Sterling, and to a lesser extent, Euro, are propelled slightly higher by hawkish comments from key figures in BoE and ECB. These officials have adopted a stance of patience, preferring to wait for additional economic data before making any decisions on interest rate cuts. Their cautious approach has also lifted benchmark yields in the UK and Eurozone. Swiss Franc is under notable pressure against these two European peers, and the selloff pushes the Franc to the bottom of the currency performance chart of the day.

On another front, Dollar is having a downshift together with Yen, continuing its consolidation phase. Despite this, the selling pressure on Dollar is relatively subdued, indicating that while it faces a pullback, investor confidence in the greenback hasn’t entirely waned. In contrast, New Zealand Dollar shines as the day’s most robust performer, eclipsing Pound with its strength. This development occurs within a broader context of cautious optimism pervading the global stock markets, which also provides a buoyant backdrop for other commodity-linked currencies such as Australian and Canadian Dollars.

Technically, GBP/CHF’s strong today this week suggests that corrective pull back form 1.1058 has completed at 1.0893 already. Immediate focus now turns to 1.1058 resistance. Firm break there will resume whole rise from 1.0634 and target 1.1153 resistance. Decisive break there will be a strong sign of medium term bullish reversal.

Earlier in Asia, Nikkei fell -0.11%. Hong Kong HSI fell -0.34%. China Shanghai SSE rose 1.44%. Singapore Strait Times rose 0.97%. Japan 10-year JGB yield fell -0.0127 to 0.710.

Fed’s Kashkari sees only two or three rate cuts this year

Minneapolis Fed President Neel Kashkari offered a more conservative outlook on policy loosening compared to market expectations. In a conversation with CNBC today, Kashkari indicated his anticipation of only two or three interest rate cuts throughout 2024, a stance that contrasts sharply with the more aggressive predictions circulating in financial markets, where fed fund futures suggest the possibility of up to five quarter-point cuts before year-end.

“Sitting here today, I would say, two or three cuts would seem to be appropriate for me right now,” Kashkari remarked, emphasizing a cautious approach rooted in current economic data.

Kashkari’s comments highlight the central role of inflation data in shaping Fed’s policy decisions. With recent data trends being “resoundingly positive,” the path forward for rate adjustments hinges on continued favorable inflation reports.

“And then the question will simply be, at what pace do we then start to adjust rates back down?” he added.

Moreover, Kashkari introduced the notion of a potentially prolonged environment of elevated interest rates, suggesting that current economic conditions might necessitate higher rates for an extended period. “There are compelling arguments to suggest we could be in a longer, higher rate environment going forward,” he remarked.

BoE’s Breeden highlights coming months as incredibly important to inflation and wage assessment

BoE Deputy Governor Sarah Breeden indicated in a speech growing confidence that further tightening of rates might not be necessary. She noted a pivotal shift in focus towards “how long rates need to remain at their current level.”

Breeden underscored the importance of upcoming pay settlements and corporate responses to rising costs as key determinants of her stance on rate cuts. With pay growth currently running “several percentage points higher than what is consistent with the inflation target were they to persist,” the pathway to aligning underlying inflation with the target hinges on “some combination of a further moderation in labor cost growth and firms’ margins will be needed.”

She noted some encouragement from other economies’ advanced progress in managing inflationary pressures but emphasized the need for “further evidence” before applying similar optimism to the UK’s situation.

The upcoming months are set to play a crucial role in shaping Breeden’s evaluation of wage and price persistence, with a significant portion of the year’s wage negotiations expected to “conclude by April”. This period will be “incredibly important for my assessment,” she remarked, indicating the critical nature of this timeframe in determining the future direction of BoE’s monetary policy.

ECB’s Schnabel: Incoming data signals tough final stretch in inflation battle

ECB Executive Board member Isabel Schnabel highlighted in an FT interview the challenges facing Eurozone as it approaches what she terms the “last mile” in the fight against inflation. Despite rapid disinflation experienced due to the reversal of supply-side shocks, Schnabel emphasizes that the region is now entering a “critical phase”. This phase demands precise calibration and transmission of monetary policy, focusing on curbing “second-round effects” to prevent inflation from becoming entrenched.

“Recent incoming data do not allay my concerns that the last mile may be the most difficult one,” Schnabel remarked, pointing to persistent issues such as “sticky services inflation” and a “resilient labour market” that complicate ECB’s policy decisions.

