By InvestMacro

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday February 20th and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

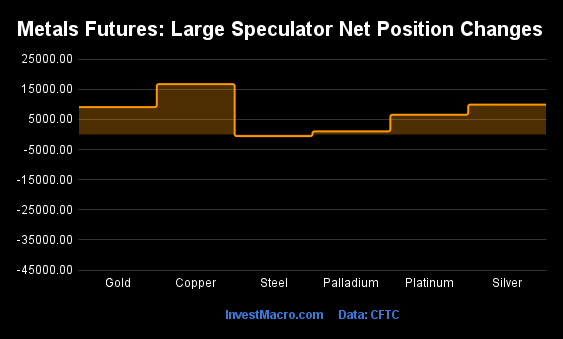

Weekly Speculator Changes led by Copper, Silver & Gold

The COT metals markets speculator bets were higher this week as five out of the six metals markets we cover had higher positioning while only one market had lower speculator contracts.

Leading the gains for the metals was Copper (16,755 contracts) with Silver (9,952 contracts), Gold (9,094 contracts), Platinum (6,557 contracts) and Palladium (1,058 contracts) also recording positive weeks.

The market with a decline in speculator bets for the week was Steel with a total change of -518 contracts on the week.

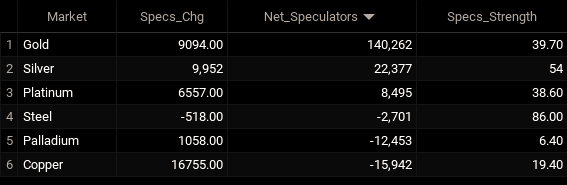

Metals Net Speculators Leaderboard

Legend: Weekly Speculators Change | Speculators Current Net Position | Speculators Strength Score compared to last 3-Years (0-100 range)

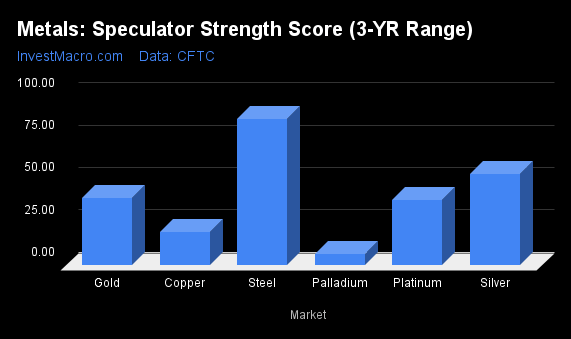

Strength Scores led by Steel & Silver

COT Strength Scores (a normalized measure of Speculator positions over a 3-Year range, from 0 to 100 where above 80 is Extreme-Bullish and below 20 is Extreme-Bearish) showed that Steel (86 percent) and Silver (54 percent) were the leaders for the metals markets this week.

On the downside, Palladium (6 percent) and Copper (19 percent) come in at the lowest strength level currently and are both in Extreme-Bearish territory (below 20 percent).

Strength Statistics:

Gold (39.7 percent) vs Gold previous week (35.6 percent)

Silver (53.6 percent) vs Silver previous week (38.4 percent)

Copper (19.4 percent) vs Copper previous week (3.0 percent)

Platinum (38.6 percent) vs Platinum previous week (22.0 percent)

Palladium (6.4 percent) vs Palladium previous week (0.0 percent)

Steel (86.0 percent) vs Palladium previous week (88.0 percent)

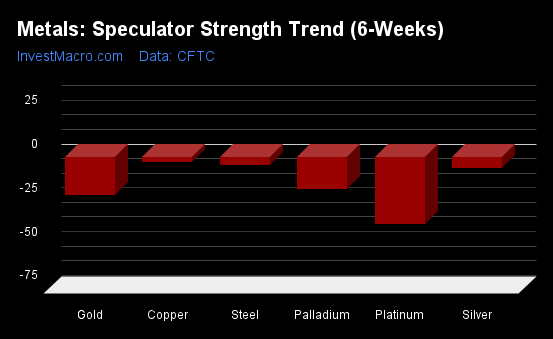

Copper & Steel top the 6-Week Strength Trends

COT Strength Score Trends (or move index, calculates the 6-week changes in strength scores) showed that all the metals markets had negative six-week trends. Copper (-3 percent) and Steel (-5 percent) have the least negative six weeks trends for metals currently.

