By InvestMacro

Here are the latest charts and statistics for the Commitment of Traders (COT) reports data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday December 3rd and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

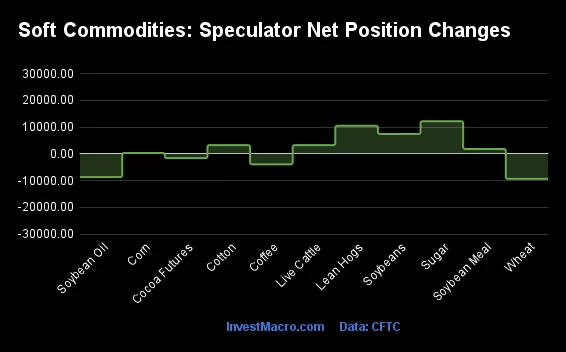

Weekly Speculator Changes led by Sugar & Lean Hogs

The COT soft commodities markets speculator bets were higher this week as seven out of the eleven softs markets we cover had higher positioning while the other four markets had lower speculator contracts.

Leading the gains for the softs markets was Sugar (12,221 contracts) with Lean Hogs (10,520 contracts), Soybeans (7,453 contracts), Cotton (3,311 contracts), Live Cattle (3,295 contracts), Soybean Meal (1,862 contracts) and Corn (359 contracts) also showing positive weeks.

The markets with the declines in speculator bets this week were Wheat (-9,345 contracts), Soybean Oil (-8,665 contracts), Coffee (-3,886 contracts) and Cocoa (-1,570 contracts) also registering lower bets on the week.

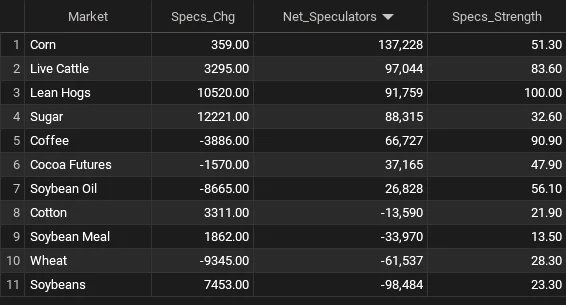

Soft Commodities Net Speculators Leaderboard

Legend: Weekly Speculators Change | Speculators Current Net Position | Speculators Strength Score compared to last 3-Years (0-100 range)

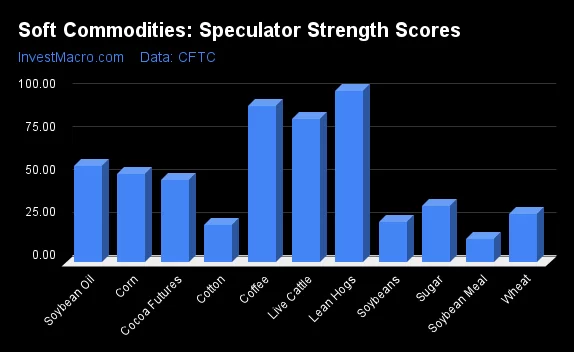

Strength Scores led by Lean Hogs & Coffee

COT Strength Scores (a normalized measure of Speculator positions over a 3-Year range, from 0 to 100 where above 80 is Extreme-Bullish and below 20 is Extreme-Bearish) showed that Lean Hogs (100 percent) and Coffee (91 percent) lead the softs markets this week. Live Cattle (84 percent), Soybean Oil (56 percent) and Corn (51 percent) come in as the next highest in the weekly strength scores.

On the downside, Soybean Meal (13 percent) comes in at the lowest strength levels currently and is in Extreme-Bearish territory (below 20 percent). The next lowest strength scores are Cotton (22 percent), Soybeans (23 percent) and Wheat (28 percent).

Strength Statistics:

Corn (51.3 percent) vs Corn previous week (51.3 percent)

Sugar (32.6 percent) vs Sugar previous week (28.3 percent)

Coffee (90.9 percent) vs Coffee previous week (94.7 percent)

Soybeans (23.3 percent) vs Soybeans previous week (21.5 percent)

Soybean Oil (56.1 percent) vs Soybean Oil previous week (60.9 percent)

Soybean Meal (13.5 percent) vs Soybean Meal previous week (12.7 percent)

Live Cattle (83.6 percent) vs Live Cattle previous week (80.0 percent)

Lean Hogs (100.0 percent) vs Lean Hogs previous week (91.8 percent)

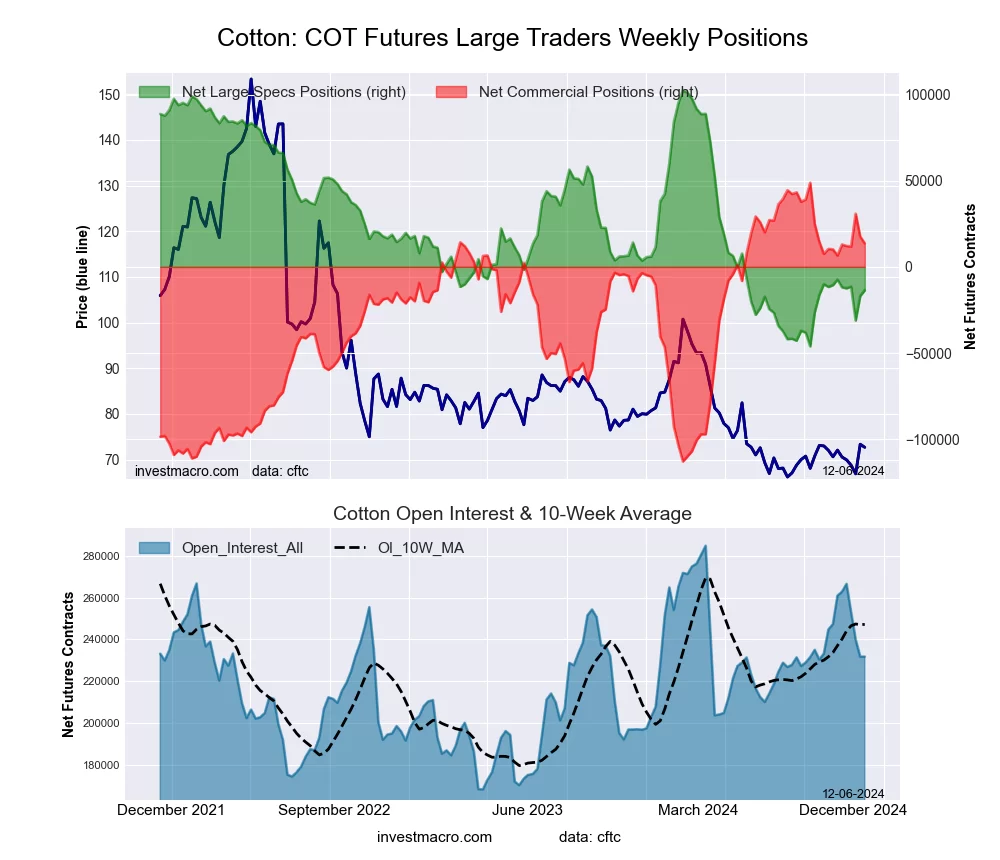

Cotton (21.9 percent) vs Cotton previous week (19.7 percent)

