MUMBAI: The BSE Sensex rose 712.4 points (0.9%) to cross the 78,000 mark for the first time. It hit a high of 78,053.5 on Tuesday, led by a surge in bank and finance stocks that had been underperforming earlier in the year. The NSE Nifty also climbed by 183.5 points (0.8%) to a new high of 23,721.3.

Private bank stocks were the main contributors to the market gains, with Axis Bank, ICICI Bank, and HDFC Bank leading the way with increases of 3.4%, 2.5%, and 2.3%, respectively.

SBI and Bajaj Finance also saw close to 1% gains. The rally in HDFC Bank was triggered by a multinational brokerage firm upgrading the stock. ICICI Bank achieved a new high with its market cap crossing $100 billion for the first time. Commenting on the market performance, Karthick Jonagadla, Manager and Founder of Quantace Research, said, “Sensex crossing the 78,000 mark reflects the strong cash buying activity in the market, driven by substantial investments from both FIIs and DIIs, who have collectively injected around Rs 28,500 crore into the cash markets over the last 11 trading sessions.”

Sensex surge ‘driven by both foreign, domestic fund buying’

Karthick Jonagadla, Manager and Founder of Quantace Research, said, “Sensex crossing the 78,000 mark reflects the strong cash buying activity in the market, driven by substantial investments from both FIIs and DIIs.” This was supported by a rise in mutual fund systematic investment plan contributions, which have increased to Rs 20,904 crore-a seven-fold increase since FY 2016-2017.

In the forex market, the rupee slightly rose by 0.03% against the US dollar, reaching 83.43 per dollar, boosted by expectations of foreign investments in domestic debt, which will soon be added to the JP Morgan index, and by news of a current account surplus in Q4FY24.

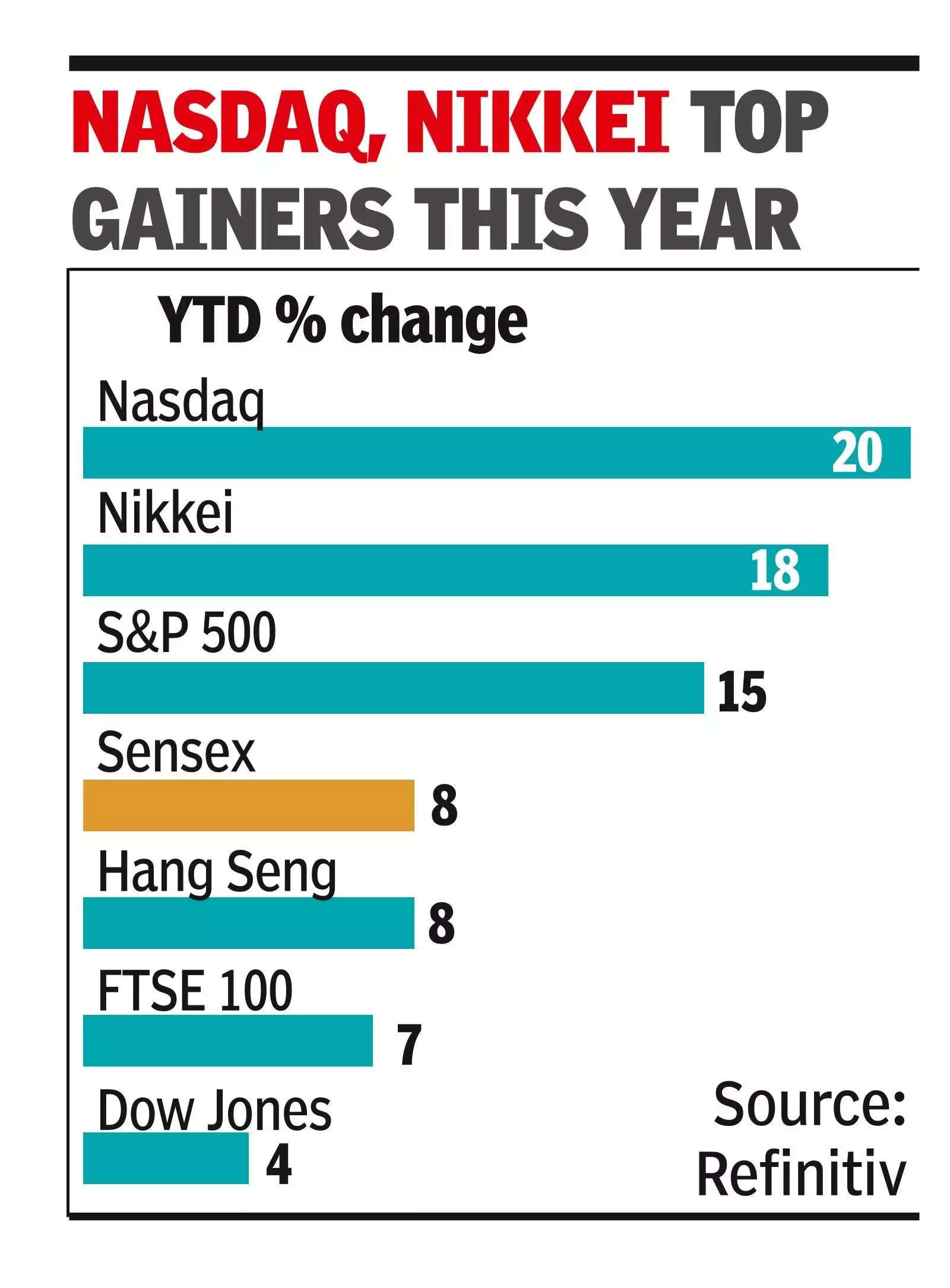

At current valuations, Indian equities are the second most expensive after the US. With the surge in demand for stocks, the supply of fresh equity is expected to catch up. According to Sarvjeet Singh Virk, MD, Shoonya by Finvasia, 56 companies are poised to raise around Rs. 90,000 crore from the capital markets.

Foreign investors have been net buyers in index futures in the last seven trading sessions. Traders attribute the market’s upward movement to positive macroeconomic indicators such as current account and business activity improvements in manufacturing and services, as well as optimism about ongoing government reforms outlined in its first 100 days agenda.

Vinod Nair, head of research at Geojit Securities, mentioned, “Amidst moderate consolidations and sector rotations, the market is moving upwards due to expectations from the upcoming Budget. Additionally, the progress of the monsoon is being watched for insights into the consumption outlook.”