Platinum (-38 percent) and Gold (-22 percent) lead the downside trend scores this week.

Move Statistics:

Gold (-21.8 percent) vs Gold previous week (-34.4 percent)

Silver (-6.1 percent) vs Silver previous week (-30.7 percent)

Copper (-2.7 percent) vs Copper previous week (-40.6 percent)

Platinum (-38.1 percent) vs Platinum previous week (-68.6 percent)

Palladium (-18.0 percent) vs Palladium previous week (-32.3 percent)

Steel (-4.7 percent) vs Steel previous week (-12.0 percent)

Individual Markets:

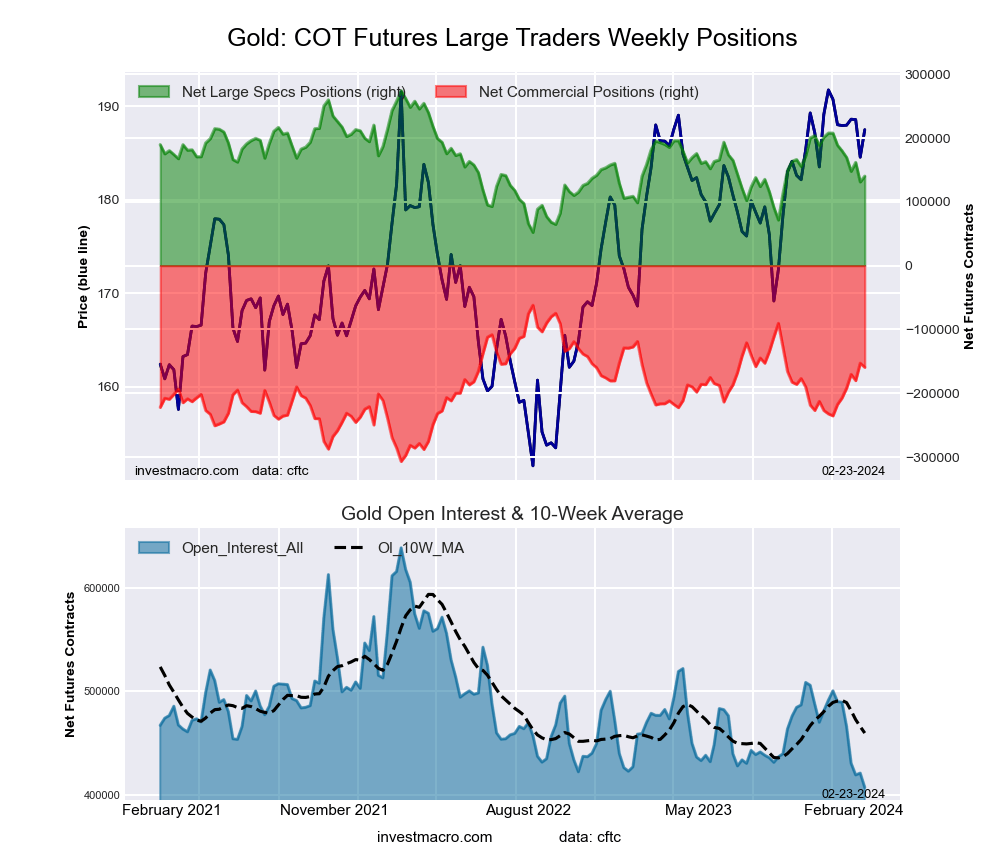

Gold Comex Futures:

The Gold Comex Futures large speculator standing this week reached a net position of 140,262 contracts in the data reported through Tuesday. This was a weekly lift of 9,094 contracts from the previous week which had a total of 131,168 net contracts.

The Gold Comex Futures large speculator standing this week reached a net position of 140,262 contracts in the data reported through Tuesday. This was a weekly lift of 9,094 contracts from the previous week which had a total of 131,168 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 39.7 percent. The commercials are Bullish with a score of 60.3 percent and the small traders (not shown in chart) are Bearish with a score of 35.7 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| Gold Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 51.8 | 26.1 | 10.3 |

| – Percent of Open Interest Shorts: | 17.4 | 65.3 | 5.6 |

| – Net Position: | 140,262 | -159,411 | 19,149 |

| – Gross Longs: | 211,034 | 106,419 | 41,846 |

| – Gross Shorts: | 70,772 | 265,830 | 22,697 |

| – Long to Short Ratio: | 3.0 to 1 | 0.4 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 39.7 | 60.3 | 35.7 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -21.8 | 23.8 | -31.9 |

