Sequoia Capital’s accelerator programme Surge will increase the amount of capital it will invest in seed-stage startups to be able to back a wider range of companies and stay with them longer as they achieve a product market fit, according to Rajan Anandan, MD, Surge and Sequoia India.

So far, Surge had a maximum investment ceiling of $2 million to invest in seed deals across India and Southeast Asia (SEA) but the Menlo Park- headquartered venture capital firm will take it up to $3 million with no minimum cap.

ET reported on June 14 that Sequoia will allocate $300 million to Surge instead of raising a separate fund like it did in previous years merging with the firm’s venture vehicle. Anandan, however, did nor detail any capital allocation while talking to ET.

Last week Sequoia had announced that it closed a $2.85 billion fund spread across India venture and growth vehicles along with a first-ever $850 million dedicated corpus to Southeast Asia ( SEA).

Surge was set up in 2019 with a $200 million fund size and last year it racked up $195 million disrupting the seed-stage dealmaking in India.

Rajan Anandan, MD, Surge and Sequoia India

By combining Surge with venture ( for early-stage investments) Sequoia aims to provide more capital to these fledgling startups. Anandan said the whole talk of Surge becoming a “sub fund” rolling up into venture was only to show that they are doubling down on the programme and that nothing else changes.

“One of the big learnings we have had at Surge is that the only real objective of a seed company is to launch and get to product market fit (PMF). It could take six months or even three years. Having a little more capital to give you more runway to get to PMF, building a strong team is very critical and that’s why we are expanding the upper range of investment,” Anandan said.

According to Anandan 20% of Surge startups were at the pre-launch stage when Sequoia first invested in them. Once selected in the Surge cohort, these went on to raise follow-on capital from Sequoia as well as other venture funds.

