Australian Dollar surged broadly in Asian session following a much stronger-than-expected monthly CPI report, sparking speculation that RBA might return to rate hikes in August. Comments from a top RBA official also indicated that the central bank is vigilant about upside risks to inflation. The upcoming inflation reports for June and the more critical Q2 data will be crucial for RBA’s next move. Even if there isn’t another rate hike, it’s clear that interest rates will need to remain high for longer.

Canadian Dollar is following Aussie as the second strongest currency, continuing to benefit from stronger-than-expected Canadian CPI data released overnight. Dollar is currently the third strongest, supported by renewed weakness in Euro and Yen. Euro is at the bottom of the performance chart along with Swiss Franc, followed by Yen. British Pound and New Zealand Dollar are positioned in the middle.

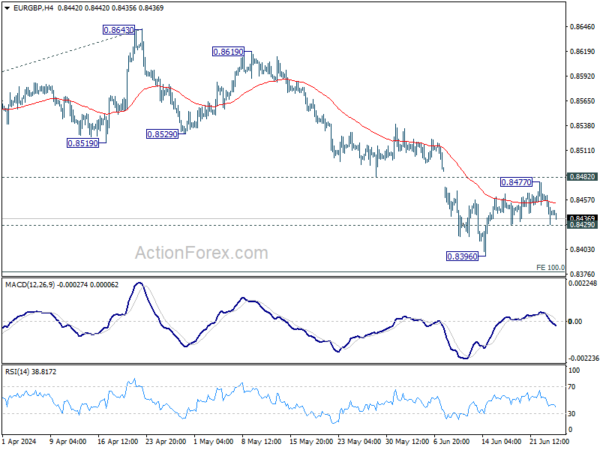

Technically, EUR/GBP’s recovery from 0.8396 might have completed at 0.8447 already, ahead of 0.8482 support turned resistance. Break of 0.8249 minor support will strengthen this bearish case and target 0.8396 low, and below. Downside breakout in EUR/GBP might also align with a break of the 1.0667 support in EUR/USD.

In Asia, Nikkei closed p 1.26%. Hong Kong HSI is up 0.21%. China Shanghai SSE is up 0.47%. Singapore Strait Times is down -0.15%. Japan 10-year JGB yield rose 0.0239 to 1.028. Overnight, DOW fell -0.76%. S&P 500 rose 0.39%. NASDAQ rose 1.26%. 10-year yield fell -0.010 to 4.238.

German Gfk consumer sentiment fells to -21.8, interruption of uptrend

Germany’s Gfk Consumer Sentiment for July fell from -21.0 to -21.8, below expectation of -20.0. In June, economic expectations fell from 9.8 to 2.5. Income expectations fell from 12.5 to 8.2. Willingness to buy fell from -12.3 to -13.0. Willingness to save jumped again from 5.0 to 8.2.

“The interruption of the recent upward trend in consumer sentiment shows that the road out of the sluggish consumption will be difficult and there can always be setbacks,” explains Rolf Buerkl, consumer expert at NIM.

Australia CPI jumps to 4%, trimmed mean rises to 4.4%

Australia’s monthly CPI accelerated from 3.6% yoy to 4.0% yoy in May, well above expectation of a fall to 3.5% yoy. The last time it was higher was last November, when it was sitting at 4.3%.

CPI excluding volatile items and holiday travel ticked down from 4.1% yoy to 4.0% yoy. Annual Trimmed Mean CPI, on the other hand, surged from 4.1% yoy to 4.4% yoy.

The most significant contributors to the annual rise to May were Housing (+5.2%), Food and non-alcoholic beverages (+3.3%), Transport (+4.9%), and Alcohol and tobacco (+6.7%).

Speculation of RBA August hike drives AUD/NZD higher

Australian Dollar surges broadly today following reacceleration in monthly inflation data, sparking speculation that RBA might need to raise interest rates again. The inflation uptick places significant pressure on RBA to not only refrain from cutting rates anytime soon but potentially consider further rate hikes.

RBA’s upcoming meeting in August is now seen as being “live,” although a decision is not yet certain. The critical factor remains Q2 CPI report due on July 31, which will provide further clarity on the inflation outlook, will heavily influence RBA’s policy decision.

