By InvestMacro

Here are the latest charts and statistics for the Commitment of Traders (COT) reports data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday May 6th and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

Weekly Speculator Changes led by Wheat & Live Cattle

The COT soft commodities markets speculator bets were slightly lower this week as five out of the eleven softs markets we cover had higher positioning while the other six markets had lower speculator contracts.

Leading the gains for the softs markets was Wheat (9,271 contracts) with Live Cattle (5,601 contracts), Lean Hogs (2,644 contracts), Cotton (1,662 contracts) and Coffee (52 contracts) also showing positive weeks.

The markets with the declines in speculator bets this week were Corn (-59,530 contracts), Soybeans (-10,088 contracts), Sugar (-16,325 contracts), Soybean Meal (-221 contracts), Soybean Oil (-3,260 contracts) and with Cocoa (-441 contracts) also registering lower bets on the week.

Soft Commodities Data:

Legend: Weekly Speculators Change | Speculators Current Net Position | Speculators Strength Score compared to last 3-Years (0-100 range)

Strength Scores led by Live Cattle & Soybean Oil

COT Strength Scores (a normalized measure of Speculator positions over a 3-Year range, from 0 to 100 where above 80 is Extreme-Bullish and below 20 is Extreme-Bearish) showed that Live Cattle (86 percent) and Soybean Oil (79 percent) lead the softs markets this week. Coffee (74 percent), Soybeans (63 percent) and Lean Hogs (57 percent) come in as the next highest in the weekly strength scores.

On the downside, Soybean Meal (5 percent), Wheat (6 percent) and Sugar (18 percent) come in at the lowest strength levels currently and are in Extreme-Bearish territory (below 20 percent).

Strength Statistics:

Corn (51.6 percent) vs Corn previous week (59.7 percent)

Sugar (17.8 percent) vs Sugar previous week (23.0 percent)

Coffee (73.7 percent) vs Coffee previous week (73.6 percent)

Soybeans (63.2 percent) vs Soybeans previous week (65.7 percent)

Soybean Oil (78.8 percent) vs Soybean Oil previous week (80.6 percent)

Soybean Meal (5.3 percent) vs Soybean Meal previous week (5.4 percent)

Live Cattle (85.6 percent) vs Live Cattle previous week (80.2 percent)

Lean Hogs (56.8 percent) vs Lean Hogs previous week (54.8 percent)

Cotton (31.7 percent) vs Cotton previous week (30.6 percent)

Cocoa (27.2 percent) vs Cocoa previous week (27.7 percent)

Wheat (6.4 percent) vs Wheat previous week (0.0 percent)

Soybean Oil & Cotton top the 6-Week Strength Trends

COT Strength Score Trends (or move index, calculates the 6-week changes in strength scores) showed that Soybean Oil (50 percent) and Cotton (27 percent) lead the past six weeks trends for soft commodities. Soybeans (16 percent) and Lean Hogs (6 percent) are the next highest positive movers in the latest trends data.

Wheat (-17 percent) leads the downside trend scores currently with Corn (-11 percent), Live Cattle (-9 percent) and Sugar (-9 percent) following next with lower trend scores.

Strength Trend Statistics:

Corn (-11.4 percent) vs Corn previous week (-8.6 percent)

Sugar (-9.5 percent) vs Sugar previous week (2.2 percent)

Coffee (-8.8 percent) vs Coffee previous week (-6.6 percent)

Soybeans (16.3 percent) vs Soybeans previous week (17.3 percent)

Soybean Oil (49.9 percent) vs Soybean Oil previous week (44.2 percent)

Soybean Meal (-1.9 percent) vs Soybean Meal previous week (-8.8 percent)

Live Cattle (-9.0 percent) vs Live Cattle previous week (-0.4 percent)

Lean Hogs (6.3 percent) vs Lean Hogs previous week (0.2 percent)

Cotton (26.7 percent) vs Cotton previous week (22.8 percent)

Cocoa (-1.4 percent) vs Cocoa previous week (0.9 percent)

Wheat (-17.2 percent) vs Wheat previous week (-27.7 percent)

Individual Soft Commodities Markets:

CORN Futures:

The CORN large speculator standing this week resulted in a net position of 115,899 contracts in the data reported through Tuesday. This was a weekly decrease of -59,530 contracts from the previous week which had a total of 175,429 net contracts.

