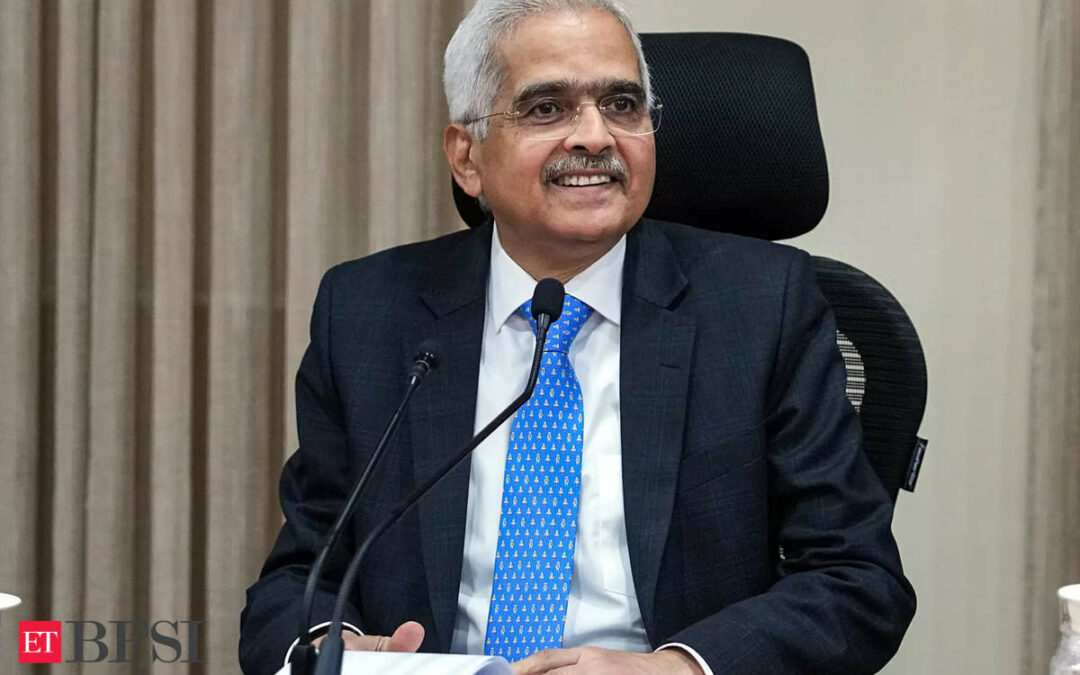

Reserve Bank Governor Shaktikanta Das on Thursday said banks should not “camouflage” stress, and extend loans only for a reasonable period of time. Speaking to reporters at the central bank headquarters, Das said the age of the borrower and the ability to repay must be considered, while extending loan tenors and also made it clear that the RBI does not want to define what constitutes a reasonable period.

It can be noted that a bill of retail loans, especially long-tenor ones like housing, are on floating rate now and the rate hikes of 2.50 per cent by the RBI have led to many such borrowings being extended to longer periods as the interest outgo increases.

“It is necessary to avoid unduly long elongation which sometimes may … camouflage an underlying stress in a particular loan,” Das said.

He said the case for elongation may vary from individual to individual, and the banks have to take a subjective call on such matters.

“We are not considering defining unreasonable elongation, it is something the board will have to consider having regard to the tenor and the repayment capacity of the individual borrowers,” Deputy Governor M Rajeshwar Rao said.

It is up to the board to decide what is a reasonable tenure and increasing that beyond a particular period would be deemed as unreasonable but it is left to the individual institution to define it, he added.

Rao said the RBI has also discussed the issue with bank chief executives during a recent meeting, where the exact concerns have been conveyed and expected action was also highlighted.

Earlier in the day, Das announced a move under which the RBI will be putting in place a transparent framework for reset of interest rates on floating interest loans.

Banks will have to clearly communicate with borrowers for resetting the tenor and/or EMI. provide options for switching to fixed rate loans or foreclosure of loans, also disclose various charges incidental to the exercise of the options; and ensure proper communication of key information to borrowers.

Das had said the measures will further strengthen consumer protection in the system.