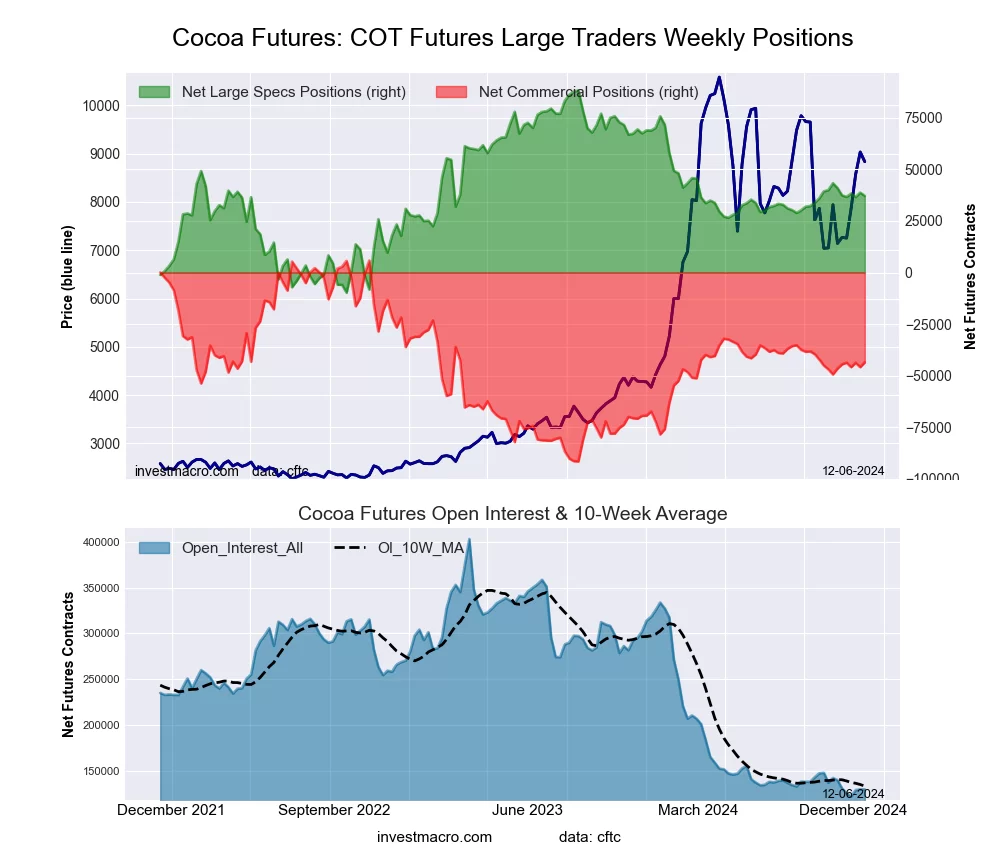

Cocoa (47.9 percent) vs Cocoa previous week (49.5 percent)

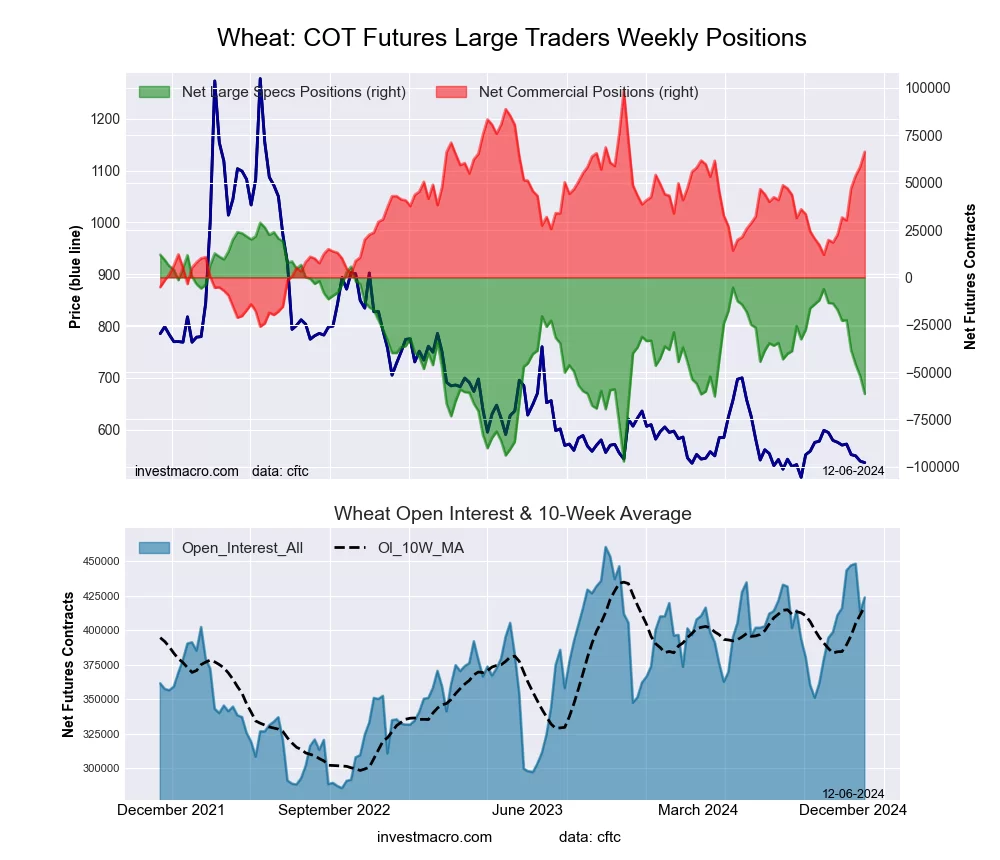

Wheat (28.3 percent) vs Wheat previous week (35.7 percent)