Additionally, she noted “notable loosening of financial conditions” driven by market anticipation of a central bank pivot, which could undermine efforts to stabilize prices.

Furthermore, Schnabel expressed concern over potential new supply chain disruptions, spurred by recent developments in the Red Sea, adding another layer of complexity to the inflation outlook.

“This cautions against adjusting the policy stance soon,” she stated. “We must be patient and cautious because we know, also from historical experience, that inflation can flare up again.”

NZ employment grows 0.4% in Q4, unemployment rate ticks up to 4%

New Zealand’s employment grew 0.4% qoq in Q4, slightly above expectation of 0.3% qoq. Unemployment rate ticked up from 3.9% to 4.0%, below expectation of 4.3%. Labor force participation rate fell from 72.0% to 71.9%.

Labor cost index for salary and wage rates, inclusive of overtime, recorded a 4.3% yoy increase, maintaining the same annual growth rate observed in the preceding three quarters of the year.

The Quarterly Employment Survey revealed a notable 6.9% yoy increase in average ordinary time hourly earnings, with public sector wages leading the charge.

Public sector hourly earnings surged by 7.4% yoy, marking the largest annual increase since March 2006 quarter, up from previous quarter’s 5.4%. In contrast, private sector had a slight deceleration to 6.6% yoy, down from 7.1% yoy in previous quarter.

EUR/CHF Mid-Day Outlook

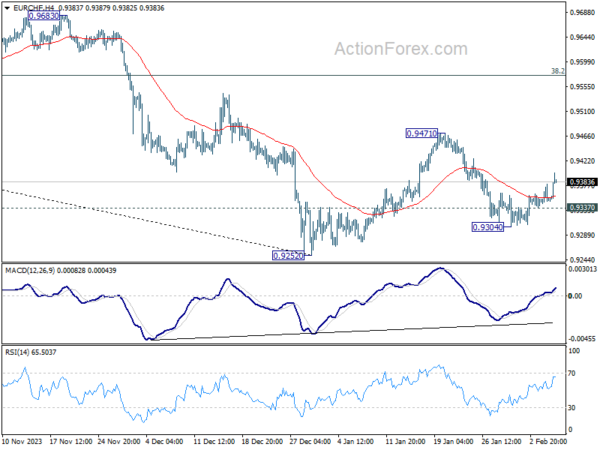

Daily Pivots: (S1) 0.9340; (P) 0.9361; (R1) 0.9375; More…

Intraday bias in EUR/CHF stays mildly on the upside for the moment, as rebound from 0.9304 extends today. As noted before, pullback from 0.9471 could have completed at 0.9304 already. Rise from there would extend to 0.9471 resistance first. On the downside, break of 0.9337 will delay this bullish case, and bring another decline. But still, downside should be contained above 0.9252 low to bring rebound.

In the bigger picture, price actions from 0.9252 are tentatively seen as a correction to the five-wave down trend from 1.0095 (2023 high). Further rise would be seen to 38.2% retracement of 1.0095 to 0.9252 at 0.9574. But overall medium term outlook will remain bearish as long as 0.9683 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Employment Change Q4 | 0.40% | 0.30% | -0.20% | -0.10% |

| 21:45 | NZD | Unemployment Rate Q4 | 4.00% | 4.30% | 3.90% | |

| 21:45 | NZD | Labour Cost Index Q/Q Q4 | 1.00% | 0.80% | 0.80% | |

| 05:00 | JPY | Leading Economic Index Dec P | 110 | 109.5 | 107.6 | |

| 06:45 | CHF | Unemployment Rate M/M Jan | 2.20% | 2.20% | 2.20% | |

| 07:00 | EUR | Germany Industrial Production M/M Dec | -1.60% | -0.20% | -0.70% | |

| 07:45 | EUR | France Trade Balance (EUR) Dec | -6.8B | -6.0B | -5.9B | |

| 08:00 | CHF | Foreign Currency Reserves (CHF) Jan | 662B | 654B | ||

| 09:00 | EUR | Italy Retail Sales M/M Dec | -0.10% | 0.20% | 0.40% | 0.30% |

| 13:30 | USD | Trade Balance (USD) Dec | -62.2B | -62.3B | -63.2B | -61.9B |

| 13:30 | CAD | Trade Balance (CAD) Dec | -0.3B | 1.1B | 1.6B | 1.1B |

| 15:30 | USD | Crude Oil Inventories | 1.7M | 1.2M | ||

| 18:30 | CAD | BoC Summary of Deliberations |