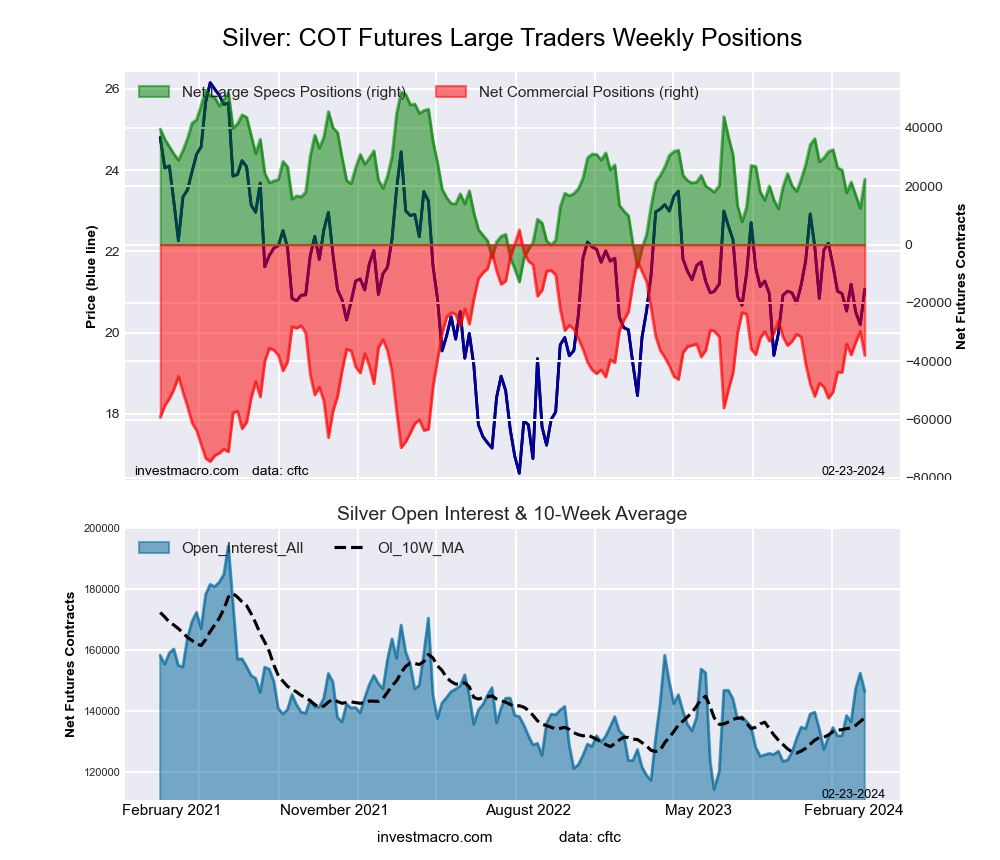

Silver Comex Futures:

The Silver Comex Futures large speculator standing this week reached a net position of 22,377 contracts in the data reported through Tuesday. This was a weekly boost of 9,952 contracts from the previous week which had a total of 12,425 net contracts.

The Silver Comex Futures large speculator standing this week reached a net position of 22,377 contracts in the data reported through Tuesday. This was a weekly boost of 9,952 contracts from the previous week which had a total of 12,425 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 53.6 percent. The commercials are Bearish with a score of 45.9 percent and the small traders (not shown in chart) are Bullish with a score of 53.0 percent.

Price Trend-Following Model: Strong Downtrend

Our weekly trend-following model classifies the current market price position as: Strong Downtrend. The current action for the model is considered to be: New Sell – Short Position.

| Silver Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 39.3 | 31.0 | 20.7 |

| – Percent of Open Interest Shorts: | 24.0 | 56.9 | 10.1 |

| – Net Position: | 22,377 | -37,945 | 15,568 |

| – Gross Longs: | 57,582 | 45,507 | 30,394 |

| – Gross Shorts: | 35,205 | 83,452 | 14,826 |

| – Long to Short Ratio: | 1.6 to 1 | 0.5 to 1 | 2.1 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 53.6 | 45.9 | 53.0 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -6.1 | 7.3 | -10.2 |

