There has been an unprecedented rise in unsecured lending as more and more fintech companies and NBFCS are acquiring new to credit customers, and customers — mostly millennials and genz are opting for small ticket size loans. However, many of these newly acquired customers are defaulting their loans, which has resulted in a poor quality of borrowers in the unsecured credit market.

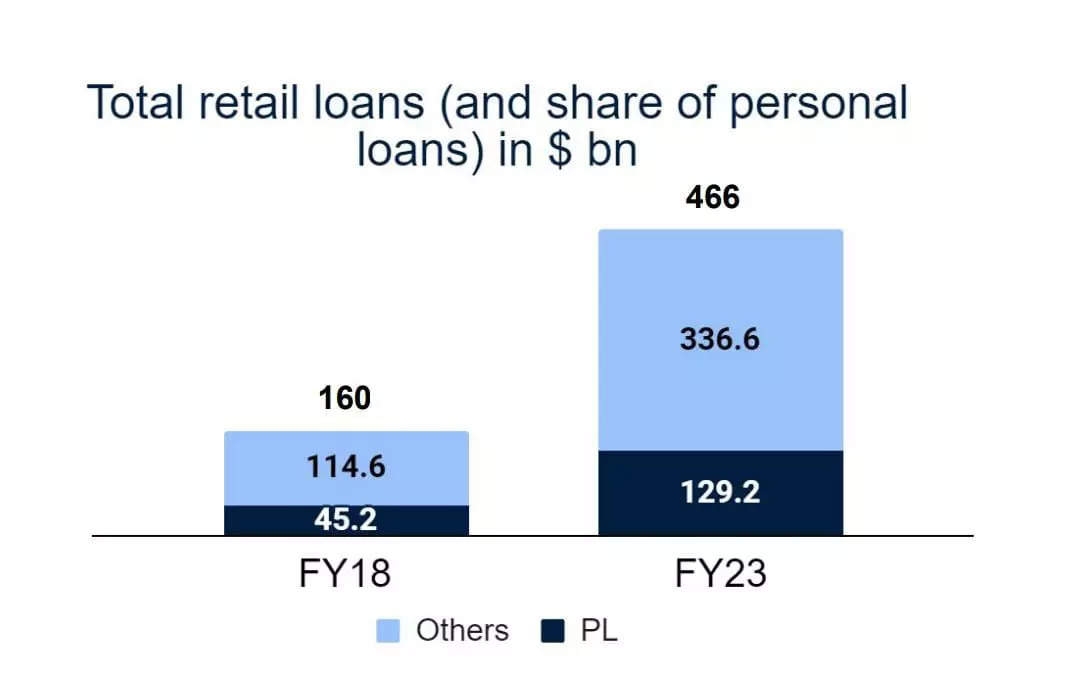

Personal loan disbursements have steadily risen, until March 2018, 3.1 per cent of total loans disbursed were personal loans while the number jumped to 6.7 per cent as of June, 2023. Personal loans have also grown by almost 12 times in volume and by 3.5 times in value. As of FY18, about 8.2 million personal loans were disbursed while by FY23 the number went up 12 times to 101.3 million, revealed a recent report by Blume Ventures.

