British Pound held steady following release of UK data showing decrease in both headline and core consumer inflation for May. This development is unlikely to influence BoE decision tomorrow, where a rate hold is widely anticipated. Although BoE is expected to begin cutting interest rates soon, this plan has been delayed due to the unexpected call for general elections on July 4. Market consensus now points to August as the likely time for the start of monetary policy easing. Traders will be looking for clues from tomorrow’s statement and possibly the voting results to solidify this expectation.

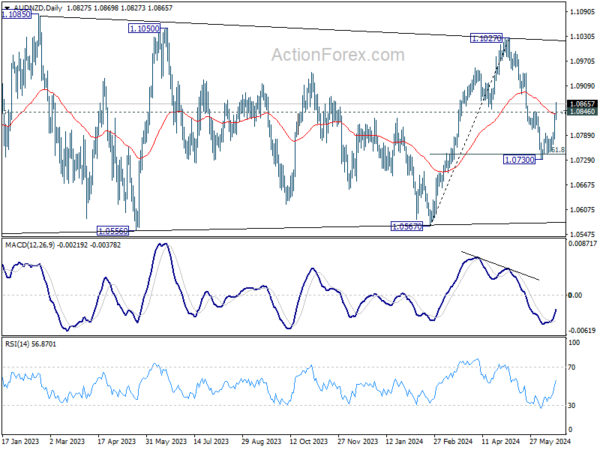

Meanwhile, Australian Dollar is currently the strongest currency, buoyed by RBA recent communications. RBA has expressed uncertainty about the disinflation process staying on track and voiced concerns over persistent price pressures. This has led the market to speculate on the possibility of another rate hike, even though this is not the baseline expectation among most economists. The situation, however, could change significantly with the Q2 CPI data due in July, which will clarify the outlook for RBA’s decision in August.

In the broader currency market, Japanese Yen is the weakest performer this week, followed by New Zealand Dollar and US Dollar. Australian Dollar has overtaken Swiss Franc as the strongest, with Euro in third place. British Pound and Canadian Dollar are trading in the middle of the pack.

Technically, AUD/NZD’ strong break of 1.0846 resistance as well as 55 D EMA suggest that correction from 1.1027 has completed at 1.0730, after drawing support from 61.8% retracement of 1.0567 to 1.1027. At this point, it’s still a bit early to determine is the cross is ready to resume the rise from 1.0567 through 1.1027. That would very much depends on the next move of RBA.

In Asia, Nikkei rose 0.10%. Hong Kong HSI is up 2.71%. China Shanghai SSE is down -0.14%. Singapore Strait Times is up 0.42%. Japan 10-year JGB yield fell -0.0081 to 0.939. Overnight, DOW rose 0.15%. S&P 500 rose 0.25%. NASDAQ rose 0.03%. 10-year yield fell -0.062 to 4.217.

UK CPI slows to 2.0% in May, core CPI down to 3.5%

UK CPI slowed from 2.3% yoy to 2.0% yoy in May, lowest since July 2021. Core CPI (excluding energy, food, alcohol and tobacco) slowed from 3.9% yoy to 3.5% yoy. Both matched expectations.

CPI goods annual rate fell from – 0.8% yoy to -1.3% yoy, while CPI services annual rate eased slightly from 5.9% yoy to 5.7% yoy.

On a monthly basis, CPI rose by 0.3%, below expectation of 0.4% mom.

BoJ Minutes highlight concerns over weak Yen’s impact on inflation

Minutes from BoJ’s April 25-26 meeting revealed that board members are closely monitoring the ongoing risks posed by the weak Yen and its effect on inflation, which could force a monetary policy response.

“Some members” emphasized that exchange rates are crucial factors influencing economic activity and prices, suggesting that “monetary policy responses would be necessary” if there were significant changes in the economic outlook or associated risks.

One of these board members noted the “trilemma of international finance,” arguing that monetary policy should not be used solely to stabilize foreign exchange rates. However, they acknowledged that if exchange rate movements impacted firms’ medium- to long-term inflation expectations and corporate behavior, this could “raise the risk of prices being affected,” making monetary policy adjustments “necessary.”

