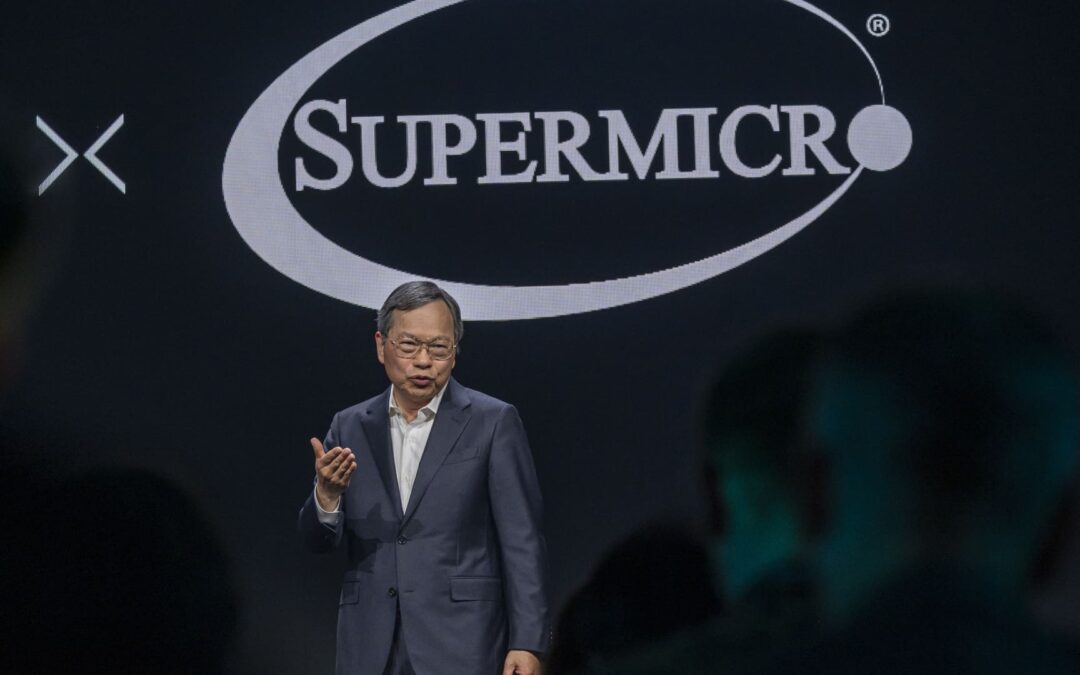

David Paul Morris | Bloomberg | Getty Images

Super Micro Computer shares plunged 18% on Friday as investors scaled back their holdings of one of the market’s hottest stocks ahead of earnings later this month.

Shares of Super Micro, which joined the S&P 500 in March, are still up about 168% this year after climbing 246% in 2023. The server and computer infrastructure company is a primary vendor for Nvidia, whose technology is the backbone for most of today’s powerful artificial intelligence models.

Super Micro said in a brief press release on Friday that it will report fiscal third-quarter results on April 30. The company broke from its pattern of providing preliminary results. In January, Super Micro increased its sales and earnings guidance 11 days before announcing second-quarter financials.

The stock is on pace for its steepest drop since Feb. 16, when it fell about 20%.

While Super Micro is getting a big boost from its ties to Nvidia, the market remains highly contested, with competitors including Dell and Hewlett Packard Enterprise planning to build systems using Nvidia’s latest generation of Blackwell graphics processing units.

WATCH: A quiet meme stock rally?