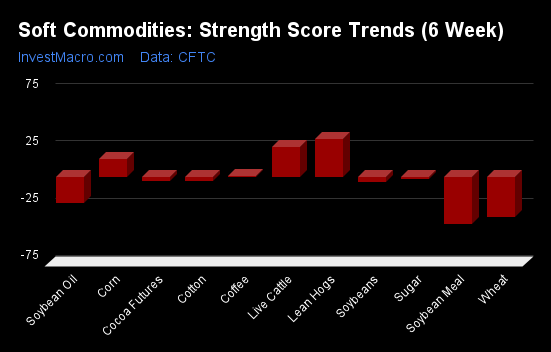

Lean Hogs & Live Cattle top the 6-Week Strength Trends

COT Strength Score Trends (or move index, calculates the 6-week changes in strength scores) showed that Lean Hogs (33 percent) and Live Cattle (26 percent) lead the past six weeks trends for soft commodities. Corn (15 percent) is the next highest positive movers in the latest trends data.

Soybean Meal (-42 percent) leads the downside trend scores currently with Wheat (-35 percent), Soybean Oil (-23 percent) and Soybeans (-5 percent) following next with lower trend scores.

Strength Trend Statistics:

Corn (15.2 percent) vs Corn previous week (18.1 percent)

Sugar (-1.8 percent) vs Sugar previous week (-10.4 percent)

Coffee (0.4 percent) vs Coffee previous week (3.6 percent)

Soybeans (-4.8 percent) vs Soybeans previous week (-9.6 percent)

Soybean Oil (-23.1 percent) vs Soybean Oil previous week (-9.5 percent)

Soybean Meal (-42.0 percent) vs Soybean Meal previous week (-40.1 percent)

Live Cattle (26.2 percent) vs Live Cattle previous week (24.1 percent)

Lean Hogs (33.1 percent) vs Lean Hogs previous week (31.7 percent)

Cotton (-4.2 percent) vs Cotton previous week (-4.2 percent)

Cocoa (-3.9 percent) vs Cocoa previous week (-4.7 percent)

Wheat (-35.3 percent) vs Wheat previous week (-30.5 percent)

Individual Soft Commodities Markets:

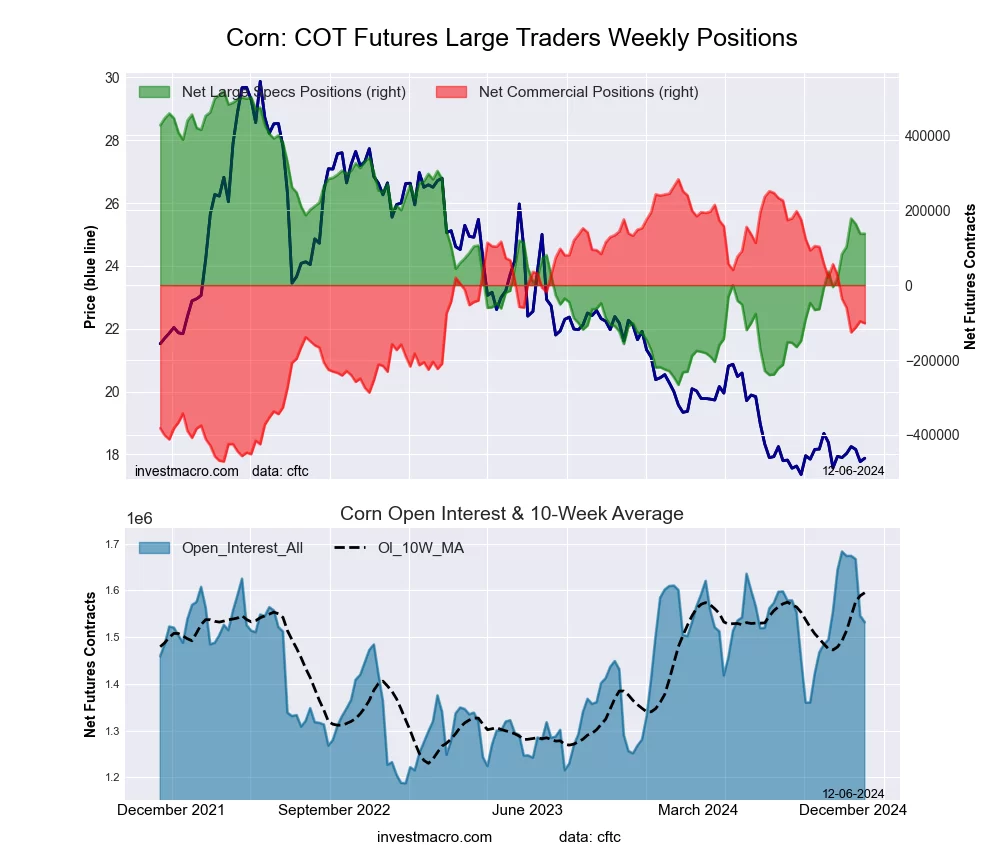

CORN Futures:

The CORN large speculator standing this week was a net position of 137,228 contracts in the data reported through Tuesday. This was a weekly gain of 359 contracts from the previous week which had a total of 136,869 net contracts.

The CORN large speculator standing this week was a net position of 137,228 contracts in the data reported through Tuesday. This was a weekly gain of 359 contracts from the previous week which had a total of 136,869 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 51.3 percent. The commercials are Bearish with a score of 49.0 percent and the small traders (not shown in chart) are Bullish with a score of 60.8 percent.

Price Trend-Following Model: Strong Uptrend

Our weekly trend-following model classifies the current market price position as: Strong Uptrend.

| CORN Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 26.4 | 46.5 | 8.2 |

| – Percent of Open Interest Shorts: | 17.5 | 53.1 | 10.5 |

| – Net Position: | 137,228 | -101,968 | -35,260 |

| – Gross Longs: | 404,920 | 711,737 | 125,015 |

| – Gross Shorts: | 267,692 | 813,705 | 160,275 |

| – Long to Short Ratio: | 1.5 to 1 | 0.9 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 51.3 | 49.0 | 60.8 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 15.2 | -17.1 | 12.0 |