The minutes also reflected a shared understanding among members that if underlying inflation increases in line with forecasts, BoJ would adjust its degree of monetary accommodation. Additionally, any changes in the outlook for economic activity and prices, or shifts in related risks, would warrant adjustments to the policy interest rate.

RBNZ’s Conway: Inflation sticky near-term, could fall more quickly medium term

In a speech today, RBNZ Chief Economist Paul Conway discussed the complexities of bringing inflation sustainably back to target, noting “remaining challenges” and various risks and uncertainties.

Conway pointed out that in the “near term”, inflation might be “more persistent” than current projections suggest. He highlighted that domestic or non-tradables inflation and services sector inflation have remained higher than expected, indicating a “sticky” inflationary environment.

Conversely, Conway also sees potential for inflation to “fall more quickly” than anticipated over the “medium term”. Factors such as increasing spare capacity in product and labor markets and shifting business and household inflation expectations could accelerate the decline in inflation.

He explained that RBNZ’s current policy strategy is “balancing these opposing factors.” The bank will closely monitor indicators of core inflation, non-tradables inflation, services inflation, and inflation expectations to assess how these risks unfold. The labor market will also be a critical signal of capacity pressure.

Fed’s Kugler encouraged by renewed progress on inflation

In a speech, Fed Governor Adriana Kugler acknowledged that while inflation remains too high, she is “encouraged” by the overall progress and outlook. Kugler expressed “cautious optimism” based on recent economic and inflation data, suggesting that Fed is on track towards its 2% inflation target.

She noted that progress may have stalled in the first quarter of the year, but subsequent information on economic activity, the labor market, and inflation indicates “renewed progress.”

Kugler indicated that, “If the economy evolves as I am expecting, it will likely become appropriate to begin easing policy sometime later this year.”

Fed’s Musalem calls for sustained favorable conditions before rate cuts

In his debut speech, St. Louis Federal Reserve President Alberto Musalem emphasized the need for sustained favorable conditions before considering a reduction in interest rate. He stated that he needs to see a period of favorable inflation, moderating demand, and expanding supply, which could take “months, and more likely quarters” to materialize.

He also did not rule out additional rate hikes if inflation remains significantly above 2% or if it reaccelerates, although he noted this was not his base case scenario.

Musalem also expressed uncertainty about whether the current monetary policy stance is sufficiently restrictive, pointing out that financial conditions “feel accommodative for some parts of the economy while restrictive for others.”

Fed’s Logan: Neutral rate may be higher post-pandemic, inflation risks persist

In a moderated Q&A session overnight, Dallas Fed President Lorie Logan stated, “From a monetary policy perspective, we’re in a good position, we’re in a flexible position to watch the data and be patient.” She highlighted the need for “several months” of favorable data to gain confidence that inflation is on track to the 2% target.

Despite signs that the economy is balancing better, Logan expressed concerns about persistent upside risks to inflation. She also suggested that the neutral rate setting may now be higher than pre-pandemic levels.

“We’ve just been surprised by how well the economy has performed at these higher levels of rates,” she noted. Logan attributed this to structural changes in the economy, implying that the neutral rate might be higher than it was in the decade before the pandemic.

Fed’s Collins warns against overreacting to short-term inflation data

In a speech, Boston Fed President Susan Collins cautioned against overreacting to “a month or two” of improvements in inflation data. She emphasized, “It is too soon to determine whether inflation is durably on a path back to the 2% target.” Collins urged patience in the approach to monetary policy, reflecting the need for a cautious stance.

“In my view, the data suggest an economy with demand and supply coming into better balance, as required to restore price stability,” Collins said. “However, this process may just take more time than previously thought.”