The CORN large speculator standing this week resulted in a net position of 115,899 contracts in the data reported through Tuesday. This was a weekly decrease of -59,530 contracts from the previous week which had a total of 175,429 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 51.6 percent. The commercials are Bearish with a score of 49.4 percent and the small traders (not shown in chart) are Bullish with a score of 59.3 percent.

Price Trend-Following Model: Strong Downtrend

Our weekly trend-following model classifies the current market price position as: Strong Downtrend.

| CORN Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 24.3 | 45.3 | 8.4 |

| – Percent of Open Interest Shorts: | 16.8 | 50.1 | 11.0 |

| – Net Position: | 115,899 | -75,297 | -40,602 |

| – Gross Longs: | 376,617 | 701,110 | 129,869 |

| – Gross Shorts: | 260,718 | 776,407 | 170,471 |

| – Long to Short Ratio: | 1.4 to 1 | 0.9 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 51.6 | 49.4 | 59.3 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -11.4 | 9.2 | 22.5 |

SUGAR Futures:

The SUGAR large speculator standing this week resulted in a net position of 22,440 contracts in the data reported through Tuesday. This was a weekly lowering of -16,325 contracts from the previous week which had a total of 38,765 net contracts.

The SUGAR large speculator standing this week resulted in a net position of 22,440 contracts in the data reported through Tuesday. This was a weekly lowering of -16,325 contracts from the previous week which had a total of 38,765 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 17.8 percent. The commercials are Bullish-Extreme with a score of 85.7 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 14.6 percent.

Price Trend-Following Model: Weak Uptrend

Our weekly trend-following model classifies the current market price position as: Weak Uptrend.

| SUGAR Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 24.6 | 53.2 | 7.7 |

| – Percent of Open Interest Shorts: | 21.8 | 55.5 | 8.2 |

| – Net Position: | 22,440 | -18,002 | -4,438 |

| – Gross Longs: | 196,150 | 424,216 | 61,109 |

| – Gross Shorts: | 173,710 | 442,218 | 65,547 |

| – Long to Short Ratio: | 1.1 to 1 | 1.0 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 17.8 | 85.7 | 14.6 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -9.5 | 14.8 | -34.7 |

COFFEE Futures:

The COFFEE large speculator standing this week resulted in a net position of 49,341 contracts in the data reported through Tuesday. This was a weekly increase of 52 contracts from the previous week which had a total of 49,289 net contracts.

The COFFEE large speculator standing this week resulted in a net position of 49,341 contracts in the data reported through Tuesday. This was a weekly increase of 52 contracts from the previous week which had a total of 49,289 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 73.7 percent. The commercials are Bearish with a score of 27.6 percent and the small traders (not shown in chart) are Bullish with a score of 59.2 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend.

| COFFEE Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 38.6 | 36.9 | 5.6 |

| – Percent of Open Interest Shorts: | 6.6 | 70.4 | 4.0 |

| – Net Position: | 49,341 | -51,788 | 2,447 |

| – Gross Longs: | 59,594 | 56,913 | 8,598 |

| – Gross Shorts: | 10,253 | 108,701 | 6,151 |

| – Long to Short Ratio: | 5.8 to 1 | 0.5 to 1 | 1.4 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 73.7 | 27.6 | 59.2 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -8.8 | 9.0 | -5.8 |

SOYBEANS Futures:

The SOYBEANS large speculator standing this week resulted in a net position of 49,385 contracts in the data reported through Tuesday. This was a weekly fall of -10,088 contracts from the previous week which had a total of 59,473 net contracts.

The SOYBEANS large speculator standing this week resulted in a net position of 49,385 contracts in the data reported through Tuesday. This was a weekly fall of -10,088 contracts from the previous week which had a total of 59,473 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 63.2 percent. The commercials are Bearish with a score of 35.7 percent and the small traders (not shown in chart) are Bullish with a score of 64.4 percent.