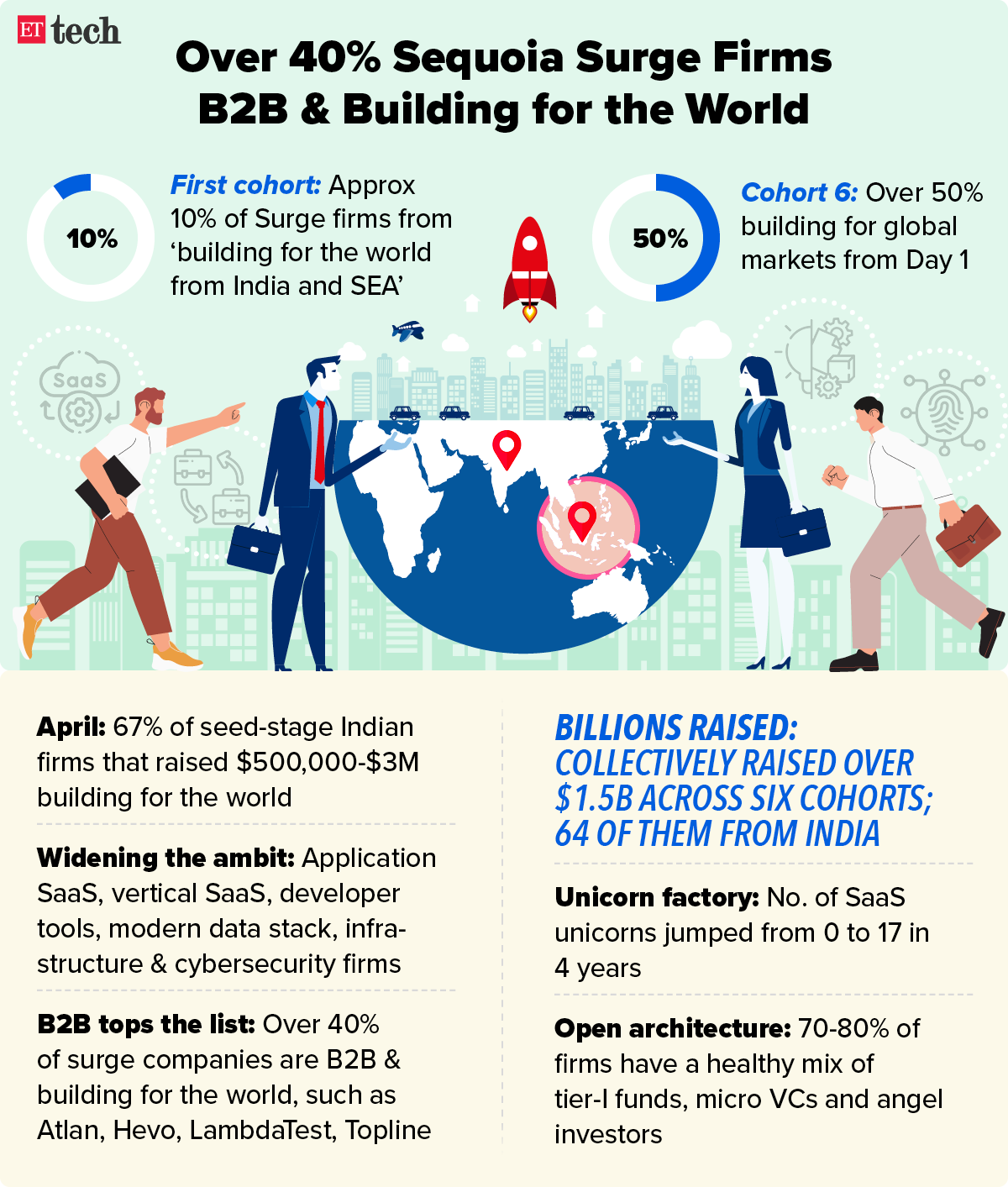

Surge startups have collectively raised over $1.5 billion in follow-on rounds across six cohorts totalling 112 startups with 64 of them being from India. “Across our cohorts, between 70-80% of our companies have co investors– be it tier-I funds, micro VCs or a group of angel inventors. We will continue with this approach and have an open architecture,” Anandan said, adding that more than 60% of Surge companies from its first four cohorts have raised series A funding.

All told, Surge has run six cohorts so far with close to 55-60% of startups coming from India while the rest are from SEA. It expects having an equal number of startups from both the geographies, going forward.

Anandan said approximately 10% of the Surge portfolio was ‘building for the world from India and SEA’ in its first programme which has now increased to as much as 50% building for global markets from Day 1.

“In April, if you look at seed-stage companies that raised between $500k to $3 million, 67% were software companies from India, building for the world… These companies represent an ever increasing range of software platforms: application SaaS, vertical SaaS, developer tools, modern data stack, infrastructure and cyber security companies. So there has been a significant shift in the kind of companies being founded in India, and that is reflecting in our more recent cohorts…” he said. He was quoting internal Sequoia data.

Four years ago, India had zero SaaS unicorns, today we have over 17. It’s the single biggest theme, he added. Over 40% of Surge companies are B2B software companies building for the world like Atlan, Hevo, LambdaTest, Outplay, Mesh, Toplyne, Multiplier, Convosight, Last9, Shipsy, Anandan said.

Amid a flurry of questions around lack of corporate governance in some of its portfolio companies which have come to the fore of late, Anandan said the venture capital firm has always spent time on due diligence of startups it is backing. In fact, we have dedicated modules for it for Surge companies as well, he said. Over the past few months, Sequoia portfolio companies like BharatPe, Zilingo and Trell have been under the radar for lack of corporate governance and financial irregularities.

“ As the companies get to later stages of series A-C, there is more data and therefore there is more diligence we can do,” he said, adding they are now expanding its scope further for Surge startups. “What we are doing more now is we have an emphasis on this.. We have had one module dedicated to board management and board governance and have expanded that..”

Surge’s increased cheque size comes at a time when late-stage funding is drying up with corrections in valuations led by global and local factors in the economy. Anandan said in seed stage, the deal flow continues to be the same though valuations have normalised going back to 2018-2019 levels.

“At series A level, changes are more significant. Valuations have adjusted and quantum of rounds have changed. In 2021, it wasn’t unusual to see a $8-15 million series A funding that has changed to around $5-8 million.” Anandan added that the milestones for a startup to raise series A have gone back to what was considered normal pre-pandemic.