New Zealand Dollar bounces broadly in quiet Asian session, partly underpinned by notable improvement economic data which showed that the services sector has swung back into expansion at the start of 2024. Additionally, economists are increasingly expecting that more work is needed by RBNZ to cool the economic to bring down inflation.

BNZ Bank said that it has postponed its expectation of an RBNZ rate cut to November from an earlier prediction of August. This adjustment comes amid lively discussions about RBNZ’s policy path, especially in the wake of ANZ’s projection of an additional rate hike in February.

BNZ’s head of research cautioned against further hikes, highlighting easing labor market conditions, increasing spare capacity, and declining inflation as reasons why another increase would constitute a policy misstep. Despite these concerns, the expectation that interest rates will remain at their current high levels continues to lend support to the Kiwi.

In the day’s trading, the Australian Dollar ranks as the second strongest currency, followed by the Japanese Yen, while the US Dollar lags significantly, grouped with the Swiss Franc and Euro as the day’s underperformers. The British Pound shows a mixed performance. Trading activity may be muted due to a nearly empty European economic calendar and a holiday in the United States.

However, the horizon is lined with significant forthcoming events that promise to reinvigorate market volatility. Key among these are the eagerly anticipated minutes from Fed, ECB, and RBA. Additionally, the release of global PMI data stands poised to offer critical insights into the global economic health.

Technically, NZD/JPY’s up trend is still in progress for 61.8% projection of 80.42 to 89.67 from 86.75 sat 92.46. Decisive break there could prompt upside acceleration to 100% projection at 96.00 next. For now, near term outlook will stay bullish as long as 91.02 support holds, in case of retreat.

In Asia, at the time of writing, Nikkei is down -0.15%. Hong Kong HSI is down -1.14%. China Shanghai SSE is up 0.82%. Singapore Strait Times is up 0.36%. Japan 10-year JGB yield is up 0.0056 at 0.736.

NZ BNZ services rises to 52.1, springs back to growth

New Zealand’s BusinessNZ Performance of Services Index rose from 48.8 to 52.1 in January, marking its highest peak since May 2023. This rebound places the sector back into expansion, albeit slightly below long-term average of 53.4.

Components of the PSI showed notable improvements: activity/sales surged to 53.0 from 47.2, employment edged up to 48.1 from 47.2, new orders/business increased to 51.8 from 50.8, and stocks/inventories rose to 53.5 from 51.7. However, a decrease in supplier deliveries to 48.7 from 50.3 hints at logistical challenges.

Reflecting on the sector’s performance, BusinessNZ’s chief executive, Kirk Hope, remarked on the “seesaw” trend between expansion and contraction observed in recent months. He highlighted that the sector’s sustained recovery hinges on “continued momentum” in business activity and new orders, coupled with alleviation in “cost of living” pressures.

BNZ Senior Economist Doug Steel provided an optimistic outlook, suggesting that the combined PMI and PSI activity indicator hints that “annual GDP growth will soon turn positive.” Yet Steel cautioned that further progress is essential to mitigate growing spare capacity within the economy.

Bitcoin eyeing 61.8% projection level after breaking 50K barrier

Bitcoin’s remarkably surged past 50k mark last week, propelling its market capitalization back over the USD 1 trillion. The significant uptick is largely driven by an influx of investments into BTC spot ETF. This bullish sentiment is further fueled by anticipation surrounding several key events this year: the forthcoming fourth Bitcoin halving, first Fed interest rate cut, and the possibility of an Ethereum spot ETF approval.

From a technical perspective, Bitcoin is now setting its sights on 61.8% projection of 24896 to 49020 from 38496 at 53404. Decisive break above this level could trigger further upside acceleration, with the next target at 100% projection at 62620. However, a retreat below 48283 support level would suggest a period of near-term consolidation. But downside should be contained above 38496 support to bring another rally.

Ethereum mirrors this bullish outlook, testing 61.8% projection of 1519to 2715 from 2164 at 2903 now. Sustained break there could prompt further upside acceleration to 100% projection at 3360. Break of 2721.9 support will bring consolidations first. But downside of retreat should be contained above 2164 to bring rebound.

The week ahead: Scrutinizing minutes from Fed, ECB, and RBA; PMI data across major economies

Three central banks will release their latest monetary policy meeting minutes this week. As for Fed, the minutes will likely reiterate that rate cuts are on the card for the year. However, uncertainty remains high regarding the rate path ahead. Thus, it’s important to maintain a careful and data-dependent approach. It’s also unlikely to see any substantial hints on the timing of the first cut, except that March is highly unlikely.

