Markets

US May CPI numbers served as an appetizer going into tonight’s FOMC meeting. Both headline (flat) and core (+0.2% m/m) inflation missed expectations for a 0.1% and 0.3% rise respectively. That resulted in slower y/y readings of 3.3% and 3.4% with the latter the lowest since April 2021. Airline fares (-3.6%), transportation (-1.1%) and energy (-2%) were a drag, offsetting still-solid price pressures in shelter (0.4%). Services rose by 0.2% (5.2% y/y), the slowest pace since September 2021. The supercore gauge (core services ex housing) turned negative (-0.04%), lowering the annualized 3m rolling average from 6.34% to 4.20%. US markets reacted with a sharp drop in yields. The front end loses up to 16 bps. German yields got caught in the slipstream (between 6.6 and 8.4 bps lower). Money market implied probability for a September Fed rate cut grew from 58% to >80% with a cumulative 50 bps of cuts priced in by the end of the year. Barring one occasion mid-May, it’s the first time since early April that markets are again fully discounting two 25 bps cuts this year. The US dollar suffered a serious setback against a euro that got some reprieve from markets for the first time this week. EUR/USD jumps from 1.072 to 1.0836. DXY erases much of the gains since last Friday (payrolls) to trade around 104.42 currently. In a broader sign of European assets breathing a sigh of relief, equities in the region trade in the green, even if it shows France’s index (+0.9%) underperforming peers a bit. The 10-yr OAT/swapspread to does eke out a tiny rise though, contrasting with semi-core peers including Belgium.

Turning to the Fed now. With currently two cuts fully priced in, a change in the dot plot from three to two cuts in 2024 won’t affect markets much. The expected 2025 projection of 3×25 bps on the other hand would come in slightly more hawkish than what markets currently anticipate (between three and four). The tone of chair Powell during the presser is a wildcard. He’ll welcome today’s benign inflation number after a string of disappointments but it’s just one of the couple of months the Fed probably wants to see. Friday’s payrolls have something in store for both parties. Strong employment and wage growth hangs in the balance with an unexpected uptick in the unemployment rate, to which the chair proved sensitive too. And even a strong services ISM could be downplayed by a manufacturing gauge venturing deeper in contraction territory. Markets’ reaction to an all in all minor downside CPI surprise follows after weeks of aggressive/hawkish repricing and suggests particular vulnerability to a dovish chair.

News & Views

The International Energy Agency published the latest edition of its annual medium-term oil market report. They expect total supply capacity to rise to nearly 114 mn barrels/day by 2030, which would be a staggering 8mn barrels/day above projected global demand. This would result in levels of spare capacity never seen before other than at the height of the Covid-19 lockdowns in 2020. Producers outside of OPEC+ are leading the expansion of global production capacity. The US alone is poised to account for 2.1mn barrels/day while Argentina, Brazil, Canada and Guyana contribute another 2.7mn. Global oil demand is set to reach a peak by the end of the decade (+3.2mn barrels/day compared to 2023) mainly because of strong demand from fast-growing countries in Asia as well as from the aviation and petrochemicals sectors. Offsetting factors include rising electric car sales, declining use for electricity generation in the Middle East and structural economic shifts. Despite this outlook, Brent crude extends this month’s rebound, rising from $82/b to $83/b.

Greece announced that it will repay a total amount of €8bn in bailout loans ahead of schedule. It’s the third time that they do such early repayment. It covers loan amortizations from 2026 to 2028 under the Greek Loan Facility. The lion share (€5bn) comes from the cash buffer built up during the crisis years, when Greece was cut off or had limited access to market funding. Simultaneously the Greek center-right government recently used positive momentum to proceed with some privatization initiatives. PM Mitsotakis pointed to real appetite for Greek assets as the market seems to believe the long-term goal story and the stable government is there to stay. Greece last year regained investment graded ratings at Moody’s and S&P. The Greek debt ratio fell from a 207% of GDP high in 2020 to 153% (expected) this year.

Graphs

US 2-yr yield tanks to new recent lows after minor CPI miss brings two rate cuts in 2024 back in focus

CAC40: French stock index is looking for a bottom after president Macron triggered sell-off

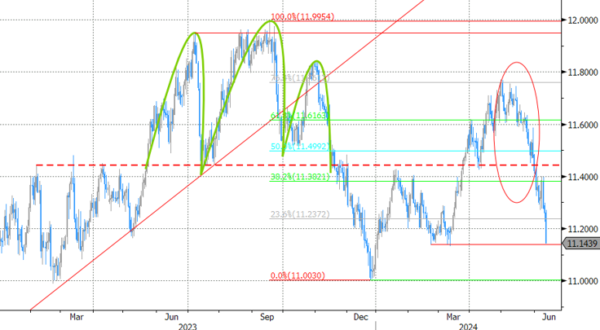

EUR/SEK: Swedish crown extends its recent bull run as global core bond yields decline sharply today

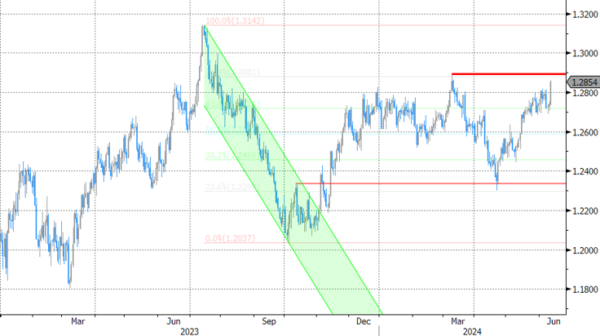

Dollar-hit hurls GBP/USD towards current YtD highs