Markets

On Friday a divergent narrative of in line, rather soft US price deflators and higher than expected EMU May CPI inflation caused US and EMU interest rate markets to part ways, with US yields declining and EMU interest rates still gaining a few bps. Today US and European bonds again moved in the same direction. US yields extend last week’s correction south declining between 1 bps (2-y) and 4.5 bps (30-y). This week’s US eco data starting with the manufacturing ISM later today, will guide market momentum short-term. A new set of not-too-hot activity data might cause markets to again raise the odds of two Fed rate cuts this year rather than only one at the end of the year. A similar reasoning can be developed for positioning on European interest rate markets. Despite last week’s higher than expected EMU inflation investors apparently conclude that enough ECB caution is discounted for now. Money markets, after this week’s 25 bps cut, see one additional step of the ECB in H2, but less than 50% chance of a third one before the end of the year. The ECB on Thursday is unlikely to give a detailed path on its future intentions. Even so, making the step of an inaugural rate cut also includes the message that inflation has cooled enough to reduce policy restriction from here. It makes little sense to do so when you don’t see a decent chance for follow-action in a not that distant future. New ECB staff forecasts in this respect probably will confirm a scenario of EMU inflation returning close to 2.0% next year and in 2026. German yields are ceding between 4.5 bps (2-& 30-y) and 6 bps (5-y). After a positive start in Asia this morning, bond markets gains also support a bid for global equity markets. The Eurostoxx 50 gains 0.9%. The S&P 500 after a solid performance on Friday opens with a decent gain ( 0.4%). Oil (Brent $80.8 p/b) still struggles to avoid further losses after the OPEC+ decision this weekend. The cartel decided to maintain most production cuts in place till end next year, but to potentially scale back 2.2 mln bpd of some voluntary reductions post September 2024. Markets apparently are not convinced that demand will be strong enough to pick up additional supply.

On FX markets the dollar is trading mixed, within established short-term ranges. DXY trades marginally lower at 104.57. Lower yields in core markets (US, EMU, UK) is giving the yen some breathing space (USD/JPY 156.85; EUR/JPY 170.1). EUR/USD trades little changed near 1.085, holding the narrow short-term band between 1.0788 and 1.0895. EUR/GBP this morning tried to resume Friday’s euro-driven rebound. However, divergence between the start of the ECB rate cut cycle and the BoE being forced to stay on hold due to stickier than expected inflation for now prevents further sterling losses (EUR/GBP 0.852).

News & Views

The Czech manufacturing downturn softened in May according to S&P Global’s PMI. It increased from 44.7 to 46.1 (vs 45.5 expected). It’s the second to best outcome since August 22 with the PMI already in contraction territory since June 2022. Details showed output, new orders, employment and purchasing activity all continuing their decline but at a slower pace. Panelists continued to highlight subdued domestic and external client demand, especially from key European export markets, including Germany. Hopes of improved customer interest sparked the second-strongest degree of confidence in the year ahead outlook for output in over two years. Input prices increased only marginally, but output charges ticked up at the fastest pace in just over a year, highlighting the inflationary risks challenging the Czech National Bank. EUR/CZK remains stuck near 24.70 where it has been trading since mid-May.

Mexican assets underperform today after Claudia Sheinbaum from the ruling Morena party won a landslide presidential election victory. The leftwing close ally of current president Lopez Obrador won nearly 60% of the votes according to a partial official count. The Morena party and its allies are also expected to win both houses of congress with what will be close to a two-third majority needed to push though constitutional changes. Some fear a weakening of democracy in this scenario given proposals by the previous president like popular elections for supreme court judges and directors of the electoral institute. USD/MXN surges from 17 to 17.50, the weakest MXN-rate YTD. MXN swap rates rise by 10-15 bps across the curve.

Graphs

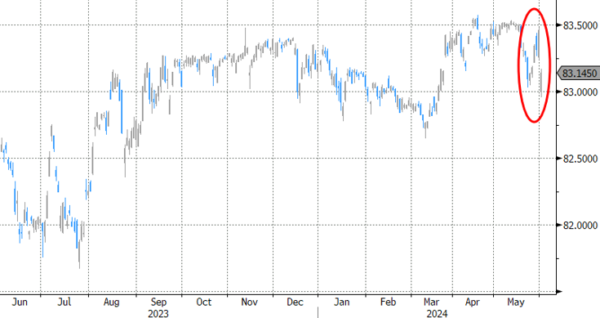

USD/INR: Indian rupee jumps as first estimates indicate a decisive victory for PM Modi’s ruling party.

Dutch TTF natural gas reference contract extends uptrend to highest level YtD after an unplanned outage in Norwegian production.

USD/MXN: Mexican peso declines as the outcome of presidential and Congress elections is seen raising the risk of market unfriendly policy.

EMU 10-y swap returning lower in the established trading range as markets are preparing for inaugural ECB rate cut.