A coalition of unions is laying out its case against Starbucks ahead of a proxy fight at its annual meeting in March, arguing the coffee giant has implemented a “flawed human capital management strategy” in response to a yearslong union movement.

The Strategic Organizing Center claims the situation has put the company at reputational risk, diminishing shareholder returns and isolating customers, based on polling conducted for a shareholder presentation. The coalition is pushing to replace three current Starbucks board members with its own nominees. It plans to file the investor presentation with the U.S. Securities and Exchange Commission on Tuesday.

“The Board’s anti-union strategy has resulted in one of the most glaring and destructive examples of human capital mismanagement in modern U.S. history,” the proxy presentations reads, according to a copy viewed by CNBC. “Starbucks’ aggressive unionization response has not only failed to resolve the Company’s dispute with employees â it has made the problem worse.”

In response, Starbucks said in a statement that its board is “stocked with world-class business leaders that bring the qualifications and expertise directly relevant to drive our current operations and future success,” adding, “with partners at the heart of our business, we have continued to significantly invest in and improve their experience, including the over 20% of profits that have gone into wage increases, training, and new equipment in the last fiscal year.”

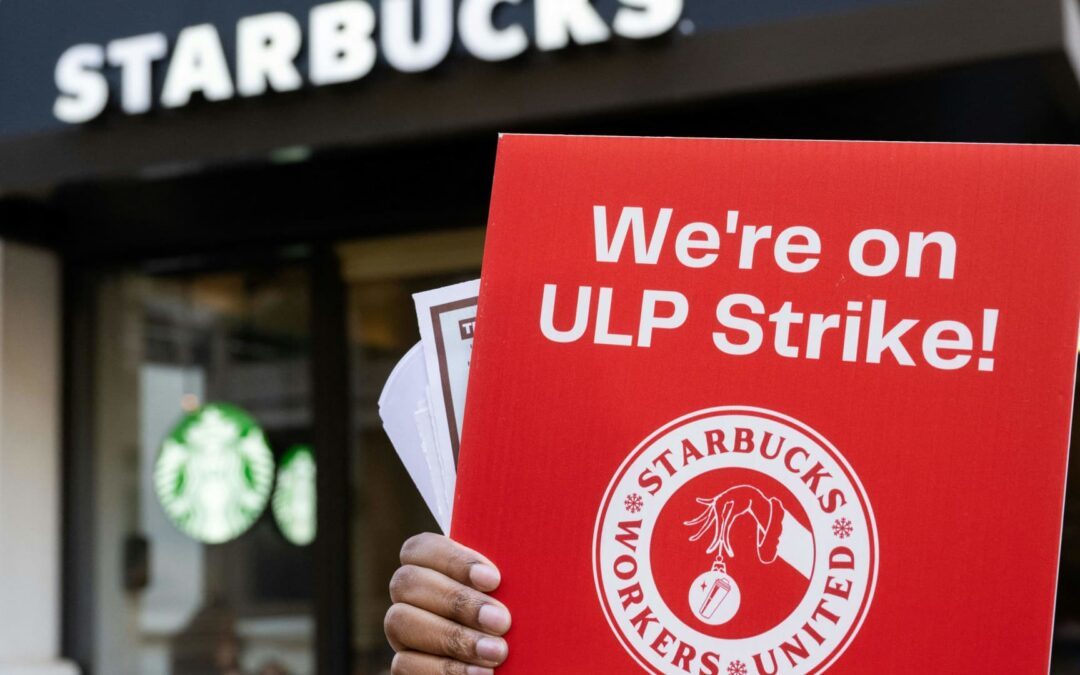

Baristas at nearly 400 Starbucks-owned cafes have voted in favor of organizing since the end of 2021, when the first location in Buffalo unionized successfully. The company has a footprint of some 16,000 cafes, between owned and licensed locations.

Howard Schultz returned as Starbucks CEO as the union battle, sparked by younger workers at the coffee chain, escalated. He stepped down last year as Laxman Narasimhan took the reins. At the end of last year, Starbucks said it wanted to resume contract talks in January, but the two sides have yet to agree to a deal. Baristas have staged high-profile strikes including during Pride weekend in June and Red Cup Day in the fall.