Price Trend-Following Model: Weak Uptrend

Our weekly trend-following model classifies the current market price position as: Weak Uptrend.

| SOYBEANS Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 22.8 | 50.4 | 5.6 |

| – Percent of Open Interest Shorts: | 16.5 | 54.4 | 8.0 |

| – Net Position: | 49,385 | -30,958 | -18,427 |

| – Gross Longs: | 177,646 | 392,063 | 43,458 |

| – Gross Shorts: | 128,261 | 423,021 | 61,885 |

| – Long to Short Ratio: | 1.4 to 1 | 0.9 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 63.2 | 35.7 | 64.4 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 16.3 | -19.7 | 24.2 |

SOYBEAN OIL Futures:

The SOYBEAN OIL large speculator standing this week resulted in a net position of 66,905 contracts in the data reported through Tuesday. This was a weekly reduction of -3,260 contracts from the previous week which had a total of 70,165 net contracts.

The SOYBEAN OIL large speculator standing this week resulted in a net position of 66,905 contracts in the data reported through Tuesday. This was a weekly reduction of -3,260 contracts from the previous week which had a total of 70,165 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 78.8 percent. The commercials are Bearish with a score of 23.0 percent and the small traders (not shown in chart) are Bearish with a score of 49.4 percent.

Price Trend-Following Model: Strong Uptrend

Our weekly trend-following model classifies the current market price position as: Strong Uptrend.

| SOYBEAN OIL Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 27.0 | 45.5 | 5.9 |

| – Percent of Open Interest Shorts: | 15.4 | 58.7 | 4.4 |

| – Net Position: | 66,905 | -75,639 | 8,734 |

| – Gross Longs: | 155,811 | 262,712 | 33,834 |

| – Gross Shorts: | 88,906 | 338,351 | 25,100 |

| – Long to Short Ratio: | 1.8 to 1 | 0.8 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 78.8 | 23.0 | 49.4 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 49.9 | -51.3 | 41.0 |