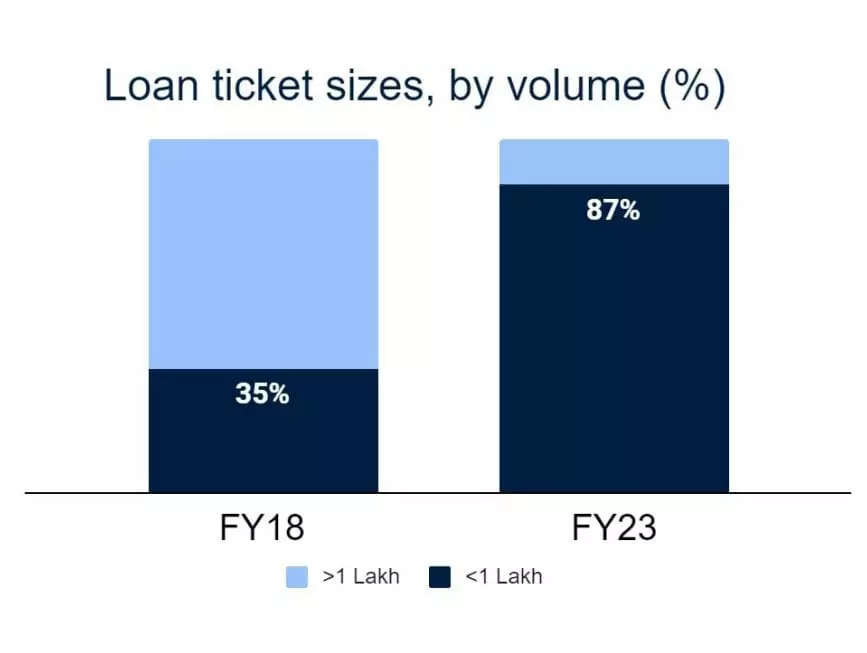

Low growth in value compared to volume of loans disbursed indicates that most of these personal loans are of small ticket sizes, less than Rs 1 lakh. Further, small ticket loans in volume saw a whopping 31x growth, recording 2.8 million small ticket loans in FY18 to 87.9 million small ticket loans in FY23.

ALSO READ: RBI crackdown on consumer credit surge set to hit bank’s co-lending of unsecured loans

Small-Ticket Size – a warning bell

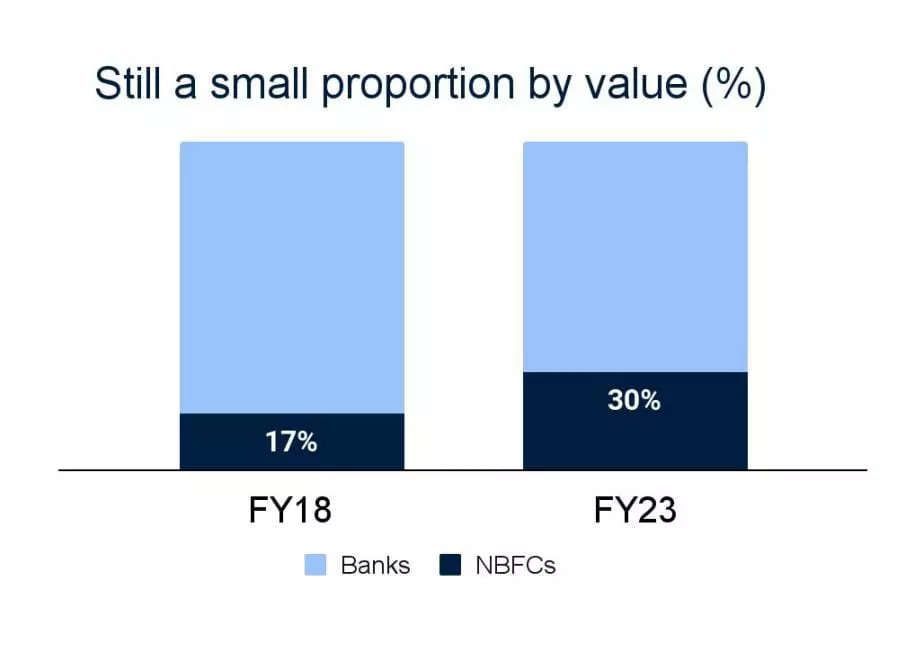

The report highlighted that much of these small ticket personal loans are disbursed by NBFCs, FinTechs and not banks. About 82 per cent of all personal loans are disbursed by NBFCs (a fair bit of these are fintechs, or originated via them) but they only make up about 30 per cent in value.

| Unsecured personal loans jumped more than four-fold to Rs 13.32 trillion as of March 2023 from Rs 4.26 trillion in March 2017. |

NBFCs account for four out of five personal loans disbursed in FY23. As of FY18, 35 per cent of the total personal loans were disbursed by NBFCs while the remaining 65 per cent were disbursed by banks. As the gradual shift happened with technological innovation, fintechs coming into play, the numbers moderated and further changed to 82 per cent of total personal loans being disbursed by NBFCs and 18 per cent by banks.

But this is less than one-third by value which indicated that these personal loans were of small ticket sizes. In terms of value, 17 per cent of total personal loans value were by NBFCs, while in FY23 the number moderated to 30 per cent, which is significantly lower in terms of volume, the report added.

Spurred by the growth in personal loans, retail credit has grown to be the largest segment of credit in India. Financial year 2018 recorded USD 160 billion worth retail loans out of which USD 45.2 billion were personal loans. Following FY18, FY23 recorded a whopping USD 466 billion worth retail loans out of which personal loans were worth USD 129.2 billion.

However, the report revealed that at 258 million borrowers, India is nearing the limit of the addressable market for credit.

ALSO READ: Digital Lending: What if customers Buy Now but Don’t Pay Later?