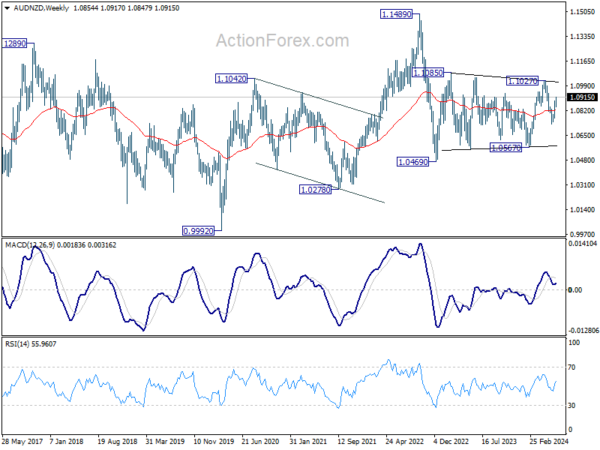

Strength of Aussie is particularly noticeable against Kiwi. AUD/NZD’s rally from 1.0730 resumed and hits as high as 1.0917 so far. The development solidifies that case that pull back from 1.1027 has completed at 1.0730, after hitting 61.8% retracement of 1.0567 to 1.1027.

Further rise is expected as long as 1.0846 support holds. Next target is the key resistance zone of 1.1027/1085. Decisive break there will resume whole medium term rebound from 1.0469 (2022 low). However, for this bullish scenario to unfold, RBA would need to actually implement additional tightening, rather then just keeping the option open.

RBA’s Kent stresses vigilance amid mixed data and uncertainty over neutral rate

RBA Assistant Governor Christopher Kent, in a speech today, emphasized that recent economic data have been “mixed,” reinforcing the need for RBA to “remain vigilant to upside risks to inflation.” Kent reiterated that, regarding the path of interest rates, RBA is “not ruling anything in or out.”

Kent noted that the recent median estimate among market economists suggested that the cash rate was around 1 percentage point above the nominal neutral rate. This indicates that current monetary policy is restrictive.

However, he acknowledged the significant uncertainty surrounding estimates of the neutral rate, making it unclear how restrictive monetary policy truly is.

Additionally, Kent mentioned that RBA’s own models suggest that the neutral rate has increased since the pandemic, aligning with trends observed in other economies.

Fed’s Cook: Dual mandate risks better balanced

In a speech last night, Fed Governor Lisa Cook stated that the risks to achieving Fed’s dual mandate of employment and inflation have “moved toward better balance this year.” However, she emphasized that the economic outlook remains “always uncertain.”

Cook stressed the importance of addressing this uncertainty by considering “a range of scenarios,” rather than relying solely on the baseline forecast. She believes that Fed’s current policy is “well positioned” to respond to any changes in the economic outlook.

“At some point,” Cook noted, it will be appropriate to start lowering interest rates. However, the timing of any such adjustment will depend on how economic data evolve and their implications for the outlook and balance of risks.

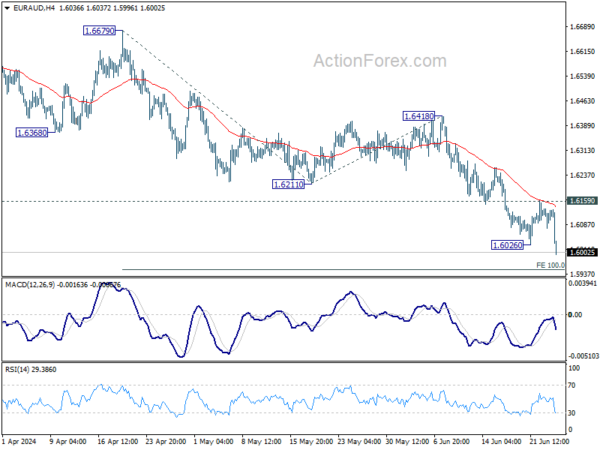

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6083; (P) 1.6113; (R1) 1.6149; More…

EUR/AUD’s down trend resumes by breaking through 1.6026 today and intraday bias is back on the downside. Next target is 100% projection of 1.6679 to 1.6211 from 1.6418 at 1.5950. Firm break there will target 1.5846 key support next. For now, risk will stay on the downside as long as 1.6159 resistance holds, in case of recovery.

In the bigger picture, fall from 1.7062 medium term top is seen as a correction to the up trend from 1.4281 (2022 low) only. Strong support is still expected between 1.5846 and 38.2% retracement of 1.4281 to 1.7062 at 1.6000 to bring rebound. Break of 1.7062 is in favor at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | AUD | Westpac Leading Index M/M May | 0.00% | 0.00% | ||

| 01:30 | AUD | Monthly CPI Y/Y May | 4.00% | 3.50% | 3.60% | |

| 06:00 | EUR | Germany GfK Consumer Confidence Jul | -21.8 | -20 | -20.9 | -21 |

| 08:00 | CHF | UBS Economic Expectations Jun | 18.2 | |||

| 14:00 | USD | New Home Sales M/M May | 650K | 634K | ||

| 14:30 | USD | Crude Oil Inventories | -2.6M | -2.5M |