Multi-asset investment specialist Saxo Bank announces several updates and enhancements that are now available on SaxoPartnerConnect (SPC).

Additional ‘Return %’ and ‘P/L’ data in Portfolio Depreciation EOD report

The Portfolio Depreciation end-of-day file has been extended to include the following new columns:

- Net Invested Amount

- QTD/YTD and ‘Since Inception’ returns

- QTD/YTD and ‘Since Inception‘ profit/loss

Model of Models UX update

In Model Manager, partners will now be able to group their ‘Model of Models’ composition. This grouping can be done either on the basis of underlying model or underlying instruments.

Portfolio historic view enhancements

Over the past few months, Saxo has implemented several enhancements to the historic portfolio view in SPC. These changes will soon be reflected on the end-client platforms as well.

- The ability to view historical positions grouped by Product and Currency

- Using the chevron to view individual positions

- A new grid column indicates L/S, showing Long, Short, and whether the trade was assigned through an option as Long or Short assignment

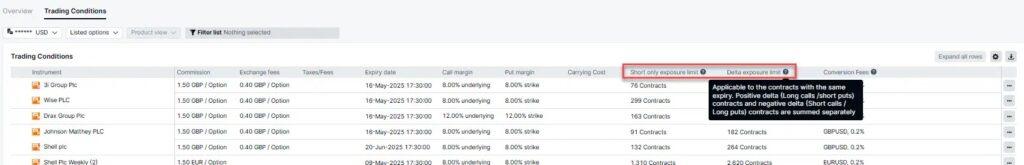

New columns on trading condition view

Saxo has introduced a coefficient aiming to increase the Max Delta exposure limit. Once the coefficient is in play, it materialises by separating the current Exposure limit in two:

- Short only exposure limit –> Applicable to the sum of short contracts across expiries. Calls and Puts contracts are summed separately

- Delta exposure limit –> Applicable to contracts with the same expiry. Positive delta (Long calls /short puts) contracts and negative delta (Short calls / Long puts) contracts are summed separately

The tooltip allows to clarify those two limits in trading conditions. The two columns are available in bulk view on SPC as well as single instrument trading condition view across all platforms.

Enhancing the owner portfolio page

Saxo has made the following changes on the owner portfolio page:

- Removal of 1-day return: To streamline the information presented and focus on more meaningful data, the 1-day return metric has been removed.

- Removal of portfolio allocation: Saxo has also removed the Portfolio allocation section. This adjustment is intended to simplify the page layout and ensure that the most pertinent details are easily accessible.