Trading has been characteristically subdued in the Monday’s Asian session. Japanese Yen is have a broad but weak recovery, with no clear indication of a reversal from its recent selloff. Australian and New Zealand Dollars are also mildly firmer, following rebound in Asian stocks. Meanwhile, Swiss Franc and Euro are among the softer currencies, while British Pound and Dollar are mixed.

Activity in the markets is likely to remain low, compounded by the holidays in both the UK and the US. However, traders are expected to return with heightened focus as significant inflation data from the US, Eurozone, Australia, and Japan are scheduled for release, alongside other important economic indicators from Canada, Swiss and China.

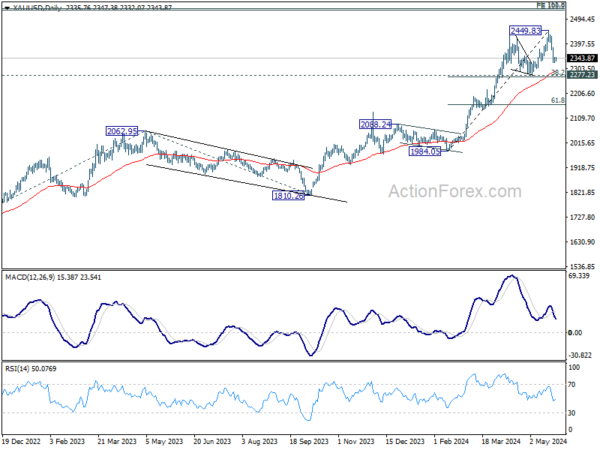

Technically, Gold’s rally was cut short after hitting 2449.83 but there is no clear sign of trend reversal yet. As long as 2277.34 cluster support holds (38.2% retracement of 1984.05 to 2449.83 at 2271.90) further rally is still expected. The real test for Golds lies in 2500 psychological level, which is close to 161.8% projection of 1614.60 to 2062.95 from 1810.26 at 2535.69.

In Asia, Nikkei rose 0.66%. Hong Kong HSI is up 1.14%. China Shanghai SSE is up 0.75%. Singapore Strait times is up 0.11%. Japan 10-year JGB yield rose further by 0.0163 to 1.026.

ECB’s Lane frames 2024 policy debate to determining degree of reduced restrictiveness

In an interview with the Financial Times, ECB Chief Economist Philip Lane indicated that, barring major surprises, there is sufficient evidence to “remove the top level of restriction” in June, suggesting an initial reduction in the 4.00% deposit rate. He noted that the forthcoming data over the next few months will guide ECB in determining the pace at which further restrictiveness can be eased.

Lane acknowledged that the path to disinflation will be “bumpy and gradual.” He framed the debate for this year by stating that ECB still “needs to be restrictive all year long,” but within this “zone of restrictiveness,” there is potential to “move down somewhat.”

He added, “We don’t need the data to say normalization is a lock. What we do need the data to say is: is it proportional, is it safe, within the restrictive zone to move down.”

Looking ahead to next year, Lane mentioned that discussions about the “normalization” of monetary policy will be more pertinent when wage growth has visibly decelerated and the inflationary impacts of current fiscal measures have diminished.

BoJ’s Ueda: Neutral rate estimation a unique challenge for Japan

In a speech today, BoJ Governor Kazuo Ueda reiterated the central bank’s commitment to achieving sustainable and stable 2% inflation. He acknowledged the progress made in “moving away from zero” and “lifting inflation expectations,” but underscored the need to “re-anchor” them at 2%.

Ueda stressed the importance of a cautious approach, aligning with other central banks that employ inflation-targeting frameworks. However, he highlighted that some challenges are “uniquely difficult” for Japan.

A notable example is determining the “neutral interest rate,” a task complicated by Japan’s “prolonged period” of near-zero short-term interest rates over the past three decades. This historical context makes it particularly challenging to estimate the neutral rate accurately.

Despite some fluctuations in real interest rates, the lack of significant interest rate movements remains a “considerable obstacle” for BoJ. This impedes their ability to assess the economy’s response to changes in interest rates effectively.

BoJ’s Uchida: Deflation battle nears end, but anchoring inflation expectations remains a challenge

In a speech today, BoJ Deputy Governor Shinichi Uchida expressed optimism that the end of Japan’s long battle against deflation is “in sight.” However, he emphasized that there remains a “big challenge” in anchoring inflation expectations at 2% target.

Uchida pointed out that it is “not so clear” whether Japan has fully overcome the “deflationary norm.” A critical question is whether companies will maintain their current price-setting behaviors once the global inflationary pressures subside. He highlighted the importance of the labor market in this context.

