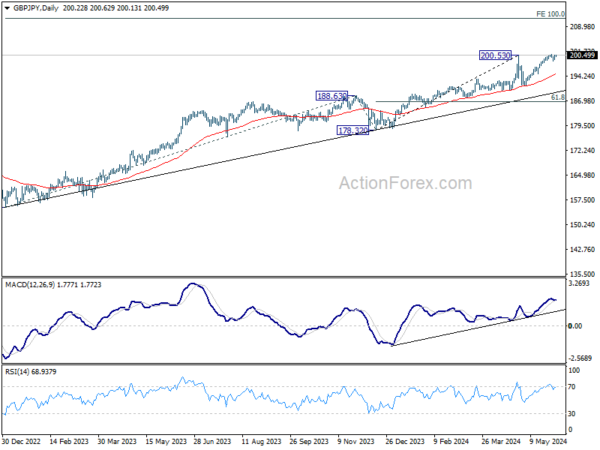

In the bigger picture, as long as 188.63 resistance turned support holds, long term up trend is expected to continue. Sustained trading above 200.53 will pave the way to 100% projection of 155.33 to 188.63 from 178.32 at 211.62.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Capital Spending Q1 | 6.80% | 12.20% | 16.40% | |

| 0:30 | JPY | Manufacturing PMI May F | 50.4 | 50.5 | 50.5 | |

| 1:45 | CNY | Caixin Manufacturing PMI May | 51.7 | 51.5 | 51.4 | |

| 7:30 | CHF | Manufacturing PMI May | 45.4 | 41.4 | ||

| 7:45 | EUR | Italy Manufacturing PMI May | 48 | 47.3 | ||

| 7:50 | EUR | France Manufacturing PMI May F | 46.7 | 46.7 | ||

| 7:55 | EUR | Germany Manufacturing PMI May F | 45.4 | 45.4 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI May F | 47.4 | 47.4 | ||

| 8:30 | GBP | Manufacturing PMI May F | 51.3 | 51.3 | ||

| 13:30 | CAD | Manufacturing PMI May | 49.4 | |||

| 13:45 | USD | Manufacturing PMI May F | 50.9 | 50.9 | ||

| 14:00 | USD | ISM Manufacturing PMI May | 49.8 | 49.2 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid May | 60 | 60.9 | ||

| 14:00 | USD | ISM Manufacturing Employment Index May | 48.6 | |||

| 14:00 | USD | Construction Spending M/M Apr | 0.20% | -0.20% |