Sterling surged broadly today, driven by stronger-than-expected PMI data indicating that the UK economy is on track for reasonably solid growth in the third quarter. This positive economic outlook comes at a time when inflationary pressures are easing, which would typically open the door for further rate cuts by BoE. However, the robust performance of the economy provides BoE with the flexibility to take a more measured approach before implementing additional cuts.

A recent Reuters poll highlights this sentiment, with 57 out of 60 economists predicting that BoE will hold rates steady at its next meeting on September 19. Additionally, 65% of those surveyed expect just one more rate cut this year. November is indeed an ideal timing when BoE will have new economic forecasts in hand.

On the continent, the Euro faced some pressure following mixed PMI data. While the headline figure appeared strong, much of the gain was attributed to France’s services sector, which has been temporarily boosted by the Olympic Games. In contrast, the underlying details revealed weaknesses, particularly in Germany, where the risk of a return to recession is growing.

For the week, Dollar remains the worst performer, followed by a distant by Canadian Dollar and Australian Dollar. On the other hand, Swiss Franc leads the pack, closely followed by Kiwi and Sterling. Euro and Yen are positioned in the middle.

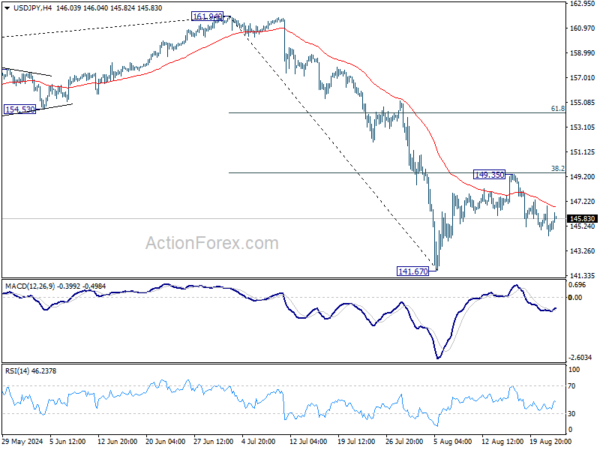

As we look to Asian session, Yen will be closely watched, with Japan set to release its July CPI data. Additionally, BoJ Governor Kazuo Ueda will face a grilling in an unusual parliamentary session, where he will need to explain the recent hawkish rate hike that led to the recent turmoil in Japan’s financial markets.

Technically, USD/JPY’s pullback from 149.35 has so far been corrective looking and lacks decisive momentum as seen in 4H MACD. That in turn argues that rise from 141.67 might not be over year. Firm break of 149.35 will extend the rebound to 61.8% retracement of 161.94 to 141.67 at 154.19.

In Europe, at the time of writing, FTSE is flat. DAX is up 0.26%. CAC is up 0.19%. UK 10-year yield is up 0.034 at 3.928. Germany 10-year yield is up 0.028 at 2.222. Earlier in Asia, Nikkei rose 0.68%. Hong Kong HSI rose 1.44%. China Shanghai SSE fell -0.27%. Singapore Strait Times fell -0.01%. Japan 10-year JGB yield rose 0.0132 to 0.880.

US initial jobless claims falls rises to 232k

US initial jobless claims rose 4k to 232k in the week ending August 17, matched expectations. Four-week moving average of initial claims fell -750 to 236k.

Continuing claims rose 4k to 1863k in the week ending August 10, highest since November 27, 2021. Four-week moving average of continuing claims rose 5k to 1878k, highest since November 21, 2021.

Fed’s Schmid needs to see a bit more data before acting on rate cut

In a Bloomberg TV interview recorded on Wednesday and aired Thursday, Kansas City Fed Bank President Jeff Schmid emphasized the importance of waiting for additional economic data before making any decisions on rate cuts.

“It makes sense for me to really look at some of the data that comes in the next few weeks,” Schmid stated.“ Before we act — at least before I act, or recommend acting — I think we need to see a little bit more.”

Schmid also downplayed concerns arising from a recent Bureau of Labor Statistics report that suggested payroll growth over the past year may have been overstated by 818k jobs.

Despite the significance of the number, Schmid remarked, “While it’s a big number, it doesn’t really change the path of the way I think of things when I think about monetary policy.”

ECB minutes highlight September as ideal time for policy re-evaluation

ECB’s July meeting accounts revealed that the upcoming September meeting is “widely seen as a good time to re-evaluate the level of monetary policy restriction,” with members emphasizing the importance of approaching that meeting with an “open mind.”

The data-dependent approach was reiterated, but with a clear message that this does not mean overemphasizing specific, single data points. Instead, the policy decisions should be guided by established elements of the reaction function.