The SOC says in its proxy presentation, titled “Brew a Better Starbucks,” that the projected response to the unionization campaign has cost the company nearly a quarter of a billion dollars, based on its own estimates, and “damaged the value of the brand.”

Two-thirds of people polled by Nielsen who visited the coffee chain in the past 30 days said they would be less likely to visit Starbucks if the company broke federal labor laws. The poll of 2,000 customers from all 50 states was commissioned by the SOC. That’s higher even than the 54% who said they would be less likely to visit in the face of price increases.

The SOC proxy presentation claims the company’s board has backed what it calls an “unnecessarily confrontational” strategy with the union. According to the National Labor Relations Board, NLRB regional offices have issued 128 complaints covering 430 unfair labor practice charges against Starbucks Corporation and Siren Retail Corporation following an investigation.

The SOC includes the Service Employees International Union, parent of Starbucks Workers United, as well as the Communications Workers of America and United Farm Workers of America. The group says its unions represent more than 2.3 million workers and, despite a small ownership stake of just 162 Starbucks shares, its affiliated unions have millions of members with “hundreds of billions of dollars invested in pension plans with substantial Starbucks shareholdings.”

The SOC presentation argues that since unionization efforts began through November when it launched its campaign, Starbucks stock has fallen 6% compared to 10.6% median gains for its peer cohort of Chipotle, Darden Restaurants, McDonald’s, Restaurant Brands International and Yum Brands. This also compares to 5.2% gains of the S&P 500 Restaurants benchmark during the same period.

During the period cited by the SOC, Starbucks said it has also navigated several other external challenges aside from labor organizing, including macroeconomic effects and the pace of recovery in China. It argues its steady operating performance speaks for itself in the face of volatile markets.

The coalition has put forth three director candidates for the coffee giant’s board that it says have expertise it currently lacks, including working with unions successfully and experience with labor law. The candidates are former White House official Maria Echaveste; Joshua Gotbaum, a Chapter 11 trustee of Hawaiian Airlines and former White House Official; and Wilma Liebman, former chair of the NLRB.

Starbucks in January added three new directors: Daniel Servitje, CEO of Grupo Bimbo; Neal Mohan, CEO of YouTube; and Mike Sievert, CEO of T-Mobile. Starbucks said it has not only a new CEO, but with these additions, it has added five new board members in the past year. Combined with other members of its board, the company said they bring the needed diversity of talent and experience to the table.

The SOC presentation claims those three new additions do not have labor-related regulatory experience. The proxy presentation targets three current Starbucks board members: Ritch Allison, Andy Campion and Jørgen Vig Knudstorp.

Starbucks filed its own proxy presentation on Friday that said all of its current board members have labor experience and argues the SOC’s nominees “lack the breadth of knowledge and experience to oversee its global and consumer facing business.”

Allison, Campion and Knudstorp, specifically, provide “continuity and highly-valuable unique perspectives,” the Starbucks presentation said.

The company further argued that it has created $92 billion in market value over the past two decades and leads its peer group in comparable store sales growth, unit growth, revenue growth and earnings per share growth over the past year, according to the presentation.

As for stock returns, Starbucks contends it outperforms its peer group â which includes Domino’s, Restaurant Brands International, Wendy’s and others â by 5 percentage points over the past three years. Since the company announced its reinvention in May 2022, the stock is up 32%, outpacing both its peer group and the S&P, the company said. The SOC fired back in its presentation, arguing Starbucks’ peer set is “overly broad and was chosen to be flattering to the company’s recent underperformance.”

Starbucks said in November and reiterated in its SEC filing that over the past three years, it has invested nearly $9 billion to uplift the overall partner and store experience, with “more than one third of that investment going directly to the partners through wage increases, training, new innovative equipment and technology.”

In addition, the company said it has taken a “constructive” approach and maintains a goal of “reaching ratified contracts for each represented store in 2024.”

It touted plans, unveiled in December, that will unlock $3 billion in efficiencies to fund reinvestments in its workers. On the company’s most recent earnings call, Narasimhan reiterated the company’s position on the unionization movement.

“I want to be clear in my view on the matter of unionization at Starbucks. We believe in a direct relationship with our partners. And in the 4% of our stores in the U.S. where our partners have chosen to be represented by a union, we are committed to finding a constructive path forward with those unions.”