Markets

US Treasury and German yields both ended a fairly quiet trading day a few basis points lower. Fed’s Waller in a second speech yesterday said that he’d consider a rate cut at the end of the year (December) if the data warranted it. He added that policy was restrictive enough though, echoing comments made just a few hours earlier. ECB’s Lagarde in an interview aired yesterday sounded very confident of inflation returning to target. She stopped short of officially declaring price pressures under control. That’s raising some eyebrows since her outspoken optimism comes just two days ahead of critical data. The Q1 wage growth numbers won’t derail a June cut but it does offer a reason for cautiousness until the actual outcome is known. Currency markets saw the two majors keeping each other pretty much in balance. EUR/USD hovered within a tight sideways trading range, eventually closing marginally lower at 1.0854. DXY’s bottoming out process continued, advancing to 104.66. Sterling continues to trade (very) strong, both against USD (cable back > 1.27) and EUR. EUR/GBP lost for a fifth consecutive day to 0.854. Bank of England governor Bailey unveiled some of the central bank’s future modus operandi. It intends to replace the system of QE with repo operations to provide the financial system with liquidity. Doing so removes the interest rate risk which today is saddling up the central bank (and thus the UK government) with massive losses as it sheds low-coupon bonds in a higher interest rate environment. The switch may start in the second half of next year.

Sterling is soaring once again in the wake of consensus-beating CPI numbers that are nothing but a setback to the BoE eying a June cut amid hopes for a quick return to 2%. Headline (2.3% from 3.2%), core (3.9% from 4.2%) or services (5.9%, barely down from 6%) all topped estimates and push EUR/GBP to the lowest level since mid-March (0.8516). In the FOMC May meeting minutes markets will be looking for some more context to a hawkish statement change saying that “In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective” combined with Powell ruling out a rate hike and the decision to taper QT (US Treasuries from a $60bn monthly pace to $25bn). The (market) debate about the (increased or not) level of the neutral rate is a lively one and probably again filtered through in the Fed discussions as well. We stick to the idea of core bond yields having found a bottom end of last week. Sideways consolidation is possible for the time being. EUR/USD shows no clear directional signs.

News & Views

The Reserve Bank of New Zealand kept its policy rate (OCR) stable at 5.5%, but updated projections provided a hawkish twist. Forecasts continue to err to an additional (final) rate hike as a next move with rate cuts now only expected to start by end 2025 rather than by mid-2025. That’s a huge contrast with NZ money markets banking on a November rate cut. The RBNZ sees the OCR-rate at 3.75% instead of 3.5% by end 2026. In its policy statement, the RBNZ refers to slowly receding global services inflation and the delay in (Fed) rate cuts. Domestically, higher dwelling rents, insurance costs, council rates and other domestic service price inflation are interfering with the disinflationary impact of weaker capacity pressures and an easing labour market. Compared to February, the RBNZ upwardly revised its inflation forecast with annual inflation now expected to enter the 1%-3% target range in Q4 2024 instead of Q3 and reaching the mid-point by mid-2026 instead of end 2025. Therefore, monetary policy needs to remain restrictive to ensure inflation returns to target within a reasonable timeframe. NZD swap rate rise by 4.5 bps (30-yr) to 9 bps (2-yr) this morning. NZD/USD spiked from 0.6090 to 0.6150 before settling around 0.6120.

The Chinese Chamber of Commerce to the EU warned that the chief expert at the Chinese Automotive Technology & Research Center called for a temporary increase of the tariff rate on imported cars with engines larger than 2.5 liters to 25%. China imported 250k such cars last year, accounting for around 1/3rd of all vehicle imports. The comments come after the US announced 100% tariffs on electric cars with Europe contemplating similar action by June 5. China last week also hinted at retaliatory levies on European wine and dairy products.

Graphs

GE 10y yield

ECB President Lagarde clearly hinted at a summer (June) rate cut which has broad backing. EMU disinflation continued in April and brought headline CPI closer to the 2% target. Together with weak growth momentum, this gives backing to deliver a first 25 bps rate cut. A more bumpy inflation path in H2 2024 and the Fed’s higher for longer strategy make follow-up moves difficult. Markets have come to terms with that.

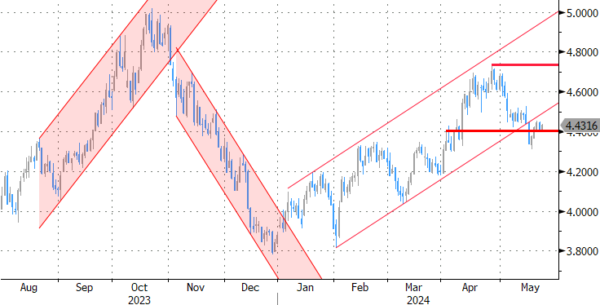

US 10y yield

The Fed in May acknowledged the lack of progress towards the 2% inflation objective, but Fed’s Powell left the door open for rate cuts later this year. Soft US ISM’s and weaker than expected payrolls supported markets’ hope on a first cut post summer, triggering a correction off YTD peak levels. Sticky inflation suggests any rate cut will be a tough balancing act. 4.37% (38% retracement Dec/April) already might prove strong support for the US 10-y yield.

EUR/USD

Economic divergence, a likely desynchronized rate cut cycle with the ECB exceptionally taking the lead and higher than expected US CPI data pushed EUR/USD to the 1.06 area. From there, better EMU data gave the euro some breathing space. The dollar lost further momentum on softer than expected early May US data. Some further consolidation in the 1.07/1.09 are might be on the cards short-term.

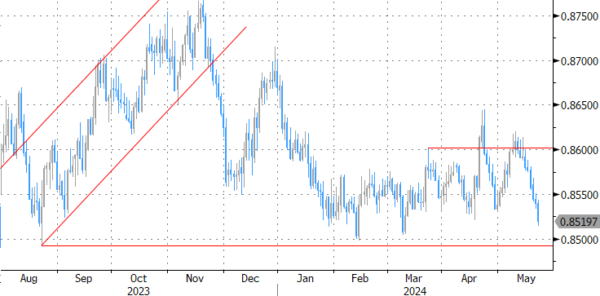

EUR/GBP

Debate at the Bank of England is focused at the timing of rate cuts. Most BoE members align with the ECB rather than with Fed view but slower than expected April disinflation complicated matters. A June cut looks in line with the ECB looks improbable. Sterling extends a recent bull rally. A test of EUR/GBP’s 2024 YtD low (0.8489) is possible. We expect this important support level to hold.