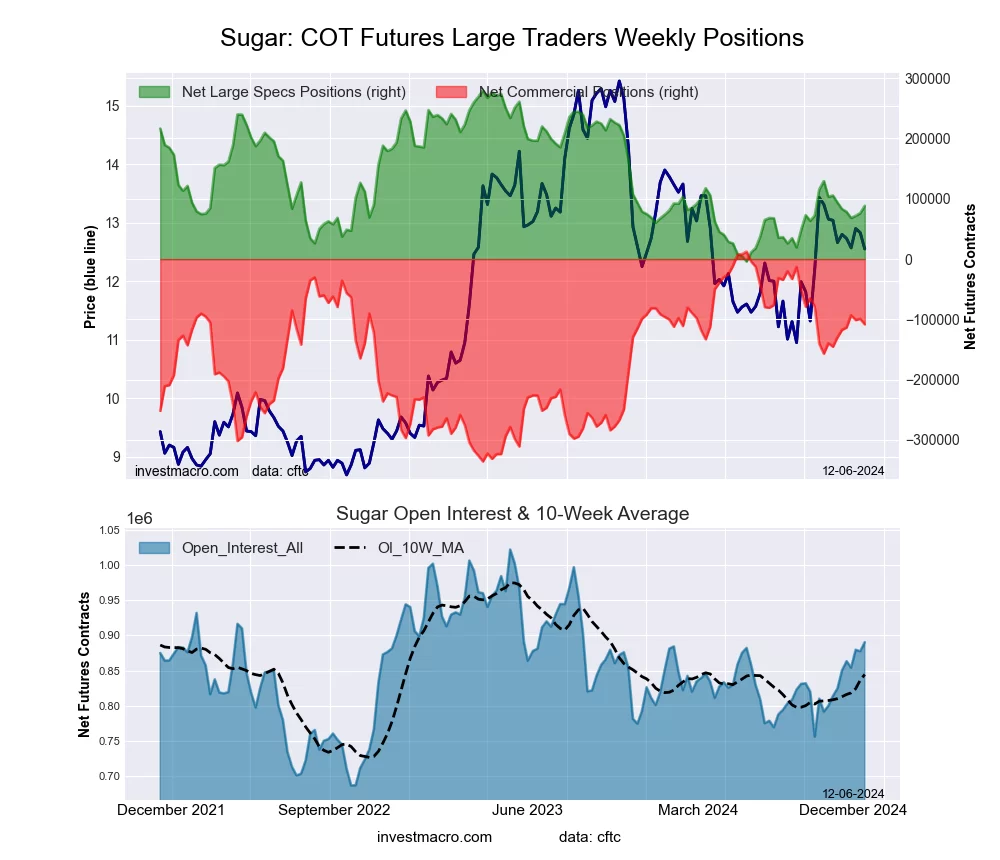

SUGAR Futures:

The SUGAR large speculator standing this week was a net position of 88,315 contracts in the data reported through Tuesday. This was a weekly boost of 12,221 contracts from the previous week which had a total of 76,094 net contracts.

The SUGAR large speculator standing this week was a net position of 88,315 contracts in the data reported through Tuesday. This was a weekly boost of 12,221 contracts from the previous week which had a total of 76,094 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 32.6 percent. The commercials are Bullish with a score of 65.3 percent and the small traders (not shown in chart) are Bearish with a score of 45.7 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend.

| SUGAR Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 25.7 | 50.5 | 8.2 |

| – Percent of Open Interest Shorts: | 15.8 | 62.7 | 6.0 |

| – Net Position: | 88,315 | -108,348 | 20,033 |

| – Gross Longs: | 228,964 | 449,489 | 73,180 |

| – Gross Shorts: | 140,649 | 557,837 | 53,147 |

| – Long to Short Ratio: | 1.6 to 1 | 0.8 to 1 | 1.4 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 32.6 | 65.3 | 45.7 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -1.8 | 6.1 | -21.0 |

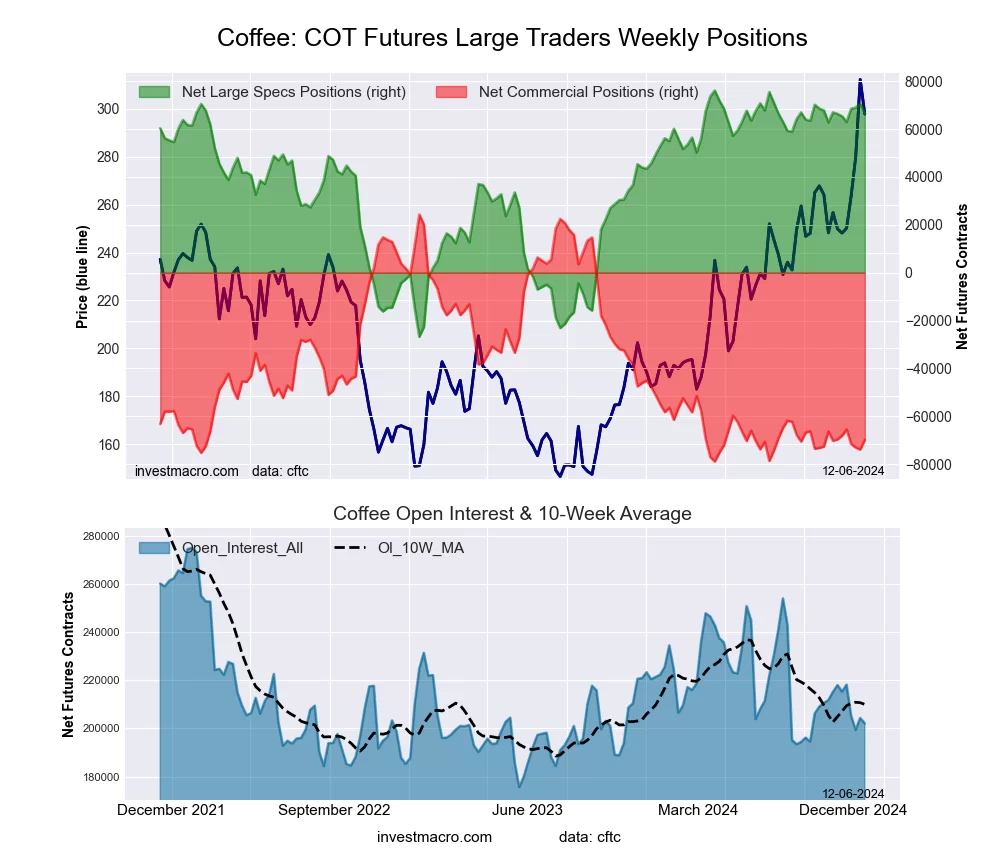

COFFEE Futures:

The COFFEE large speculator standing this week was a net position of 66,727 contracts in the data reported through Tuesday. This was a weekly lowering of -3,886 contracts from the previous week which had a total of 70,613 net contracts.