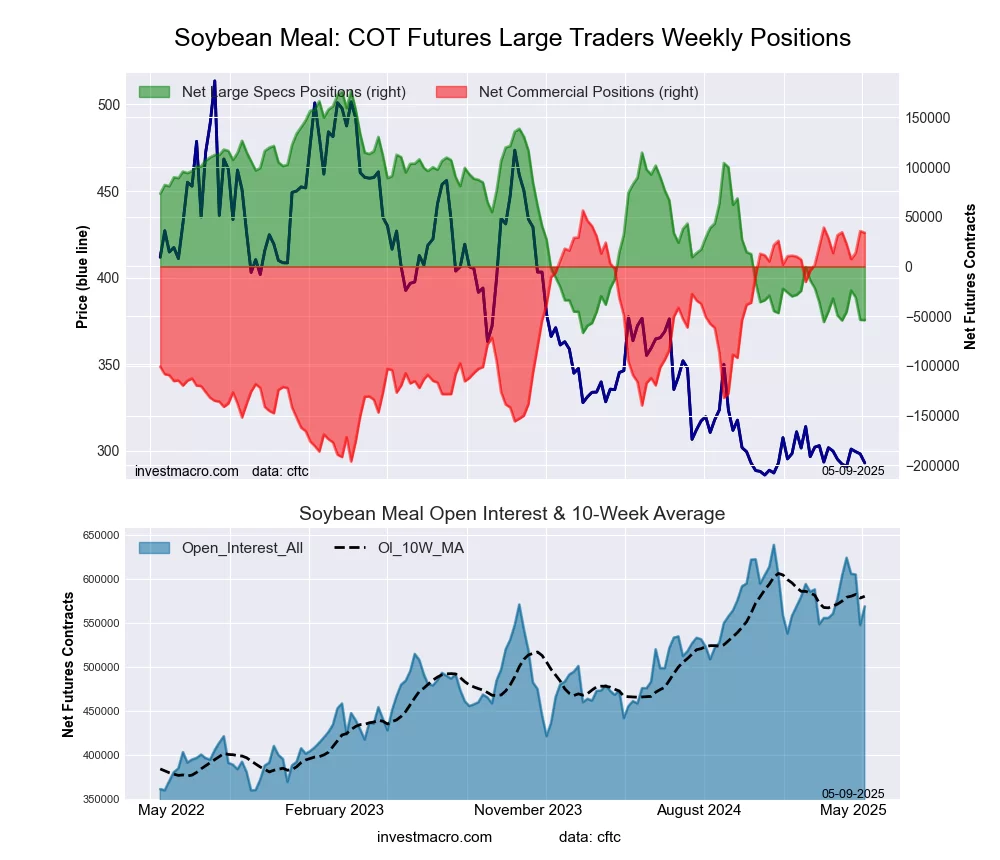

SOYBEAN MEAL Futures:

The SOYBEAN MEAL large speculator standing this week resulted in a net position of -53,955 contracts in the data reported through Tuesday. This was a weekly decline of -221 contracts from the previous week which had a total of -53,734 net contracts.

The SOYBEAN MEAL large speculator standing this week resulted in a net position of -53,955 contracts in the data reported through Tuesday. This was a weekly decline of -221 contracts from the previous week which had a total of -53,734 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 5.3 percent. The commercials are Bullish-Extreme with a score of 91.2 percent and the small traders (not shown in chart) are Bullish with a score of 54.2 percent.

Price Trend-Following Model: Strong Downtrend

Our weekly trend-following model classifies the current market price position as: Strong Downtrend.

| SOYBEAN MEAL Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 21.0 | 50.3 | 8.7 |

| – Percent of Open Interest Shorts: | 30.4 | 44.3 | 5.1 |

| – Net Position: | -53,955 | 33,912 | 20,043 |

| – Gross Longs: | 119,134 | 285,863 | 49,215 |

| – Gross Shorts: | 173,089 | 251,951 | 29,172 |

| – Long to Short Ratio: | 0.7 to 1 | 1.1 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 5.3 | 91.2 | 54.2 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -1.9 | 1.0 | 11.3 |

LIVE CATTLE Futures:

The LIVE CATTLE large speculator standing this week resulted in a net position of 108,631 contracts in the data reported through Tuesday. This was a weekly boost of 5,601 contracts from the previous week which had a total of 103,030 net contracts.

The LIVE CATTLE large speculator standing this week resulted in a net position of 108,631 contracts in the data reported through Tuesday. This was a weekly boost of 5,601 contracts from the previous week which had a total of 103,030 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 85.6 percent. The commercials are Bearish-Extreme with a score of 18.8 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 14.2 percent.

Price Trend-Following Model: Strong Uptrend

Our weekly trend-following model classifies the current market price position as: Strong Uptrend.

| LIVE CATTLE Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 48.5 | 27.5 | 7.3 |

| – Percent of Open Interest Shorts: | 20.1 | 49.7 | 13.5 |

| – Net Position: | 108,631 | -84,943 | -23,688 |

| – Gross Longs: | 185,603 | 105,351 | 27,847 |

| – Gross Shorts: | 76,972 | 190,294 | 51,535 |

| – Long to Short Ratio: | 2.4 to 1 | 0.6 to 1 | 0.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 85.6 | 18.8 | 14.2 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -9.0 | 11.7 | -0.9 |

LEAN HOGS Futures:

The LEAN HOGS large speculator standing this week resulted in a net position of 37,501 contracts in the data reported through Tuesday. This was a weekly boost of 2,644 contracts from the previous week which had a total of 34,857 net contracts.

The LEAN HOGS large speculator standing this week resulted in a net position of 37,501 contracts in the data reported through Tuesday. This was a weekly boost of 2,644 contracts from the previous week which had a total of 34,857 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 56.8 percent. The commercials are Bearish with a score of 40.9 percent and the small traders (not shown in chart) are Bullish with a score of 62.3 percent.

