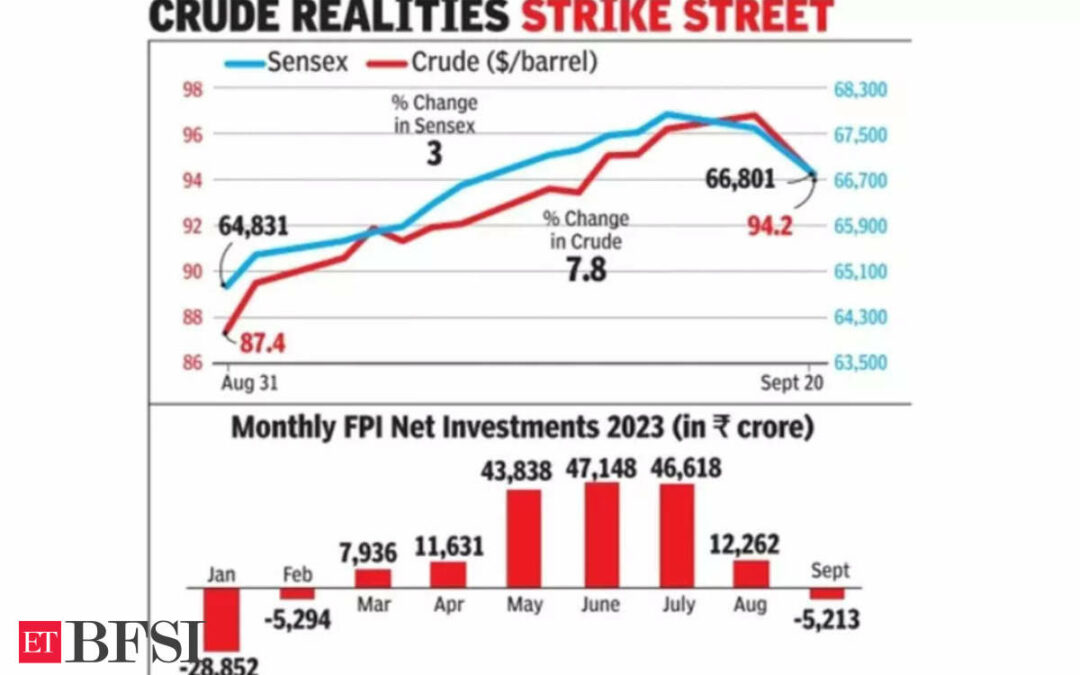

MUMBAI: For several days since the second week of September, Dalal Street veterans were expecting a sharp slide in the stock market even as the sensex continued to rise unabated. Their logic was that a correction would make market valuations healthy. That fall finally took place on Wednesday, shaving off 796 points from the sensex, which closed at 66,801 as a combination of domestic and international factors weighed on the market.

During Wednesday’s session, traders finally factored in negatives like rising crude oil prices and the weakness of the rupee after a record rally of 11 sessions that added about 3,000 points to the index. The slide was led by HDFC Bank, along with other heavyweights like RIL and Infosys. A US Federal Reserve board meeting on rates with the decision set for late evening also pushed investors to be cautious, market players said.

Nifty lost 232 points to close at 19,901. The selling was mainly led by foreign investors with a net outflow at Rs 3,111 crore, BSE data showed. Domestic funds, too, joined in with a net outflow of Rs 573 crore. The day’s session left investors poorer by Rs 2.9 lakh crore, with BSE’s market capitalisation now at Rs 323.4 lakh crore.

According to Vinod Nair of Geojit Financial Services, the markets remained under pressure due to rising US bond yields and a stronger greenback. “Concerns reigned over the upcoming US Fed policy, interest rate trajectory and rising oil prices,” Nair said a note to investors.

At close, HDFC Bank was down 4% — contributing 482 points in the sensex’s almost 800-point loss, BSE data showed. Other major index laggards were RIL, L&T and ICICI Bank. Among the gainers from the sensex constituents were Power Grid Corp, ITC and Axis Bank.