The COFFEE large speculator standing this week was a net position of 66,727 contracts in the data reported through Tuesday. This was a weekly lowering of -3,886 contracts from the previous week which had a total of 70,613 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 90.9 percent. The commercials are Bearish-Extreme with a score of 8.7 percent and the small traders (not shown in chart) are Bullish with a score of 64.3 percent.

Price Trend-Following Model: Strong Uptrend

Our weekly trend-following model classifies the current market price position as: Strong Uptrend.

| COFFEE Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 38.6 | 35.1 | 4.5 |

| – Percent of Open Interest Shorts: | 5.6 | 69.6 | 2.9 |

| – Net Position: | 66,727 | -69,817 | 3,090 |

| – Gross Longs: | 78,015 | 70,936 | 9,014 |

| – Gross Shorts: | 11,288 | 140,753 | 5,924 |

| – Long to Short Ratio: | 6.9 to 1 | 0.5 to 1 | 1.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 90.9 | 8.7 | 64.3 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 0.4 | -0.2 | -3.7 |

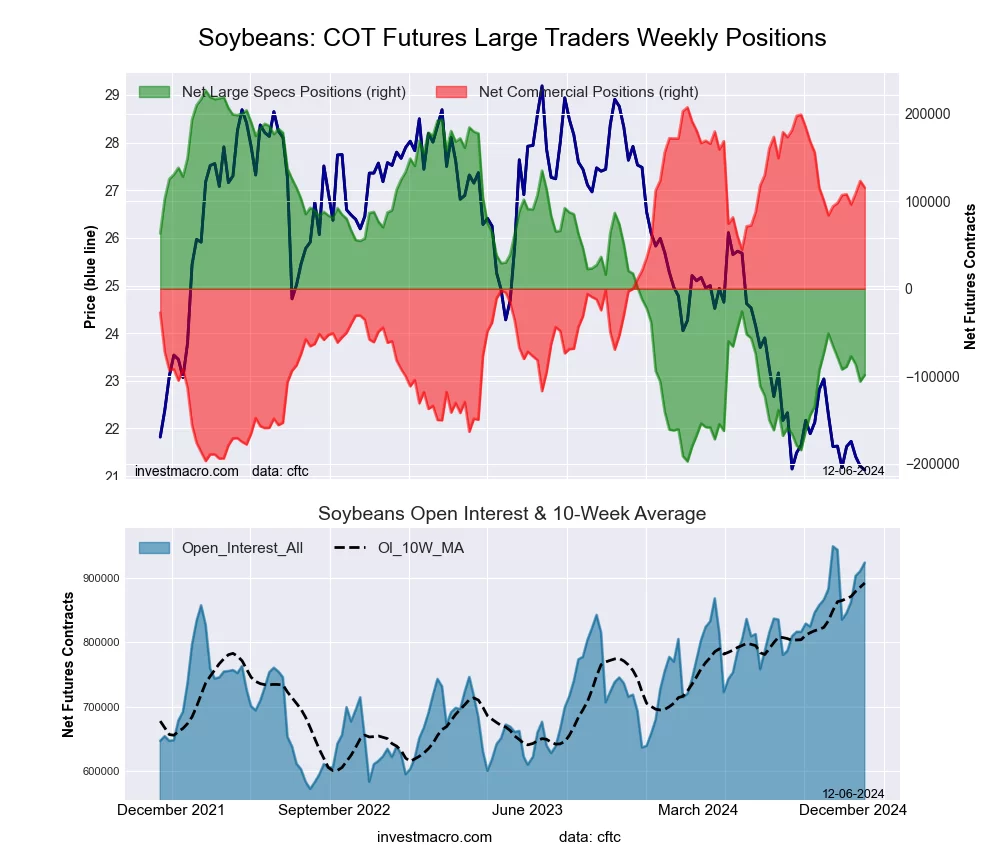

SOYBEANS Futures:

The SOYBEANS large speculator standing this week was a net position of -98,484 contracts in the data reported through Tuesday. This was a weekly increase of 7,453 contracts from the previous week which had a total of -105,937 net contracts.

The SOYBEANS large speculator standing this week was a net position of -98,484 contracts in the data reported through Tuesday. This was a weekly increase of 7,453 contracts from the previous week which had a total of -105,937 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 23.3 percent. The commercials are Bullish with a score of 77.3 percent and the small traders (not shown in chart) are Bullish with a score of 67.6 percent.

Price Trend-Following Model: Strong Downtrend

Our weekly trend-following model classifies the current market price position as: Strong Downtrend.

| SOYBEANS Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 17.2 | 56.4 | 5.4 |

| – Percent of Open Interest Shorts: | 27.9 | 43.9 | 7.2 |

| – Net Position: | -98,484 | 115,653 | -17,169 |

| – Gross Longs: | 158,897 | 520,431 | 49,744 |

| – Gross Shorts: | 257,381 | 404,778 | 66,913 |

| – Long to Short Ratio: | 0.6 to 1 | 1.3 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 23.3 | 77.3 | 67.6 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -4.8 | 4.4 | 6.7 |