Price Trend-Following Model: Downtrend

Our weekly trend-following model classifies the current market price position as: Downtrend.

| LEAN HOGS Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 37.4 | 35.5 | 7.3 |

| – Percent of Open Interest Shorts: | 23.5 | 48.5 | 8.2 |

| – Net Position: | 37,501 | -34,963 | -2,538 |

| – Gross Longs: | 100,650 | 95,588 | 19,676 |

| – Gross Shorts: | 63,149 | 130,551 | 22,214 |

| – Long to Short Ratio: | 1.6 to 1 | 0.7 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 56.8 | 40.9 | 62.3 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 6.3 | -6.8 | -0.8 |

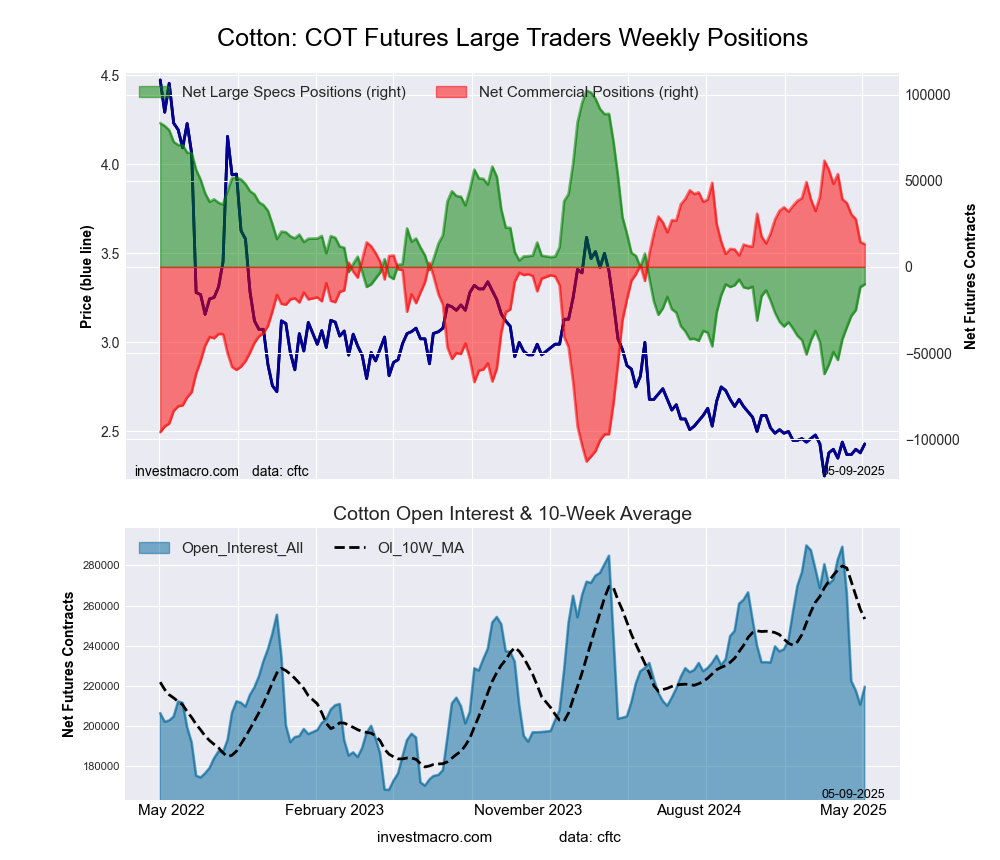

COTTON Futures:

The COTTON large speculator standing this week resulted in a net position of -10,076 contracts in the data reported through Tuesday. This was a weekly advance of 1,662 contracts from the previous week which had a total of -11,738 net contracts.

The COTTON large speculator standing this week resulted in a net position of -10,076 contracts in the data reported through Tuesday. This was a weekly advance of 1,662 contracts from the previous week which had a total of -11,738 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 31.7 percent. The commercials are Bullish with a score of 72.2 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 0.0 percent.