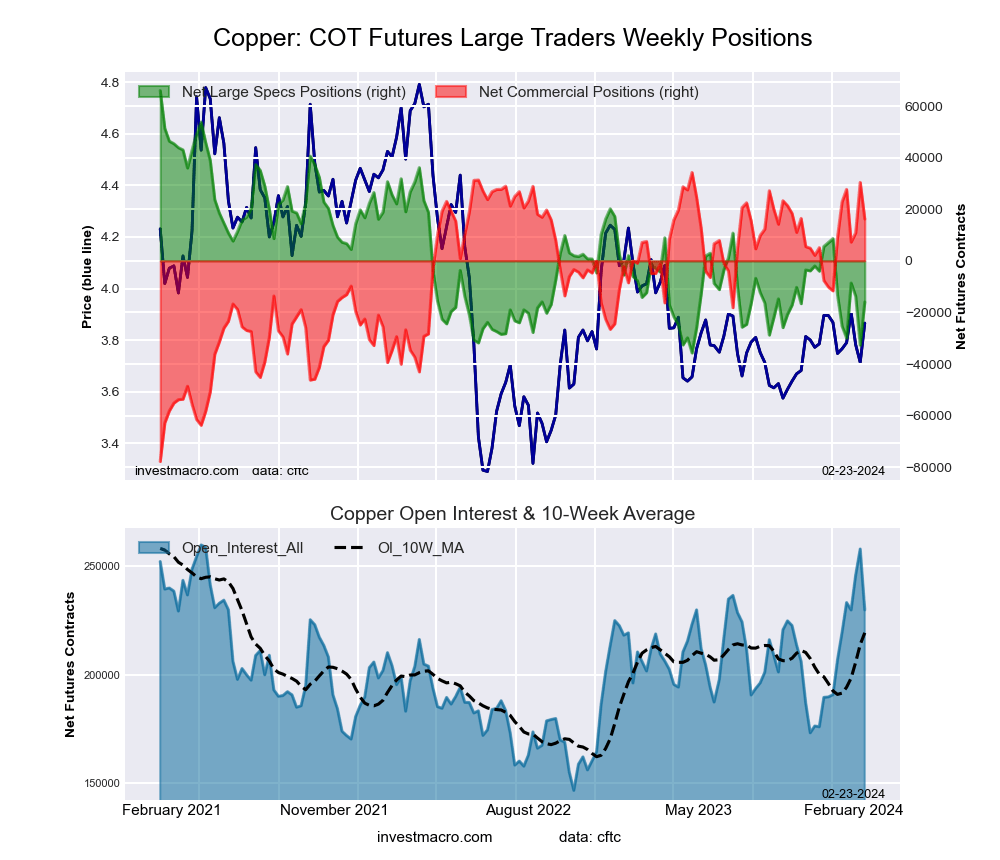

Copper Grade #1 Futures:

The Copper Grade #1 Futures large speculator standing this week reached a net position of -15,942 contracts in the data reported through Tuesday. This was a weekly advance of 16,755 contracts from the previous week which had a total of -32,697 net contracts.

The Copper Grade #1 Futures large speculator standing this week reached a net position of -15,942 contracts in the data reported through Tuesday. This was a weekly advance of 16,755 contracts from the previous week which had a total of -32,697 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 19.4 percent. The commercials are Bullish-Extreme with a score of 83.9 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 16.8 percent.

Price Trend-Following Model: Strong Uptrend

Our weekly trend-following model classifies the current market price position as: Strong Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| Copper Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 34.8 | 39.1 | 7.1 |

| – Percent of Open Interest Shorts: | 41.7 | 32.1 | 7.2 |

| – Net Position: | -15,942 | 16,208 | -266 |

| – Gross Longs: | 79,941 | 89,887 | 16,243 |

| – Gross Shorts: | 95,883 | 73,679 | 16,509 |

| – Long to Short Ratio: | 0.8 to 1 | 1.2 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 19.4 | 83.9 | 16.8 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -2.7 | 6.4 | -27.8 |