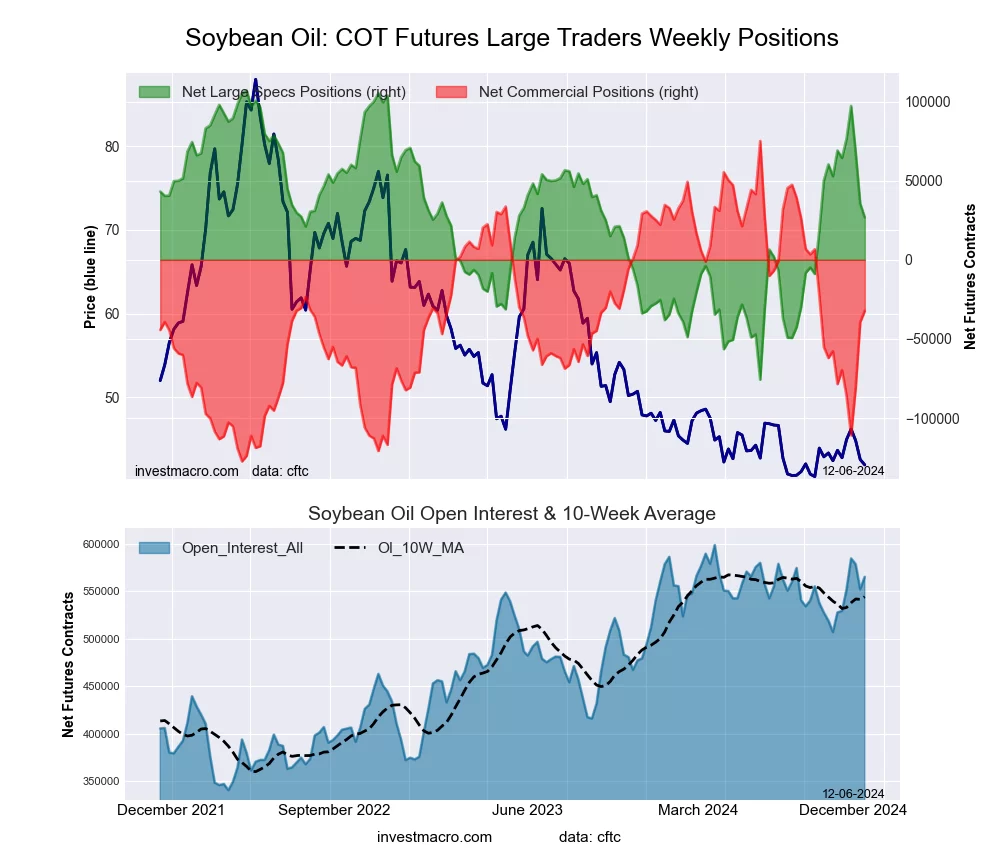

SOYBEAN OIL Futures:

The SOYBEAN OIL large speculator standing this week was a net position of 26,828 contracts in the data reported through Tuesday. This was a weekly decline of -8,665 contracts from the previous week which had a total of 35,493 net contracts.

The SOYBEAN OIL large speculator standing this week was a net position of 26,828 contracts in the data reported through Tuesday. This was a weekly decline of -8,665 contracts from the previous week which had a total of 35,493 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 56.1 percent. The commercials are Bearish with a score of 47.0 percent and the small traders (not shown in chart) are Bearish with a score of 35.1 percent.

Price Trend-Following Model: Weak Uptrend

Our weekly trend-following model classifies the current market price position as: Weak Uptrend.

| SOYBEAN OIL Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 24.5 | 53.7 | 5.7 |

| – Percent of Open Interest Shorts: | 19.8 | 59.4 | 4.7 |

| – Net Position: | 26,828 | -32,252 | 5,424 |

| – Gross Longs: | 138,699 | 303,490 | 32,253 |

| – Gross Shorts: | 111,871 | 335,742 | 26,829 |

| – Long to Short Ratio: | 1.2 to 1 | 0.9 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 56.1 | 47.0 | 35.1 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -23.1 | 22.8 | -15.6 |

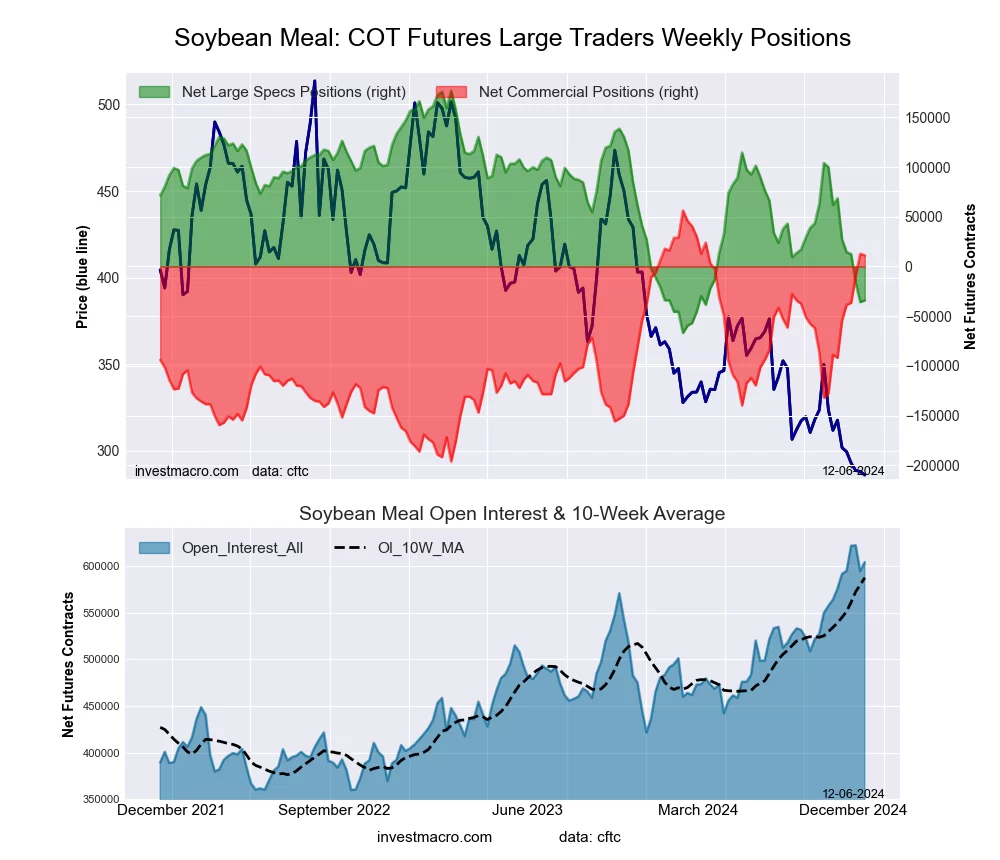

SOYBEAN MEAL Futures:

The SOYBEAN MEAL large speculator standing this week was a net position of -33,970 contracts in the data reported through Tuesday. This was a weekly lift of 1,862 contracts from the previous week which had a total of -35,832 net contracts.

The SOYBEAN MEAL large speculator standing this week was a net position of -33,970 contracts in the data reported through Tuesday. This was a weekly lift of 1,862 contracts from the previous week which had a total of -35,832 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 13.5 percent. The commercials are Bullish-Extreme with a score of 82.2 percent and the small traders (not shown in chart) are Bullish with a score of 58.0 percent.