Price Trend-Following Model: Downtrend

Our weekly trend-following model classifies the current market price position as: Downtrend.

| COTTON Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 29.5 | 47.1 | 4.8 |

| – Percent of Open Interest Shorts: | 34.1 | 41.1 | 6.2 |

| – Net Position: | -10,076 | 13,137 | -3,061 |

| – Gross Longs: | 64,851 | 103,419 | 10,468 |

| – Gross Shorts: | 74,927 | 90,282 | 13,529 |

| – Long to Short Ratio: | 0.9 to 1 | 1.1 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 31.7 | 72.2 | 0.0 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 26.7 | -23.3 | -22.4 |

COCOA Futures:

The COCOA large speculator standing this week resulted in a net position of 16,911 contracts in the data reported through Tuesday. This was a weekly fall of -441 contracts from the previous week which had a total of 17,352 net contracts.

The COCOA large speculator standing this week resulted in a net position of 16,911 contracts in the data reported through Tuesday. This was a weekly fall of -441 contracts from the previous week which had a total of 17,352 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 27.2 percent. The commercials are Bullish with a score of 72.3 percent and the small traders (not shown in chart) are Bullish with a score of 62.8 percent.

Price Trend-Following Model: Downtrend

Our weekly trend-following model classifies the current market price position as: Downtrend.

| COCOA Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 29.8 | 40.2 | 10.4 |

| – Percent of Open Interest Shorts: | 11.1 | 63.5 | 5.7 |

| – Net Position: | 16,911 | -21,174 | 4,263 |

| – Gross Longs: | 27,028 | 36,520 | 9,402 |

| – Gross Shorts: | 10,117 | 57,694 | 5,139 |

| – Long to Short Ratio: | 2.7 to 1 | 0.6 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 27.2 | 72.3 | 62.8 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -1.4 | 0.6 | 8.8 |

WHEAT Futures:

The WHEAT large speculator standing this week resulted in a net position of -107,537 contracts in the data reported through Tuesday. This was a weekly increase of 9,271 contracts from the previous week which had a total of -116,808 net contracts.

The WHEAT large speculator standing this week resulted in a net position of -107,537 contracts in the data reported through Tuesday. This was a weekly increase of 9,271 contracts from the previous week which had a total of -116,808 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 6.4 percent. The commercials are Bullish-Extreme with a score of 94.0 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 90.1 percent.

Price Trend-Following Model: Strong Downtrend

Our weekly trend-following model classifies the current market price position as: Strong Downtrend.

| WHEAT Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 26.3 | 38.6 | 8.0 |

| – Percent of Open Interest Shorts: | 49.9 | 16.4 | 6.7 |

| – Net Position: | -107,537 | 101,506 | 6,031 |

| – Gross Longs: | 119,875 | 176,106 | 36,682 |

| – Gross Shorts: | 227,412 | 74,600 | 30,651 |

| – Long to Short Ratio: | 0.5 to 1 | 2.4 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 6.4 | 94.0 | 90.1 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -17.2 | 16.3 | 15.9 |

Article By InvestMacro – Receive our weekly COT Newsletter

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- COT Soft Commodities Charts: Speculator bets led by Wheat & Live Cattle this week May 11, 2025

- COT Stock Market Charts: Speculator Changes led higher by VIX & MSCI EAFE-Mini May 11, 2025

- The US and UK signed a trade agreement. China’s trade balance data pleased investors May 9, 2025

- Oil prices rose to 60 dollars per barrel. PBoC lowered reserve requirement ratios (RRR) by 50 bps May 7, 2025

- Tariff policy uncertainty persists. China’s service sector shows a decline May 6, 2025

- Japanese yen halts gains as US trade negotiations return to the spotlight May 6, 2025

- The US labor market unexpectedly showed resilience. Oil prices fell sharply after the OPEC+ meeting May 5, 2025

- Gold rises as demand for safe-haven assets returns May 5, 2025

- Speculators boost Brazilian Real and Japanese Yen Bets to New Record Highs May 4, 2025

- Speculator Extremes: JPY, BRL, Wheat & 5-Year Bonds lead Bullish & Bearish Positions May 3, 2025