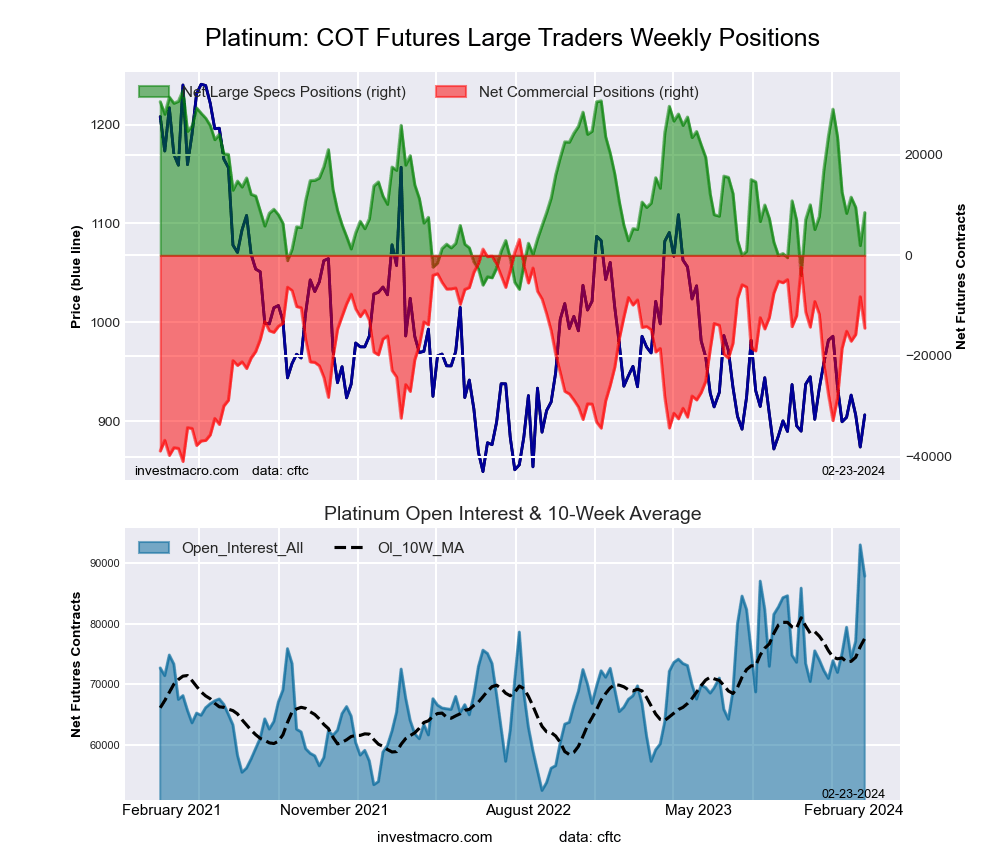

Platinum Futures:

The Platinum Futures large speculator standing this week reached a net position of 8,495 contracts in the data reported through Tuesday. This was a weekly increase of 6,557 contracts from the previous week which had a total of 1,938 net contracts.

The Platinum Futures large speculator standing this week reached a net position of 8,495 contracts in the data reported through Tuesday. This was a weekly increase of 6,557 contracts from the previous week which had a total of 1,938 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 38.6 percent. The commercials are Bullish with a score of 60.1 percent and the small traders (not shown in chart) are Bearish with a score of 48.0 percent.

Price Trend-Following Model: Weak Uptrend

Our weekly trend-following model classifies the current market price position as: Weak Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| Platinum Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 59.8 | 22.3 | 10.5 |

| – Percent of Open Interest Shorts: | 50.1 | 38.8 | 3.7 |

| – Net Position: | 8,495 | -14,471 | 5,976 |

| – Gross Longs: | 52,505 | 19,626 | 9,191 |

| – Gross Shorts: | 44,010 | 34,097 | 3,215 |

| – Long to Short Ratio: | 1.2 to 1 | 0.6 to 1 | 2.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 38.6 | 60.1 | 48.0 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -38.1 | 31.5 | 15.1 |