Price Trend-Following Model: Strong Downtrend

Our weekly trend-following model classifies the current market price position as: Strong Downtrend.

| SOYBEAN MEAL Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 22.0 | 45.9 | 9.3 |

| – Percent of Open Interest Shorts: | 27.6 | 44.0 | 5.5 |

| – Net Position: | -33,970 | 11,231 | 22,739 |

| – Gross Longs: | 132,664 | 277,159 | 55,879 |

| – Gross Shorts: | 166,634 | 265,928 | 33,140 |

| – Long to Short Ratio: | 0.8 to 1 | 1.0 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 13.5 | 82.2 | 58.0 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -42.0 | 40.8 | -2.9 |

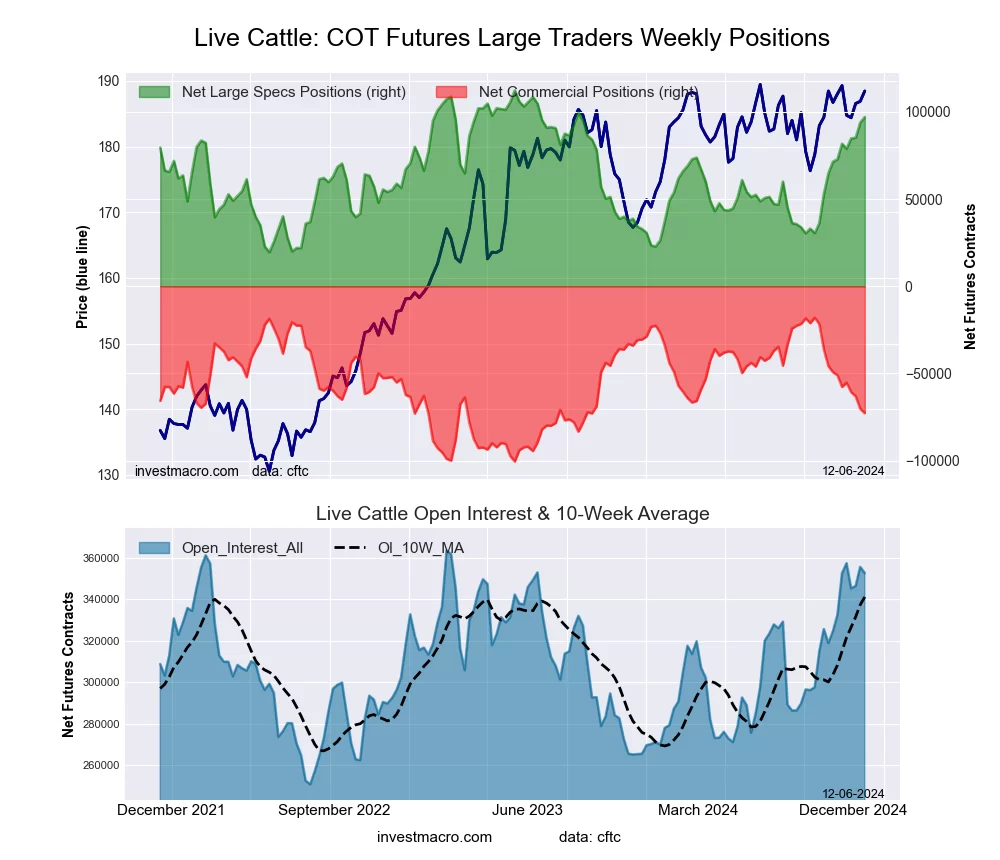

LIVE CATTLE Futures:

The LIVE CATTLE large speculator standing this week was a net position of 97,044 contracts in the data reported through Tuesday. This was a weekly advance of 3,295 contracts from the previous week which had a total of 93,749 net contracts.

The LIVE CATTLE large speculator standing this week was a net position of 97,044 contracts in the data reported through Tuesday. This was a weekly advance of 3,295 contracts from the previous week which had a total of 93,749 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 83.6 percent. The commercials are Bearish with a score of 33.6 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 0.0 percent.

Price Trend-Following Model: Strong Uptrend

Our weekly trend-following model classifies the current market price position as: Strong Uptrend.

| LIVE CATTLE Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 46.4 | 31.0 | 6.8 |

| – Percent of Open Interest Shorts: | 18.8 | 51.6 | 13.7 |

| – Net Position: | 97,044 | -72,727 | -24,317 |

| – Gross Longs: | 163,456 | 109,258 | 24,090 |

| – Gross Shorts: | 66,412 | 181,985 | 48,407 |

| – Long to Short Ratio: | 2.5 to 1 | 0.6 to 1 | 0.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 83.6 | 33.6 | 0.0 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 26.2 | -26.3 | -9.9 |

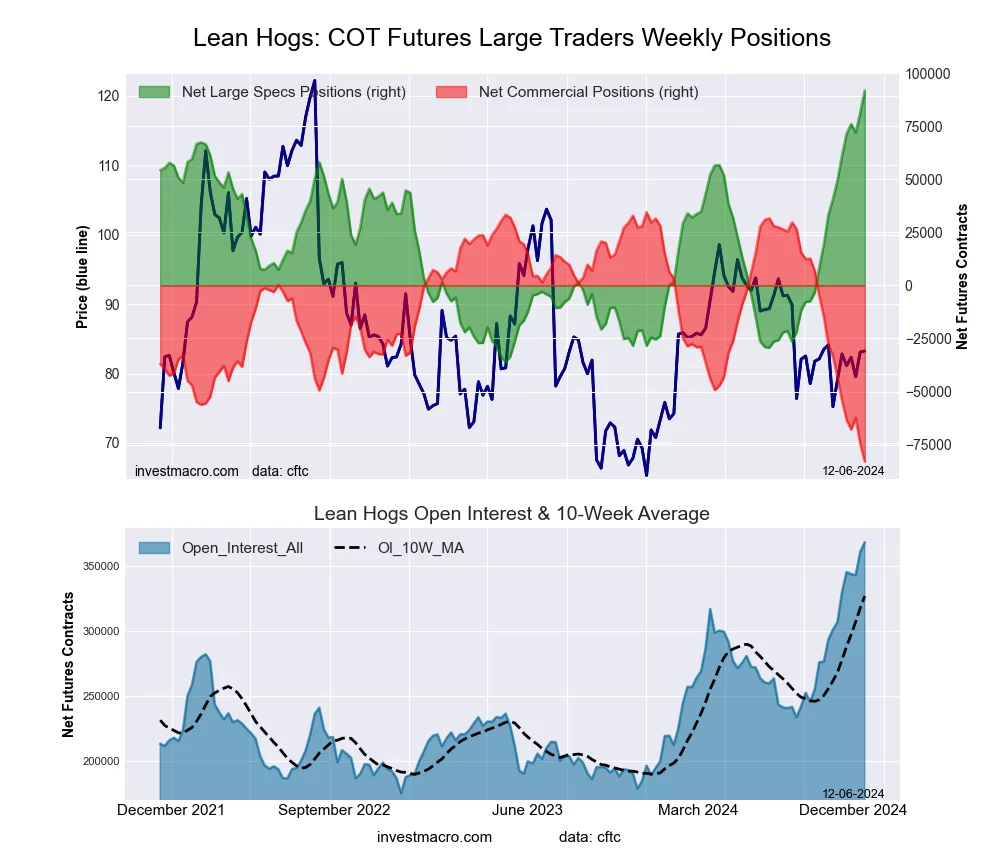

LEAN HOGS Futures:

The LEAN HOGS large speculator standing this week was a net position of 91,759 contracts in the data reported through Tuesday. This was a weekly increase of 10,520 contracts from the previous week which had a total of 81,239 net contracts.