“If the structural changes in the labor market continue, companies will have to build business models that generate enough profits and wages to keep and attract employees,” Uchida noted. Regarding price-setting strategies, he added that companies need to “rewrite their prices in their menus promptly,” reflecting labor costs while considering the potential impact on product demand.

The week’s spotlights on inflation data from US, Eurozone, Australia, and Japan

Inflation data from several major economies will be under intense scrutiny this week. Although these data points may not directly impact imminent monetary policy decisions, they will significantly influence interest rate outlook for the remainder of the year.

In the US, PCE data is anticipated to reflect the trends observed in recent CPI reports, which indicated resumed cooling in both headline and core inflation. Unless there are unexpectedly large deviations, it is likely that the probabilities of a Fed rate cut in September will remain broadly unchanged at 50/50.

Moving to Europe, preliminary CPI for Eurozone might register a modest increase in May, with the core CPI expected to remain stable. This shouldn’t change ECB’s plan to reduce interest rates in June. But prospects for a follow-up rate cut in July seem minimal unless economic conditions deteriorate significantly.

In Australia, slight moderation is forecasted in monthly CPI for April. Such a trend would support RBA decision to maintain the current interest rate well into late 2024. However, any unexpected increase in inflation could tilt the balance towards an interest rate hike in the latter half of the year.

Japan’s focus will be on Tokyo CPI, where a rebound in core inflation within the capital is anticipated. Yet, it remains premature for BoJ.

Additionally, other economic indicators such as US consumer confidence, Canadian GDP, Australian retail sales, Swiss GDP, and China’s NBS PMIs.

Here are some highlights for the week:

- Monday: German Ifo business climate.

- Tuesday: Japan corporate service price; Australia retail sales; Canada IPPI and RMPI; US house price index, consumer confidence.

- Wednesday: New Zealand ANZ business confidence; Australia CPI; German Gfk consumer sentiment; Germany CPI flash; Swiss UBS economic expectations; Eurozone M3 money supply; Fed’s Beige Book.

- Thursday: Australia building approvals, private capital expenditure; Swiss trade balance, GDP, KOF economic barometer; Eurozone unemployment rate; Canada current account; US GDP revision, jobless claims, goods trade balance, pending home sales.

- Friday: Japan Tokyo CPI, unemployment rate, industrial production, retail sales; China NBS PMIs; German import prices, retail sales; Swiss retail sales; UK M4 money supply, mortgage approvals; Eurozone CPI flash; Canada GDP; US personal income and spending, PCE inflation, Chicago PMI.

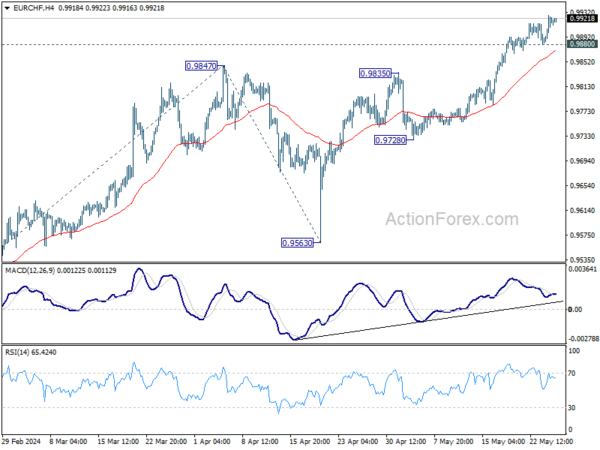

EUR/CHF Daily Outlook

Daily Pivots: (S1) 0.9894; (P) 0.9911; (R1) 0.9939; More….

Intraday bias in EUR/CHF is now on the upside this week as recent rally continues. Current rise from 0.9252 should target 100% projection of 0.9304 to 0.9847 from 0.9563 at 1.0106, which is slightly above 1.0095 key structural resistance. On the downside, below 0.9880 minor support will turn intraday bias neutral and bring consolidations first.

In the bigger picture, as long as 0.9728 support holds, rise from 0.9252 medium term bottom is still in favor to continue. Next target is 38.2% retracement of 1.2004 (2018 high) to 0.9252 (2023 low) at 1.0303, even just as a correction to the down trend from 1.2004.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | Germany IFO Business Climate May | 90.3 | 89.4 | ||

| 08:00 | EUR | Germany IFO Current Assessment May | 89.9 | 88.9 | ||

| 08:00 | EUR | Germany IFO Expectations May | 90.5 | 89.9 |