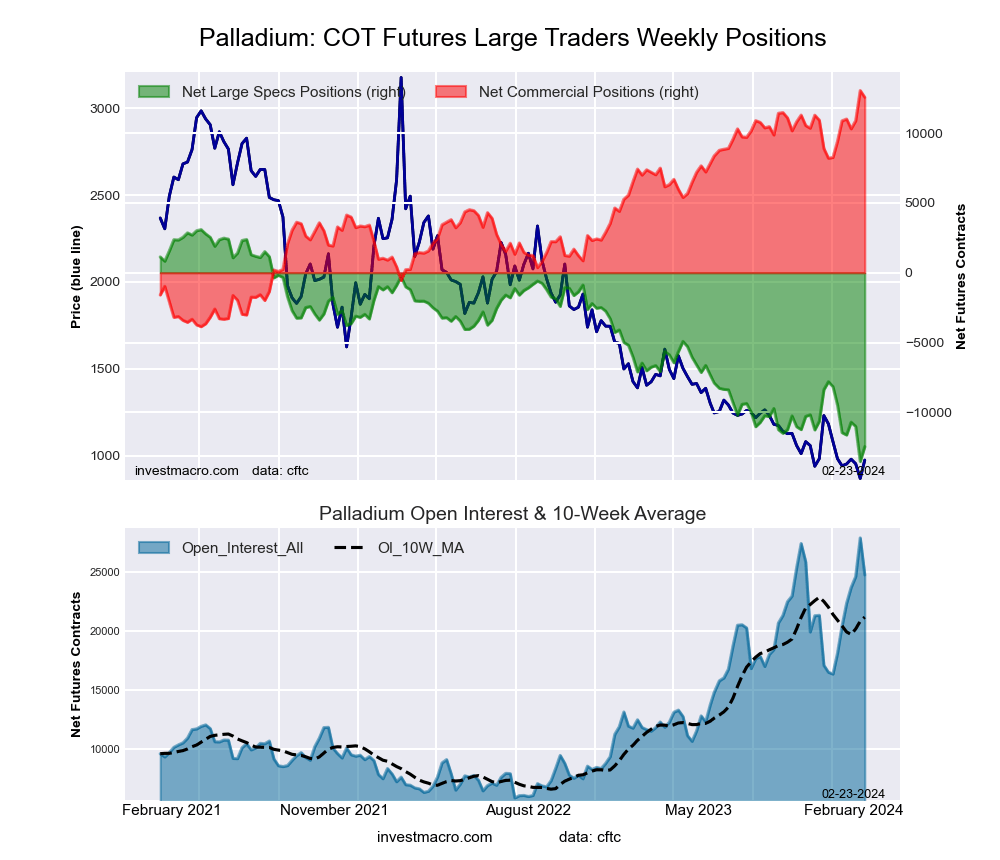

Palladium Futures:

The Palladium Futures large speculator standing this week reached a net position of -12,453 contracts in the data reported through Tuesday. This was a weekly advance of 1,058 contracts from the previous week which had a total of -13,511 net contracts.

The Palladium Futures large speculator standing this week reached a net position of -12,453 contracts in the data reported through Tuesday. This was a weekly advance of 1,058 contracts from the previous week which had a total of -13,511 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 6.4 percent. The commercials are Bullish-Extreme with a score of 97.1 percent and the small traders (not shown in chart) are Bearish with a score of 35.5 percent.

Price Trend-Following Model: Downtrend

Our weekly trend-following model classifies the current market price position as: Downtrend. The current action for the model is considered to be: Hold – Maintain Short Position.

| Palladium Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 18.1 | 56.0 | 7.0 |

| – Percent of Open Interest Shorts: | 68.4 | 5.3 | 7.4 |

| – Net Position: | -12,453 | 12,557 | -104 |

| – Gross Longs: | 4,465 | 13,858 | 1,733 |

| – Gross Shorts: | 16,918 | 1,301 | 1,837 |

| – Long to Short Ratio: | 0.3 to 1 | 10.7 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 6.4 | 97.1 | 35.5 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -18.0 | 18.7 | -10.3 |

