- Expectations of a June cut by the SNB have been gaining traction

- But inflation picture isn’t entirely favourable; weak franc doesn’t help

- A lot of uncertainty awaits the SNB’s decision due Thursday at 07:30 GMT

Will the SNB cut rates again?

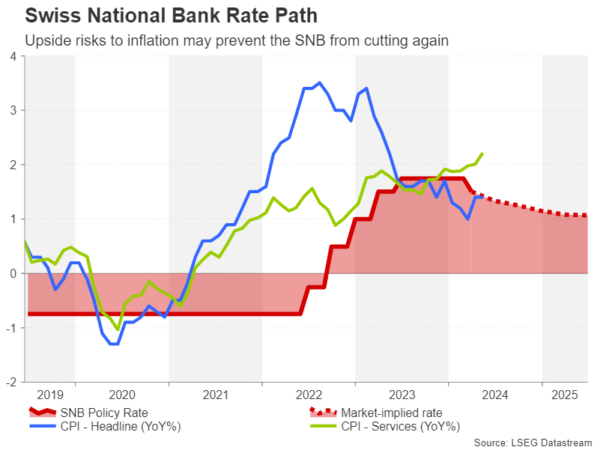

The Swiss National Bank (SNB) got the ball rolling with interest rate cuts back in March, becoming the first major central bank to start its easing cycle. Inflation in Switzerland only peaked at 3.5% y/y and has been within the Bank’s 0-2% target for the past year. Investors might therefore be right to think that further easing is on the cards at the June meeting.

However, inflation may not be quite as subdued as the headline CPI figures suggest. Services inflation remains on an uptrend, reaching 2.2% y/y in May – the highest since 2001. But even headline CPI has started to creep up again, rising to 1.4% y/y in April and holding steady in May. Moreover, the Swiss franc has been on the slide this year, adding to price pressures via higher import costs.

SNB President Thomas Jordan, who is due to step down from his post in September, recently said he sees small upside risks to inflation, with the weaker Swiss franc being the likely source. Those comments at the end of May caught investors off guard, triggering a sizeable reversal in the franc against both the US dollar and the euro (although possible SNB intervention in the foreign exchange market may also have been a factor for the rebound).

Are expectations of a cut justified?

Yet, most investors have been ratcheting up their bets of a follow-up 25-basis-point cut in June since Jordan’s remarks and market pricing currently points to around a 68% probability of such an action. Quite possibly, the rally in the franc is seen as lessening the upside risks to inflation and that’s why rate cut expectations have been moving in tandem with franc appreciation.

However, the Swiss currency is still more than 5% down against the dollar in the year-to-date and more than 2% lower versus the euro. When also considering the acceleration in services inflation and the stronger-than-expected GDP growth in the first quarter, there is little urgency for SNB policymakers to cut again so soon.

Swissie could be in for a bumpy ride

All this has set the stage for some heightened volatility on Thursday as a ‘surprise’ decision to stand pat would wrong foot many investors, while a rate cut would also come as unexpected to some traders. For the franc, the June decision will likely be critical for its near-term outlook as the chances of further gains depend on it.

Dollar/franc is in danger of breaching the key support barrier of the 200-day moving average (MA) in the 0.8890 area. If the SNB disappoints the dovish expectations and keeps rates unchanged at 1.50%, this could drag the pair down to the 50% Fibonacci retracement of the late December-early May uptrend at 0.8777 before testing the 61.8% Fibo of 0.8672.

But if the Bank does deliver a cut and hints at more to follow, dollar/franc could rebound towards the June peak of 0.8993 before aiming for the 50-day MA at 0.9061.

All in all, the SNB’s decision of whether to ease policy again in June is likely to be much more of a close call than the market pricing suggests and there will be a surprise element whatever the outcome.