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2678; (P) 1.2700; (R1) 1.2730; More…

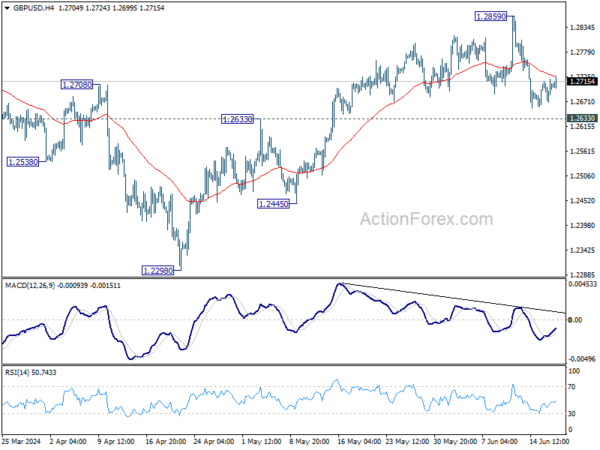

GBP/USD is staying in consolidations in tight range and intraday bias remains neutral. Risk will stay on the downside as long as 1.2859 resistance holds. Firm break of 1.2633 resistance turned support will argue that whole rise from 1.2298 has completed, and target 1.2445 and below.

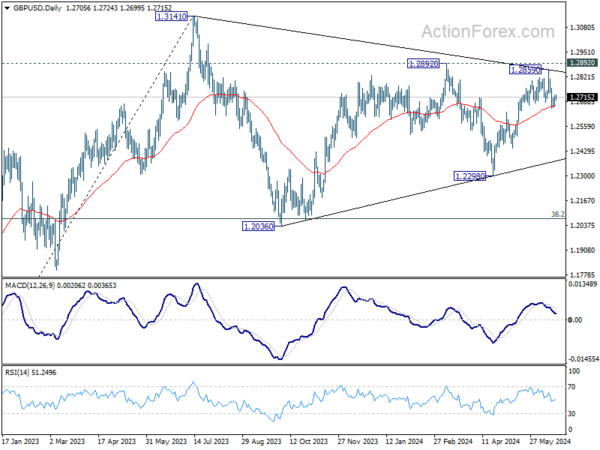

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern. Fall from 1.2892 is seen as the third leg which might have completed already. Break of 1.2892 resistance will argue that larger up trend from 1.0351(2022 low) is ready to resume through 1.3141. Meanwhile, break of 1.2445 support will extend the corrective pattern with another decline instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Current Account (NZD) Q1 | -4.36B | -4.65B | -7.84B | -7.98B |

| 23:50 | JPY | Trade Balance (JPY) May | -0.62T | -0.63T | -0.56T | |

| 23:50 | JPY | BoJ Minutes | ||||

| 06:00 | GBP | CPI M/M May | 0.30% | 0.40% | 0.30% | |

| 06:00 | GBP | CPI Y/Y May | 2.00% | 2.00% | 2.30% | |

| 06:00 | GBP | Core CPI Y/Y May | 3.50% | 3.50% | 3.90% | |

| 06:00 | GBP | RPI M/M May | 0.40% | 0.50% | 0.50% | |

| 06:00 | GBP | RPI Y/Y May | 3.00% | 3.10% | 3.30% | |

| 06:00 | GBP | PPI Input M/M May | 0% | -0.20% | 0.60% | 0.80% |

| 06:00 | GBP | PPI Input Y/Y May | -0.10% | -1.60% | -1.40% | |

| 06:00 | GBP | PPI Output M/M May | -0.10% | 0.10% | 0.20% | 0.30% |

| 06:00 | GBP | PPI Output Y/Y May | 1.70% | 1.10% | ||

| 06:00 | GBP | PPI Core Output M/M May | 0.20% | 0.00% | 0.20% | |

| 06:00 | GBP | PPI Core Output Y/Y May | 1.00% | 0.20% | 0.30% | |

| 08:00 | EUR | Eurozone Current Account (EUR) Apr | 35.2B | 35.8B | ||

| 14:00 | USD | NAHB Housing Index Jun | 46 | 45 | ||

| 17:30 | CAD | BoC Summary of Deliberations |