Borrowers in Debt-Spiral

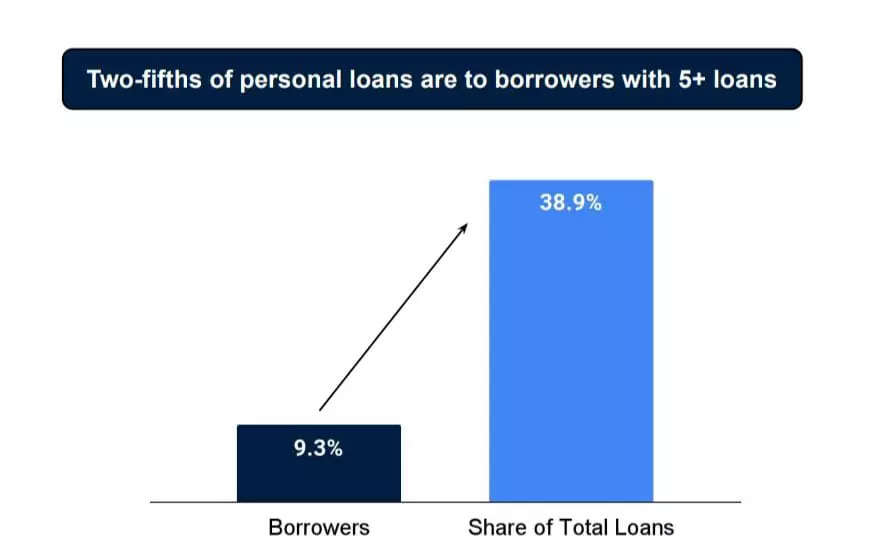

However, much of personal loans growth is on the back of poor quality borrowers. About two-fifths of personal loans are to borrowers who have more than 5 existing loans.

About 10 per cent of the borrower base have more than 5 existing loans and they account for two-fifths of the loans. Clearly some are using it to rotate money across these loans, and are in a debt spiral, the report highlighted.

| In December 2023, RBI intervened by increasing the risk weight of personal loans to 125 per cent, implying that lenders needed to raise more capital to grow. This slows down lending though won’t stop it altogether. |

There has also been more than 3 times increase in loans to defaulters with a 90+ day due loan. About 23.1 per cent of new loans in FY23 were to borrowers who had at least 1 delinquency. This has doubled from FY19. Even as delinquency worsens due to poor quality borrowers coming on board, these borrowers are targeted further for newer loans.

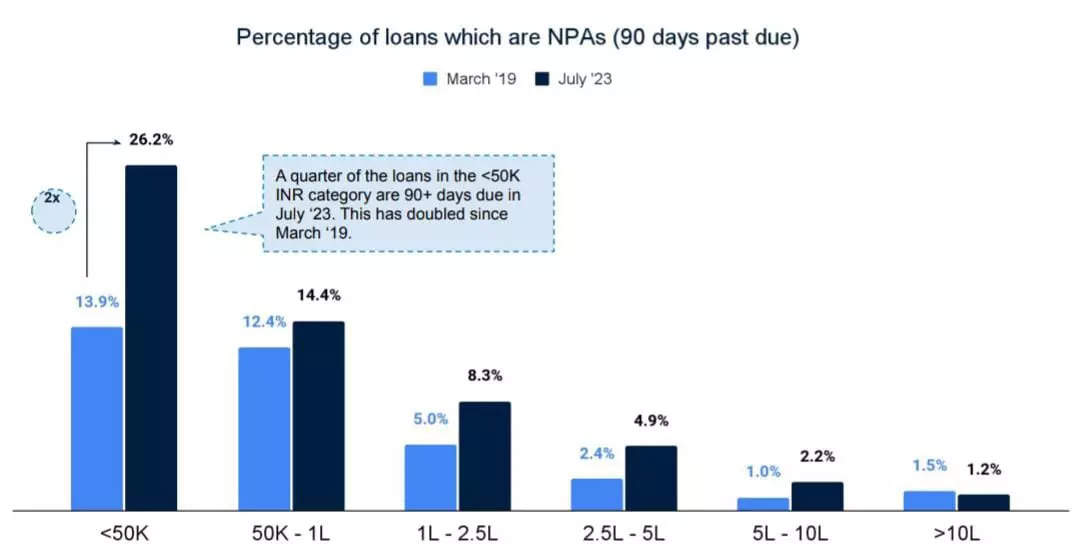

Rise of personal credit on the back of disbursal to high credit risk customers is leading to higher NPAs. The lower the loan ticket size, the higher the default rate. Just over a quarter of loans, of more than Rs 50k are NPAs (90+ days due).