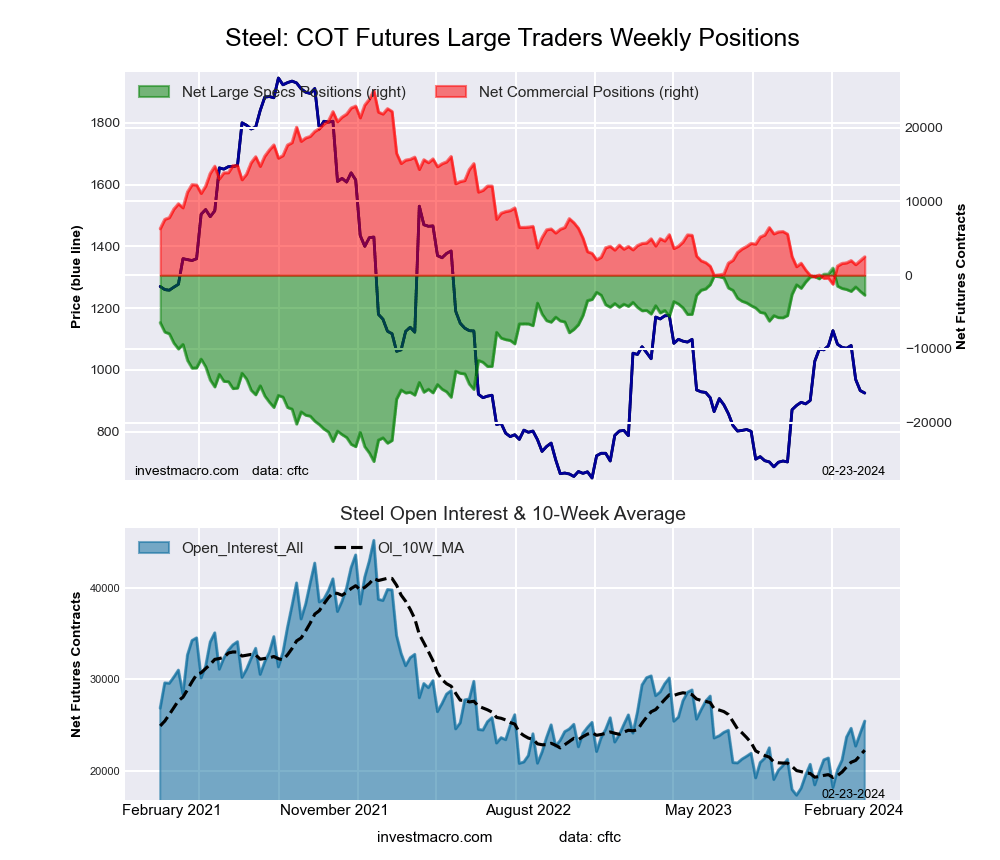

Steel Futures Futures:

The Steel Futures large speculator standing this week reached a net position of -2,701 contracts in the data reported through Tuesday. This was a weekly lowering of -518 contracts from the previous week which had a total of -2,183 net contracts.

The Steel Futures large speculator standing this week reached a net position of -2,701 contracts in the data reported through Tuesday. This was a weekly lowering of -518 contracts from the previous week which had a total of -2,183 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 86.0 percent. The commercials are Bearish-Extreme with a score of 14.1 percent and the small traders (not shown in chart) are Bullish with a score of 54.5 percent.

Price Trend-Following Model: Weak Uptrend

Our weekly trend-following model classifies the current market price position as: Weak Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| Steel Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 12.3 | 81.3 | 1.9 |

| – Percent of Open Interest Shorts: | 22.9 | 71.5 | 1.1 |

| – Net Position: | -2,701 | 2,499 | 202 |

| – Gross Longs: | 3,134 | 20,682 | 471 |

| – Gross Shorts: | 5,835 | 18,183 | 269 |

| – Long to Short Ratio: | 0.5 to 1 | 1.1 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 86.0 | 14.1 | 54.5 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -4.7 | 4.8 | -3.7 |

Article By InvestMacro – Receive our weekly COT Newsletter

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- COT Metals Charts: Speculator Bets led higher by Copper, Silver & Gold Feb 24, 2024

- COT Bonds Charts: Speculator Bets led higher by 5-Year & 2-Year Treasuries Feb 24, 2024

- COT Soft Commodities Charts: Speculator bets led by Lean Hogs & Cotton Feb 24, 2024

- COT Stock Market Charts: Speculator Bets led by VIX & Russell-Mini Feb 24, 2024

- Rising stock indices overshadowed hawkish speeches by US Fed policymakers. Canada is seeing a drop in retail sales Feb 23, 2024

- NVIDIA reported record earnings and issued an encouraging outlook. Traders are no longer reacting to the Fed’s hawkish bias Feb 22, 2024

- Drone Co.s Revenue and Income Forecasts Climb Through 2025 Feb 21, 2024

- Canada is seeing a sharp decline in inflation. SNB continues to increase foreign exchange reserves Feb 21, 2024

- European indices set new price highs. PBoC cut the rate on 5-year loans Feb 20, 2024

- Trade Of The Week: EURUSD waits for directional spark Feb 20, 2024