The LEAN HOGS large speculator standing this week was a net position of 91,759 contracts in the data reported through Tuesday. This was a weekly increase of 10,520 contracts from the previous week which had a total of 81,239 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 100.0 percent. The commercials are Bearish-Extreme with a score of 0.0 percent and the small traders (not shown in chart) are Bearish with a score of 39.8 percent.

Price Trend-Following Model: Downtrend

Our weekly trend-following model classifies the current market price position as: Downtrend.

| LEAN HOGS Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 49.0 | 28.0 | 6.5 |

| – Percent of Open Interest Shorts: | 24.1 | 50.5 | 8.9 |

| – Net Position: | 91,759 | -82,933 | -8,826 |

| – Gross Longs: | 180,550 | 103,197 | 23,829 |

| – Gross Shorts: | 88,791 | 186,130 | 32,655 |

| – Long to Short Ratio: | 2.0 to 1 | 0.6 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 100.0 | 0.0 | 39.8 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 33.1 | -33.8 | -12.3 |

COTTON Futures:

The COTTON large speculator standing this week was a net position of -13,590 contracts in the data reported through Tuesday. This was a weekly rise of 3,311 contracts from the previous week which had a total of -16,901 net contracts.

The COTTON large speculator standing this week was a net position of -13,590 contracts in the data reported through Tuesday. This was a weekly rise of 3,311 contracts from the previous week which had a total of -16,901 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 21.9 percent. The commercials are Bullish with a score of 78.2 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 16.5 percent.

Price Trend-Following Model: Strong Uptrend

Our weekly trend-following model classifies the current market price position as: Strong Uptrend.

| COTTON Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 25.8 | 46.3 | 5.5 |

| – Percent of Open Interest Shorts: | 31.7 | 40.4 | 5.6 |

| – Net Position: | -13,590 | 13,602 | -12 |

| – Gross Longs: | 59,802 | 107,282 | 12,854 |

| – Gross Shorts: | 73,392 | 93,680 | 12,866 |

| – Long to Short Ratio: | 0.8 to 1 | 1.1 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 21.9 | 78.2 | 16.5 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -4.2 | 4.3 | -4.7 |

COCOA Futures:

The COCOA large speculator standing this week was a net position of 37,165 contracts in the data reported through Tuesday. This was a weekly decrease of -1,570 contracts from the previous week which had a total of 38,735 net contracts.

The COCOA large speculator standing this week was a net position of 37,165 contracts in the data reported through Tuesday. This was a weekly decrease of -1,570 contracts from the previous week which had a total of 38,735 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 47.9 percent. The commercials are Bearish with a score of 49.3 percent and the small traders (not shown in chart) are Bullish with a score of 66.9 percent.

Price Trend-Following Model: Weak Downtrend

Our weekly trend-following model classifies the current market price position as: Weak Downtrend.

| COCOA Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 43.3 | 35.9 | 9.0 |

| – Percent of Open Interest Shorts: | 14.7 | 69.4 | 4.1 |

| – Net Position: | 37,165 | -43,594 | 6,429 |

| – Gross Longs: | 56,340 | 46,774 | 11,738 |

| – Gross Shorts: | 19,175 | 90,368 | 5,309 |

| – Long to Short Ratio: | 2.9 to 1 | 0.5 to 1 | 2.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 47.9 | 49.3 | 66.9 |

| – Strength Index Reading (3 Year Range): | Bearish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -3.9 | 3.1 | 6.5 |

WHEAT Futures:

The WHEAT large speculator standing this week was a net position of -61,537 contracts in the data reported through Tuesday. This was a weekly reduction of -9,345 contracts from the previous week which had a total of -52,192 net contracts.

The WHEAT large speculator standing this week was a net position of -61,537 contracts in the data reported through Tuesday. This was a weekly reduction of -9,345 contracts from the previous week which had a total of -52,192 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 28.3 percent. The commercials are Bullish with a score of 74.1 percent and the small traders (not shown in chart) are Bearish with a score of 31.7 percent.

Price Trend-Following Model: Weak Uptrend

Our weekly trend-following model classifies the current market price position as: Weak Uptrend.

| WHEAT Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 29.6 | 38.3 | 7.0 |

| – Percent of Open Interest Shorts: | 44.1 | 22.7 | 8.1 |

| – Net Position: | -61,537 | 66,335 | -4,798 |

| – Gross Longs: | 125,216 | 162,383 | 29,486 |

| – Gross Shorts: | 186,753 | 96,048 | 34,284 |

| – Long to Short Ratio: | 0.7 to 1 | 1.7 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 28.3 | 74.1 | 31.7 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -35.3 | 35.2 | 3.2 |

Article By InvestMacro – Receive our weekly COT Newsletter

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- COT Soft Commodities Charts: Speculator bets led by Sugar & Lean Hogs Dec 7, 2024

- OPEC+ countries postponed production cuts until spring. The Reserve Bank of India (RBI) unexpectedly lowered the cash reserve ratio Dec 6, 2024

- Gold Prices Dip but Remain Supported by Fed Rate Cut Expectations Dec 6, 2024

- Bitcoin has surpassed the $100,000 mark for the first time. Today, the focus of oil traders is on the OPEC+ meeting Dec 5, 2024

- Market round-up: Bitcoin hits $100k, OPEC+ delay output hike Dec 5, 2024

- GBP/USD Continues its Rally: Third Day of Buying Dec 5, 2024

- Australian dollar declines amid weak GDP data. Short-term martial law was imposed in South Korea Dec 4, 2024

- Australian Dollar Hits Four-Month Low Amid Weak GDP Data Dec 4, 2024

- EURUSD gripped by French political turmoil Dec 4, 2024

- ECB may go for a double rate cut in December. US stock indices continue to update historical highs Dec 3, 2024