As inflation is coming down “only gradually,” the Governing Council opted for a cautious stance during the July meeting, supporting a pause in rate cuts. This cautious approach was deemed necessary due to the “prevailing uncertainties” surrounding key economic factors such as wages, profits, productivity, and services inflation. These elements require further monitoring and assessment as new data becomes available to gain greater confidence in the inflation outlook.

By the September meeting, ECB will have access to extensive new data, including July and August inflation figures, second-quarter national account information covering compensation per employee, profits, and productivity, as well as updated monetary data and a new set of staff projections.

Eurozone PMI composite rises to 51.2, easing cost pressures strengthens case for ECB Sep cut

Eurozone PMI Manufacturing fell slightly from 45.8 to 45.6 in August, an 8-month low and below expectations of 46.1. In contrast, PMI Services showed a strong performance, rising from 51.9 to 53.3, surpassing the expected 52.2. This divergence led to a modest increase in PMI Composite, which climbed from 50.2 to 51.2, signaling faster expansion.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, offered a cautious interpretation of the data, noting that the underlying fundamentals might be “shakier than they appear.” He highlighted that the boost in PMI Composite is largely driven by a surge in services activity in France, likely linked to the Olympic Games in Paris. However, de la Rubia expressed doubt that this momentum will persist in the coming months. Meanwhile, Germany’s services sector showed a slowdown in growth, and Eurozone’s manufacturing sector “remains in rapid decline.”

On the inflation front, de la Rubia pointed out that input costs in the services sector, a key focus for ECB, rose at the slowest pace in 40 months. This easing of cost pressures, despite the faster climb in output prices compared to July, strengthens the case for an interest rate cut at ECB’s upcoming September meeting.

Germany’s PMI Manufacturing dropped from 43.2 to 42.1, falling short of the expected 43.5. PMI Services also declined, falling from 52.5 to 51.4, below the expected 52.4. PMI Composite fell from 49.1 to 48.5. Anticipated recovery in the second half of the year is “failing to take shape,” and the likelihood of Germany experiencing a second consecutive quarter of negative growth has increased. This raises the possibility of a renewed recession in Germany.

France’s PMI Manufacturing fell from 44.0 to 42.1, marking an 8-month low and falling short of the expected 44.6. On the other hand, PMI Services surged from 50.1 to 55.0, significantly exceeding expectations of 50.5 and reaching a 27-month high. This strong performance in the services sector led to a rise PMI Composite from 49.1 to 52.7. However, the strong performance in August could be an “outlier”, influenced by the Olympic Games.

UK PMI data shows robust growth, easing inflation opens door for BoE rate cuts

UK’s PMI data for August showed positive momentum across both the manufacturing and services sectors. PMI Manufacturing edged up from 52.1 to 52.5, surpassing expectations of 52.2 and marking a 26-month high. PMI Services also rose from 52.5 to 53.3, above the expected 52.8. This led to PMI Composite increase from 52.8 to 53.4.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, highlighted the significance of these figures, noting that “August is witnessing a welcome combination of stronger economic growth, improved job creation, and lower inflation.” He emphasized that both manufacturing and service sectors are showing solid output growth and increased job gains, with business confidence remaining historically high.

However, Williamson tempered expectations by pointing out that while GDP growth is likely to slow in Q3 compared to the impressive gains seen earlier in the year, the PMI data still indicates the economy is expanding at a “reasonably solid quarterly rate of around 0.3%.”

On the inflation front, pressures have continued to moderate, particularly in the service sector, which has been a key area of concern for BoE. Williamson suggested that the latest survey data could “lower the bar for further interest rate cuts,” though he cautioned that the still-elevated nature of service sector inflation means that policymakers are likely to proceed with caution.

Japan’s PMI composite rises to 53.0, increasing margin pressures

Japan’s PMI data for August revealed a mixed yet overall positive picture for the economy. PMI Manufacturing inched up from 49.1 to 49.5, still indicating contraction but showing improvement. PMI Services increased from 53.7 to 54.0, signaling continued strong expansion in the service sector. As a result, PMI Composite, which combines both manufacturing and services, rose from 52.5 to 53.0, reflecting sustained overall growth.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence, noted that the solid expansion of business activity at Japanese private sector firms continued into Q3. She highlighted that growth was largely driven by an acceleration in services activity, while manufacturing output returned to positive growth after a brief decline in July.

Pan pointed out that “overall optimism levels remained above average,” suggesting that firms are confident about growth in the months ahead. However, she also warned of rising “margin pressures” across both manufacturing and service sectors. This concern arises as overall selling price inflation dropped to its lowest level since November 2023, even though average input costs rose at the fastest pace in 16 months.

