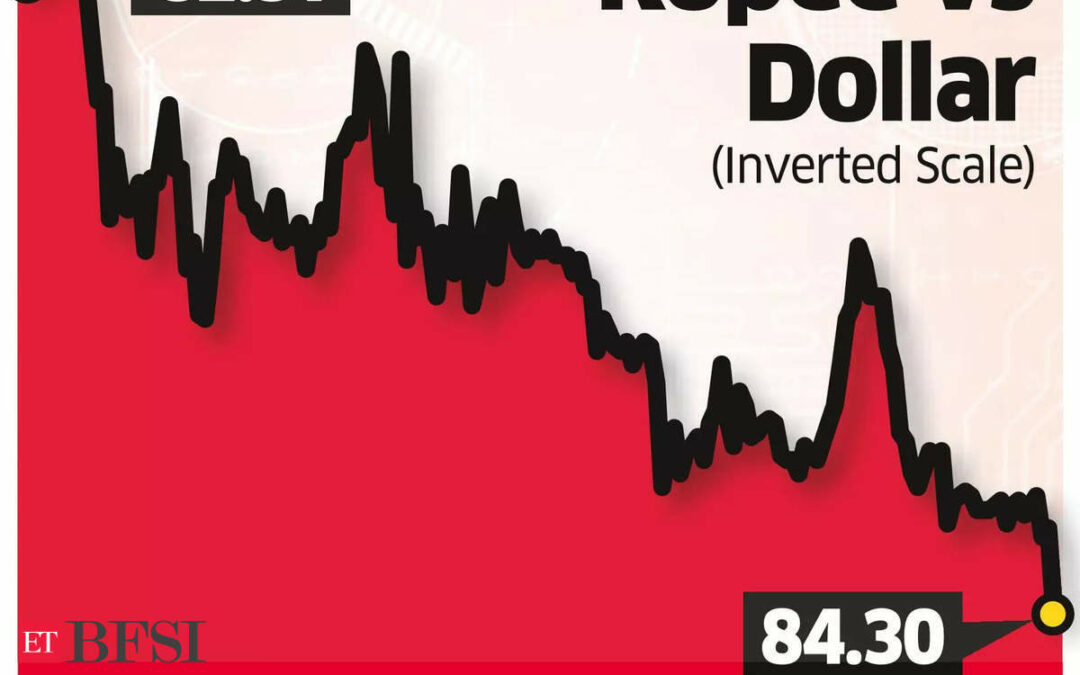

On Wednesday, the rupee fell by 22 paise, ending at a record low of 84.31 against the US dollar. The rupee fell following Donald Trump’s victory in the US Presidential Elections 2024.

The rupee dropped to 84.1725 against the US dollar, registering a 0.07% decline from its previous close of 84.1075.

Analysts noted that Trump’s policies, such as tax cuts and deregulation, could boost US growth, making the dollar more attractive to investors. Additionally, the threat of tariffs is expected to weaken the euro and other Asian currencies.

However, at the interbank foreign exchange on Thursday, the rupee opened at 84.26 against the US dollar, up by 5 paise from its previous close.

Forex traders expect RBI interventions to keep the USD/INR pair within the range of 83.80 to 84.35. Market attention is also on the US Federal Reserve’s monetary policy and any comments from officials that could influence market sentiment.

Investors are awaiting the US Federal Reserve’s policy decision. The Fed is widely expected to cut rates by 25 basis points, and attention will be on Chair Powell’s comments for insights into the future direction of interest rates.