Markets

US and EMU (interest rate) markets today are holding tight ranges with trading mostly technical in nature. If anything markets still err to rather dovish bias, with yields on both sides of the Atlantic hold with reach of recent lows. There were no data in EMU. In the US, the Philly Fed non-manufacturing index and the Chicago Fed national activity index printed on the better side of expectations. US S&P Corelogic house prices also were slightly stronger than expected. Fed’s Bowman, one of the hawkish members within the Fed FOMC, understandably still warned on upside inflation risks. She reiterated that rates will have to be kept high for some time. She still sees no room for interest rate cuts this year and as such shifted the expected cuts to next year. Amongst others, she also warned a fiscal stimulus and on a loosening of financial conditions as potential risks to the inflation outlook. The comments were no surprise. Still, US yields gradually reversed a tentative decline to currently add between 1.0 and 2.0 bps. Later today, the US consumer confidence (Conference Board) and a 2-yr $ 69 bln auction of US Treasuries still are worth looking at. Bunds slightly outperform Treasuries with yields easing about 1 bp across the curve. After some modest narrowing yesterday, spreads of France (10-yr +1 bp) and peripheral bond markets (Italy+3 bps) again widened slightly as investors are counting down the first round of the French elections this weekend. European equities couldn’t hold on to yesterday’s constructive start of the week. The EuroStoxx 50 is ceding about 0.5%. US indices, after yesterday’s setback in AI relates stocks today open mixed to marginally stronger (S&P + 0.15%). Recent rebound in oil shows tentative signs of running into resistance (Brent $ 85.75 p/b).

On FX markets, the dollar slightly outperforms today. DXY trades near 105.62. EUR/USD struggles not the fall back below the 1.07 handle (1.0705). The market focus remains on the USD/JPY cross rate. At 159.65, it still trades only a whisker away from the 160 area that trigger BoJ interventions end-April/early May. However, looking at the USD/JPY price pattern, markets apparently have little confidence that Japanese authorities will be able to change fortunes for the yen in a sustainable way. EUR/GBP also show no clear directional trend trading marginally weaker at 0.8445, probably due to euro softens rather sterling strength.

News & Views

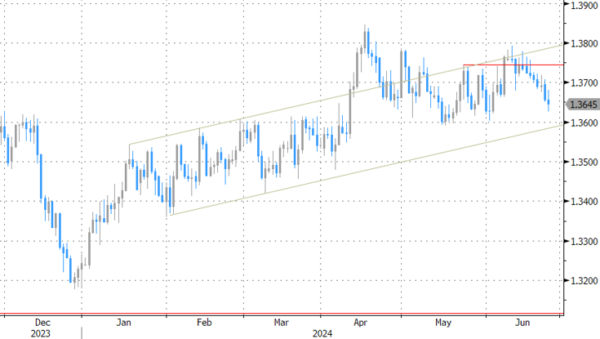

Canadian inflation unexpectedly accelerated in May. Coming in at 0.6% m/m – double the 0.3% expected – the yearly figure increased from 2.7% to 2.9% (2.6% anticipated). Statistics Canada said the quickening was largely due to higher prices for services (4.6% y/y, up from 4.2%). Prices for goods (+1%) rose at the same rate as in April. The Bank of Canada’s core inflation gauges snapped a four-month y/y decline with the average picking up from 2.7% to 2.85%. The central bank earlier this month lowered the policy rate a first time to 4.75% amidst “continued evidence that underlying inflation is easing”, agreeing that monetary policy “no longer needs to be as restrictive” as it was. Today’s CPI reading is the first of two in total that the BoC will have at its disposal at the next policy meeting July 24. For now, though, they significantly raise the bar for a follow-up rate cut. Canadian money markets have pared odds for a July move from 62% to about 40%. The Canadian dollar quickly erased a kneejerk strengthening move with USD/CAD currently trading unchanged around 1.365.

Three people familiar with the Bank of Japan’s thinking said a rate hike would be on the table at each policy meeting, including July’s. One of the sources said that given what’s happening with inflation, interest rates are clearly too low. Governor Ueda in recent appearances also highlighted the possibility of that to happen, not surprisingly in the wake of recent JPY weakness. If the BoJ would indeed hike rates from 0-0.1% currently, it would come as a surprise to some 50% of the market. Moreover, it may come in tandem with a detailed plan on how the central bank plans to trim bond buying (currently JPY 6tn per month) and reduce the size of its $5tn balance sheet. Given the re-weakening of the Japanese yen to historical lows, any QT plan needs to be ambitious enough, creating the potential of the BoJ announcing bigger-than-expected buying cuts on July 31.

Graphs

USD/CAD: Loonie gains a few ticks as unexpected jump in inflation questions room for BOC follow-up rate cuts anytime soon.

USD/JPY: markets testing Japanese authorities’ preparedness to stem the decline of the yen.

Cocoa prices extends decline on rumoured exit of long positions both of commercial parties and funds.

Brent oil ($ p/b): rebound running into resistance