Australia’s PMI composite rises to 51.4, inflation risks remain

Australia’s PMI data for August revealed a slight uptick in economic activity, with Manufacturing PMI rising from 47.5 to 48.7, Services PMI increasing from 50.4 to 52.2, and Composite PMI climbing from 49.9 to 51.4.

Warren Hogan, Chief Economic Advisor at Judo Bank, noted “improvement in activity indicators,” coupled with “further upward pressure on business costs,” and “weakening in final prices.” Hogan emphasized that the Australian economy continues to expand in the third quarter, with rising demand for labor being a positive sign.

Meanwhile, the final prices index dipped, indicating that Australian businesses are struggling to pass on higher costs to consumers. Hogan warned that if this trend continues, it could signal some easing of inflation pressures, but at the expense of business margins and profitability.

Hogan also expressed caution regarding the outlook for inflation, pointing out that the ongoing rise in business costs and improving economic activity—likely boosted by the tax cuts implemented in July—underscore the continued inflation risks in the economy.

He questioned the financial markets’ certainty in pricing the next move in RBA’s cash rate as a cut, stating, “There is nothing in these results that allows us to reduce the probability that the RBA may still have to raise the cash rate further before a concerted easing cycle can begin.”

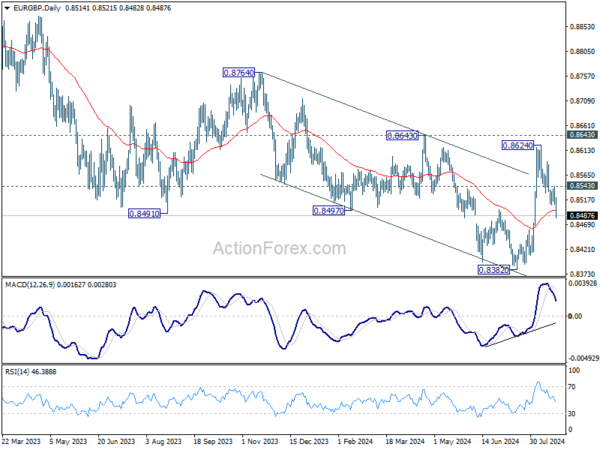

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8502; (P) 0.8524; (R1) 0.8538; More….

EUR/GBP’s fall from 0.8624 resumed by breaking through 0.8507 temporary low as well as 55 D EMA (now at 0.8498. Intraday bias is back on the downs for 61.8% retracement of 0.8382 to 0.8624 at 0.8474. Firm break there will argue that recent down trend is ready to resume through 0.8382 low. For now, risk will stay on the downside as long as 0.8543 minor resistance holds, in case of recovery.

In the bigger picture, while the rebound from 0.8382 is strong, there is no confirmation of trend reversal yet. As long as 0.8643 resistance holds, down trend from 0.9267 could still resume through 0.8382 at a later stage. However, firm break of 0.8643 will indicate that such down trend has completed, and turn outlook bullish for 0.8764 resistance next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Aug P | 48.7 | 47.5 | ||

| 23:00 | AUD | Services PMI Aug P | 52.2 | 50.4 | ||

| 0:30 | JPY | Manufacturing PMI Aug P | 49.5 | 49.8 | 49.1 | |

| 0:30 | JPY | Services PMI Aug P | 54 | 53.7 | ||

| 7:15 | EUR | France Manufacturing PMI Aug P | 42.1 | 44.6 | 44 | |

| 7:15 | EUR | France Services PMI Aug P | 55 | 50.5 | 50.1 | |

| 7:30 | EUR | Germany Manufacturing PMI Aug P | 42.1 | 43.5 | 43.2 | |

| 7:30 | EUR | Germany Services PMI Aug P | 51.4 | 52.4 | 52.5 | |

| 8:00 | EUR | Eurozone Manufacturing PMI Aug P | 45.6 | 46.1 | 45.8 | |

| 8:00 | EUR | Eurozone Services PMI Aug P | 53.3 | 52.2 | 51.9 | |

| 8:30 | GBP | Manufacturing PMI Aug P | 52.5 | 52.2 | 52.1 | |

| 8:30 | GBP | Services PMI Aug P | 53.3 | 52.8 | 52.5 | |

| 11:30 | EUR | ECB Meeting Accounts | ||||

| 12:30 | USD | Initial Jobless Claims (Aug 16) | 232K | 230K | 227K | 228K |

| 13:45 | USD | Manufacturing PMI Aug P | 49.4 | 49.6 | ||

| 13:45 | USD | Services PMI Aug P | 54.2 | 55 | ||

| 14:00 | USD | Existing Home Sales Jul | 3.89M | 3.89M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Aug P | -11 | -13 | ||

| 14:30 | USD | Natural Gas Storage | 26B | -6B |