As for ECB, the minutes should echo comments from officials that inflation is on track to 2% target. For now, the minutes should also repeat that convincing evidence of a sustained turnaround in wages had yet to emerge. And hence, it’s still early to decide on cutting rates. A critical point to scrutinize is whether there are voices that with new economic available, March could be an option to start lowering interest rates. Or on the other hand, any explicit preference regarding April or June.

As for RBA minutes, the main question is on how uncomfortable or confident the board is regarding disinflation back to target range. Governor Michele Bullock was explicit that another hike is neither ruled out nor ruled in. This stance would likely be reflected in the minutes too.

The week is also busy with economic data too. PMIs from major economies, in particular services will be watched closely, on aspects including activity, prices, employment. Canada’s CPI data is another highlight, together with New Zealand’s retail sales, Germany Ifo business climate.

Here are some highlights for the week:

- Monday: New Zealand BusinessNZ services index; Japan machine order; Canada IPPI and RMPI.

- Tuesday: RBA minutes; Swiss trade balance; Eurozone current account; Canada CPI.

- Wednesday: New Zealand PPI; Japan trade balance; Australia wage price index; Canada new housing price index; Eurozone consumer confidence; FOMC minutes.

- Thursday: Australia PMIs; Japan PMIs; Eurozone PMIs, CPI final, ECB meeting accounts; UK PMIs; Canada retail sales; US jobless claims, PMIs, existing home sales.

- Friday: New Zealand retail sales; UK Gfk consumer sentiment; Germany GDP final Ifo business climate.

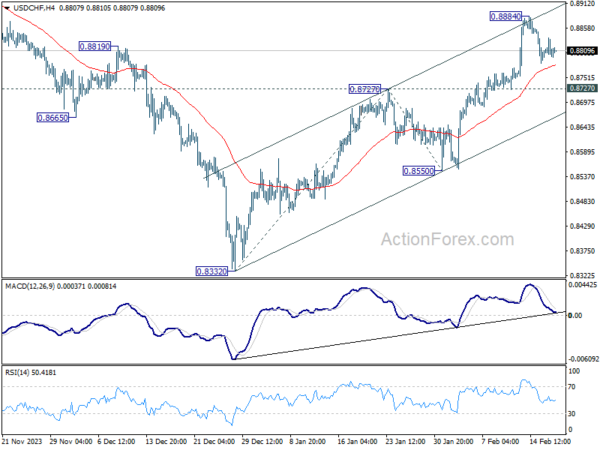

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.8788; (P) 0.8813; (R1) 0.8835; More….

Intraday bias in USD/CHF remains neutral at this point, and more consolidations could be seen below 0.8884. Nevertheless, further rally is expected as long as 0.8727 resistance turned support holds. On the upside, break of 0.8885 will resume the rise from 0.8332 and target and 100% projection of 0.8332 to 0.8727 from 0.8550 at 0.8954. However, sustained break of 0.8727 will dampen this bullish view, and turn bias back to the downside for 0.8550 support instead.

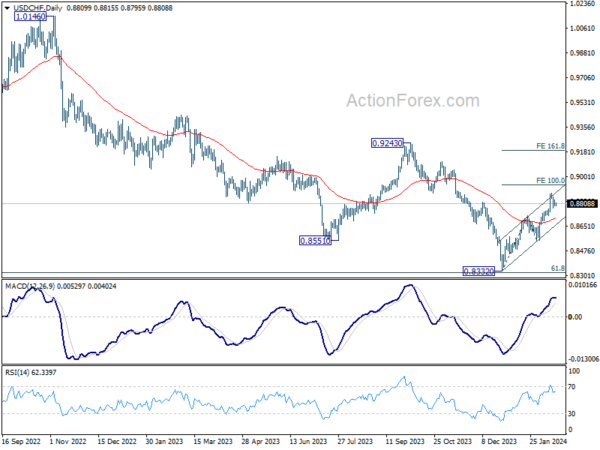

In the bigger picture, a medium term bottom should be formed at 0.8332, on bullish convergence condition in W MACD, just ahead of 0.8317 long term fibonacci support. It’s still early to decide if the larger down trend from 1.0146 (2022 high) is reversing. But further rise should be seen to 0.9243 resistance even as a correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PSI Jan | 52.1 | 48.8 | ||

| 23:50 | JPY | Machinery Orders M/M Dec | 2.70% | 2.50% | -4.90% | |

| 00:01 | GBP | Rightmove House Price Index M/M Feb | 0.90% | 1.30% | ||

| 11:00 | EUR | German Buba Monthly Report | ||||

| 13:30 | CAD | Industrial Product Price M/M Jan | 0.10% | -1.50% | ||

| 13:30 | CAD | Raw Material Price Index Jan | 0.80% | -4.90% |